Please #Extend_Due_Dates_Immediately #GSTAmnesty #gstr4 #gstr9 #gstr1 #GSTR3B #GSTLateFees500 #savegst PMO India Narendra Modi Narendra Modi_in Ministry of Finance #ResignNirmalaSitaraman #ResignFm Nirmala Sitharaman (Modi Ka Parivar) Anurag Thakur (मोदी का परिवार) GST Council Sushil Kumar Modi (मोदी का परिवार ) CBIC

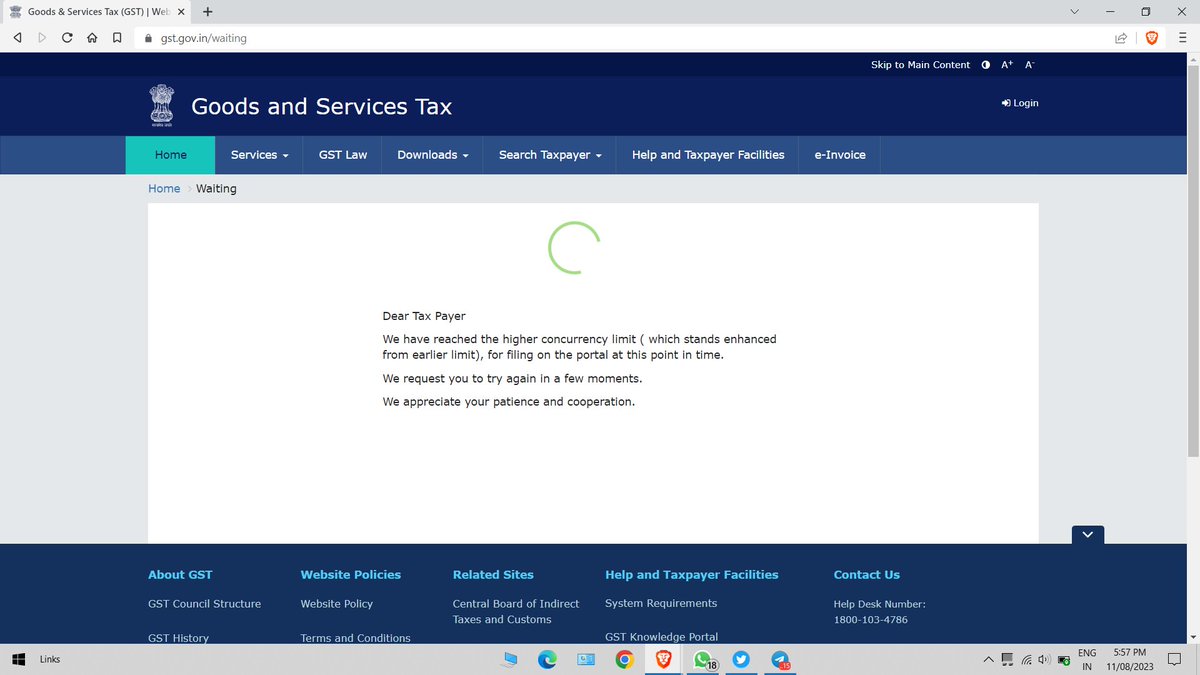

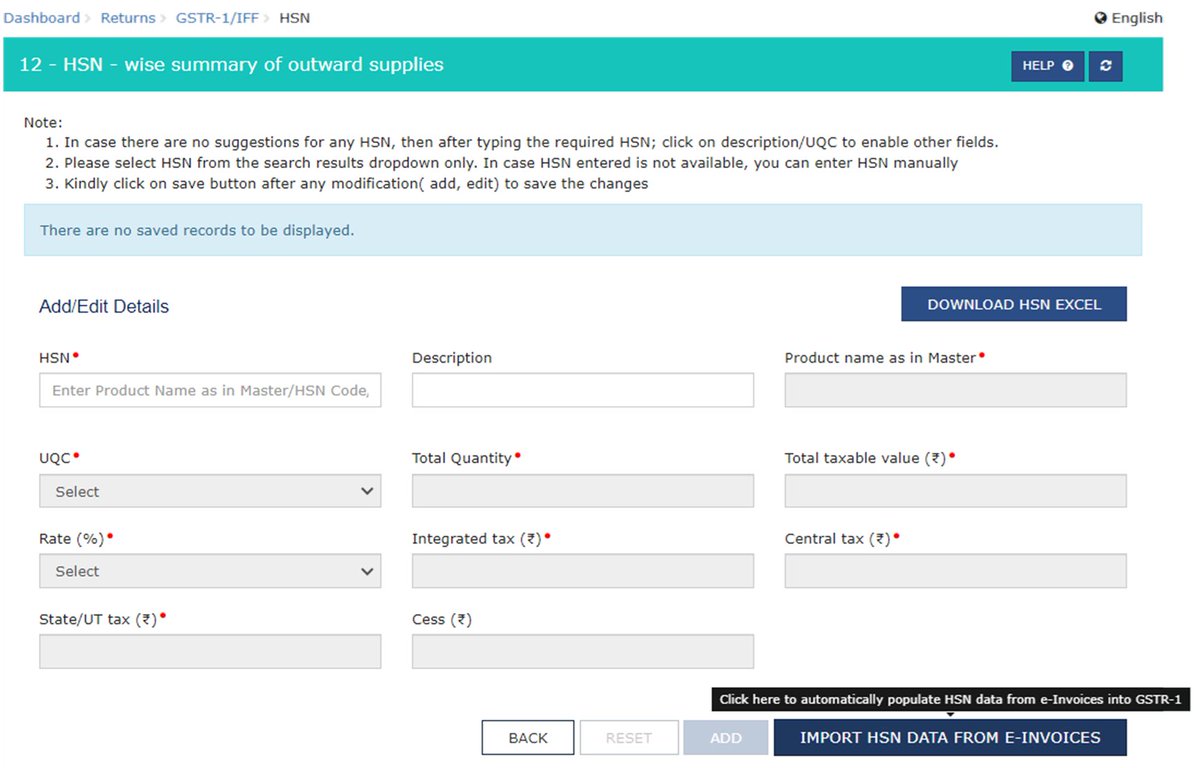

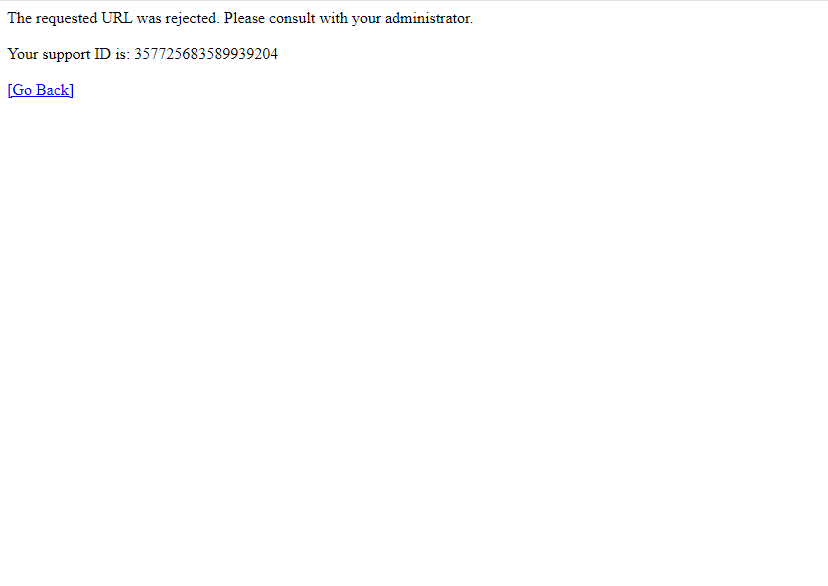

#GSTportal is not working at all.

Returns module is down.

Today is the last date for #GSTR1 of March 2024 month.

CBIC Ministry of Finance

The G.O.A.T arrives on September 5th 💥💥💥

Finally he's coming to blast box office 🔥⚡️😎

#TheGreatestOfAllTime #Thalapathy #Thalapathy Vijay #AskMikha #Cars3 #DonBelle #AEWDynamite #GSTR1

Today's position of GST portal.

Here is Month end as well as year end.

#Extend_GSTR1_Due_Date_immediately

#GST R1 deadline today's, but #GST portal is not working properly today's.

Please #extended due date of filing the #GST R1 because portal show many errors and portal not properly working

Nirmala Sitharaman (Modi Ka Parivar) Ministry of Finance CBIC GST Tech PMO India GST Council #GST #gstn