Sypher Capital

@syphercapital

Tweets are not investing advice.

ID: 1877346908563488768

https://linktr.ee/syphercapital 09-01-2025 13:29:31

155 Tweet

269 Followers

433 Following

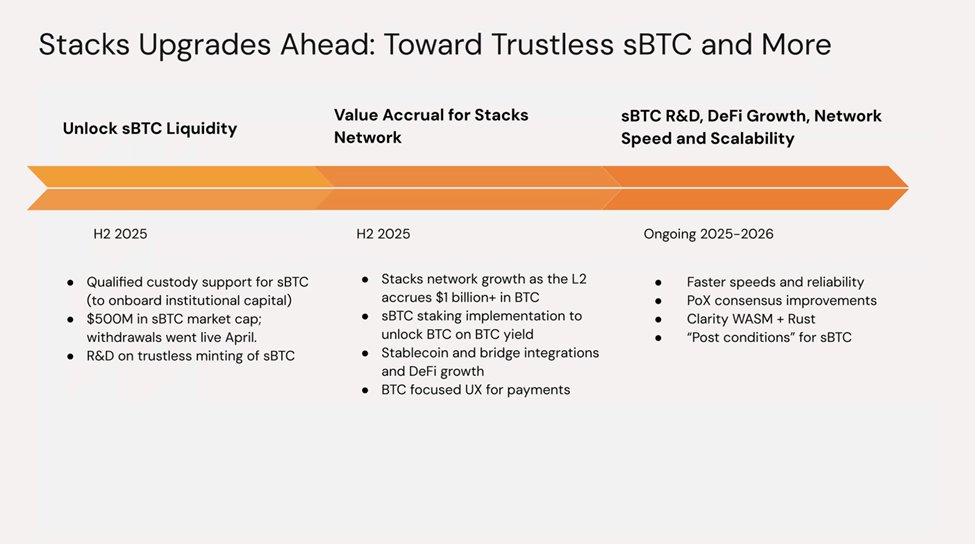

Presenting our latest house view on stacks.btc! In this report, we cover: - #BTCFi as a trillion dollar market, and how stacks.btc will capitalize it - why #sBTC is a game changer - latest alpha and roadmap for the Stacks ecosystem - our STX price prediction

Wow, moving $sBTC is lighting fast! stacks.btc #STX