System (,,゚Д゚)

@system_717

Building my growth through consistency.

ID: 1829964505758998528

31-08-2024 19:29:22

660 Tweet

764 Takipçi

153 Takip Edilen

64/100 of Stoic Trader Thursday. 2 trades -> +0.5R. Slight profit for the day. I was trying to catch equal highs as a possible draw of liquidity for both trades, but failed in the end. LTF with HTF directions were not matching with each other, in the end I've got played by PA.

65/100 of Stoic Trader Friday. 1 trade -> 1 win -> +1.5R. Perfection SBS at the end of ASIA session. Might needed to hold the runner for NY lows, but decided from the beginning that I'll won't take any greedy decisions and just take LHF target. Idea was simple for the day, to find

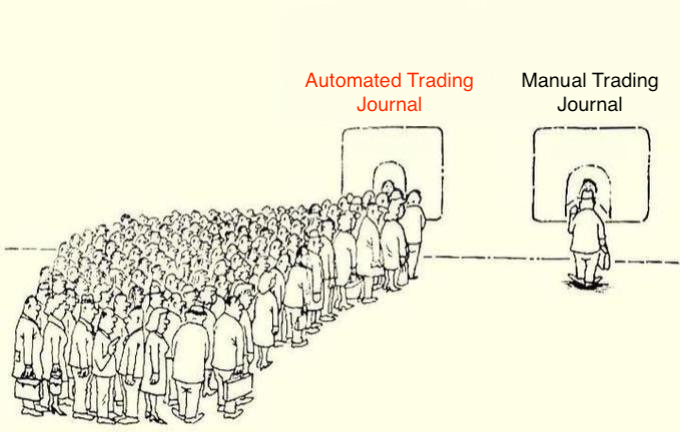

66/100 of Stoic Trader Saturday. Reflection on my performance through previous week. Reviewed all my trades, updated my journal. Understood that time takes a crucial role to my trading. I've never had a single winning trade taken in the middle of the session. It's either London or

67/100 of Stoic Trader Sunday. A bit different day for my journal. First time nothing related to trading, but in the end result will be related. I've spent my day inspecting/reading/analysing extremely wide variety topic -> supplements. I won't get to deep in my research, but most

68/100 of Stoic Trader Monday. 2 trades -> -2R. Was bearish for the session, expected Friday rebalance. I had my HTF SBS short entries from London session with UMO resistance from Tokyo. Ended up with several loosing trades, more about them below in my post. 1st trade: 1m TF

69/100 of Stoic Trader Tuesday. 3 trades taken -> 1BE, -2R. Rough start of the week, overall market read is on, but my execution and PA reading when/where I need to place my entries is completely off. Once again I need to do a step back and review complete basics, backtest it and

70/100 of Stoic Trader Wednesday. Time for a change! If you are still struggling like me to determine a correct market structure, SBS, UMO/Supply&Demand area, and just a correct game-plan for your trading, I think this post will be really helpful. I'll provide a my go-to learning

71/100 of Stoic Trader Thursday. Still letting myself breath without live trading and reflect from my mistakes to define a clear approach on developing a system where your A+ setup is taken every time - consistently. I rewatched some youtube content from Stoic Trader where he mention's

72/100 of Stoic Trader Friday. One of the best SBS opportunities that I've seen provided in a while, a pitch perfect trade, easily recognisable. Break of trend -> Lose of structure -> Manipulation before start of NY session -> SBS entry + LTF UMO resistance for more clear stop

73/100 of Stoic Trader Saturday. Spent my day fully concentrating on how I should properly backtest and determine rules for my trading. I think I found a proper way on how to collect valuable data and also have a clear mechanical rules with the entry-exit. If you are taking trades

74/100 of Stoic Trader Sunday. Time to prepare, slow-down, have a proper rest both for mind and body. Not much of the chart time today, just inspected the price action and did a little preparation for upcoming week. Also no trading tomorrow because of bank holiday. I'll do

75/100 Stoic Trader Monday. Bank holiday, no trades taken, just inspected price action, had a proper reset and have myself fully ready for upcoming week PA. As expected, even on the bank holiday NQ provided perfect setup for nr2 sweep having support from HTF UMO. Also this setup

76/100 Stoic Trader Tuesday. -1R(-300$) / 1 trade taken. Today 2 A+ setup trades were provided from HTF side. 1st on Transition session, 2nd NY. Trend direction was on top, execution needed to be better. I did not re-entered after nr4 got taken out with nr5 because of a possibility

77/100 of Stoic Trader Wednesday. -2R(-600$). Got cooked early, I played against HTF trend and got played back from PA :) Simple as that. No bad feelings, just a bit angry at myself that one again I am not able to be patient enough on waiting HTF setup and instead I took LTF one.

78/100 of Stoic Trader Thursday. 1 trade -1R(-300$). Patiently waited for 1/1 highest probability setup for the day for HTF important low takeover of nr2. Was looking for longs(following HTF trend) everything played by the rules. Once my setup arrived, waited for LTF MS switch

79/100 of Stoic Trader Friday. No trades taken. Waited for news, afterwards NY just extended lower. HTF perspective I see that we are stuck in the range. It's extremely important to understand price action behaviour from HTF perspective. That might be the case why I've failed for

80/100 of Stoic Trader Saturday. Reviewed my trades that I've took this week. Only one day I had a wrong bias for my game plan, all other days were really precise and I knew what PA is building up for us. So really happy about this results, even though my execution was not perfect