Swissblock

@swissblock__

Pioneering the next investment frontiers, block by block

linktr.ee/swissblock_?ut…

ID: 1889302672081039360

https://swissblock.net 11-02-2025 13:17:42

148 Tweet

2,2K Takipçi

92 Takip Edilen

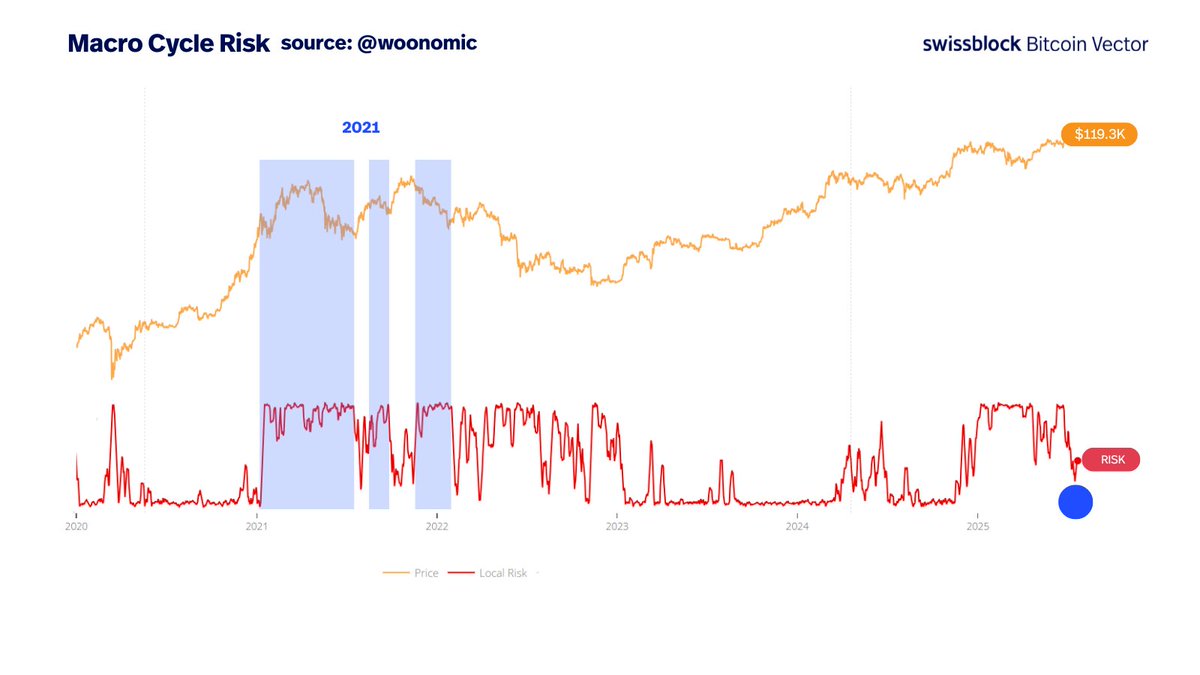

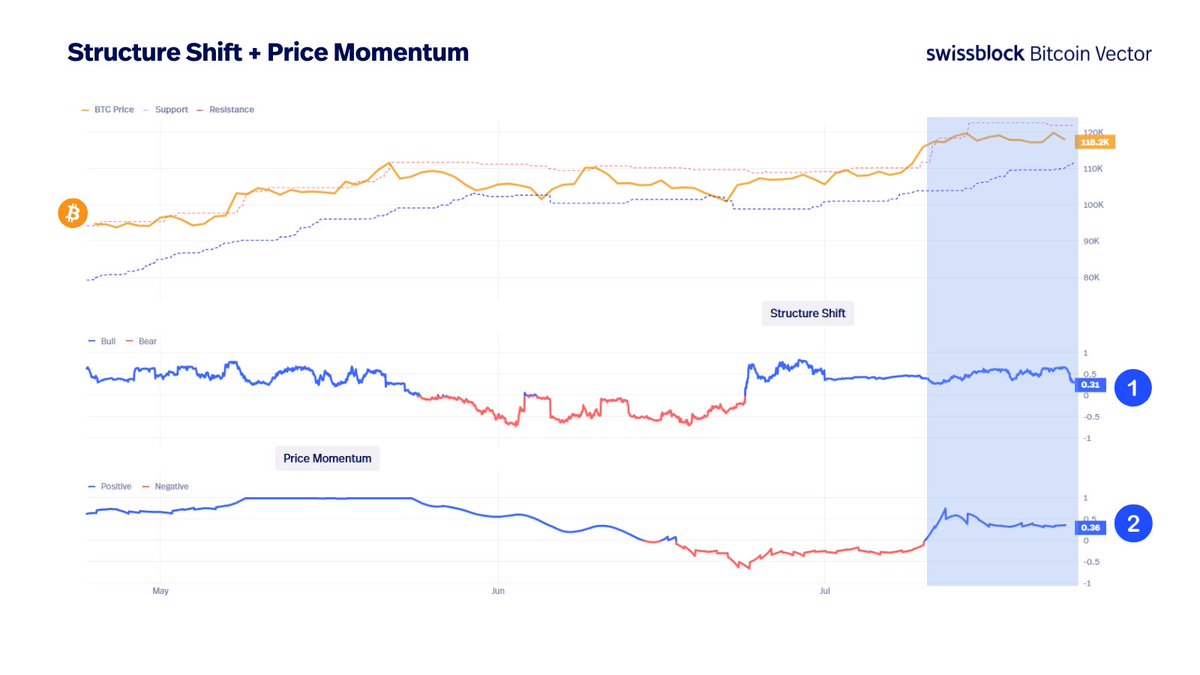

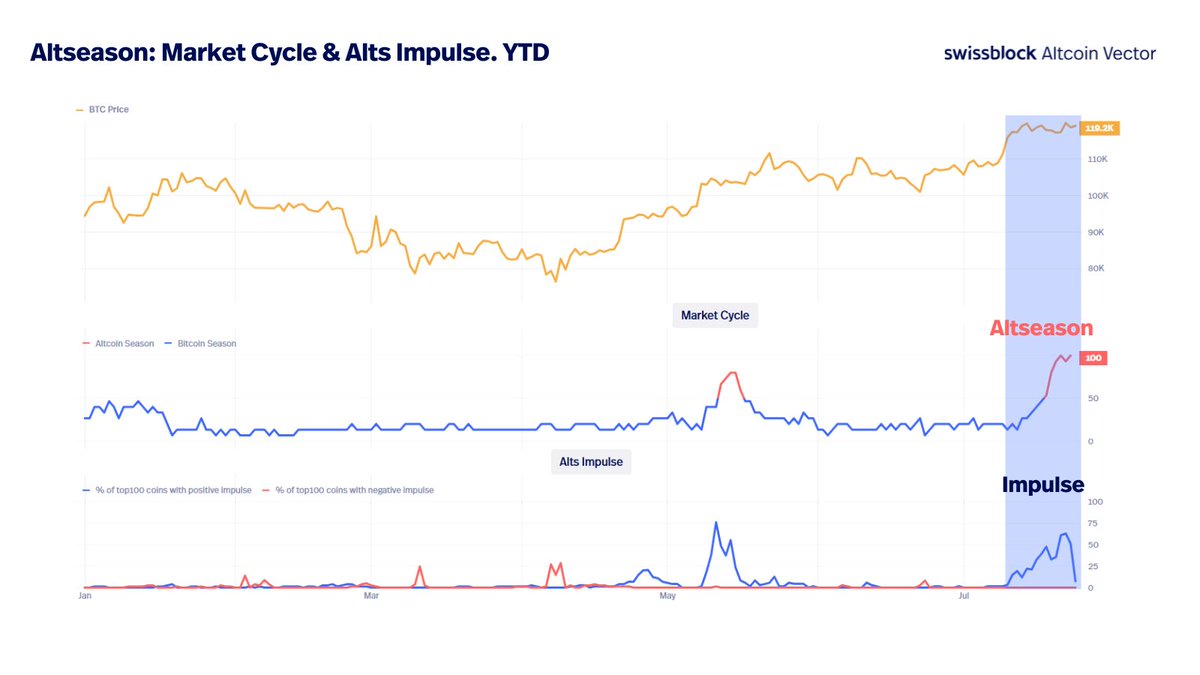

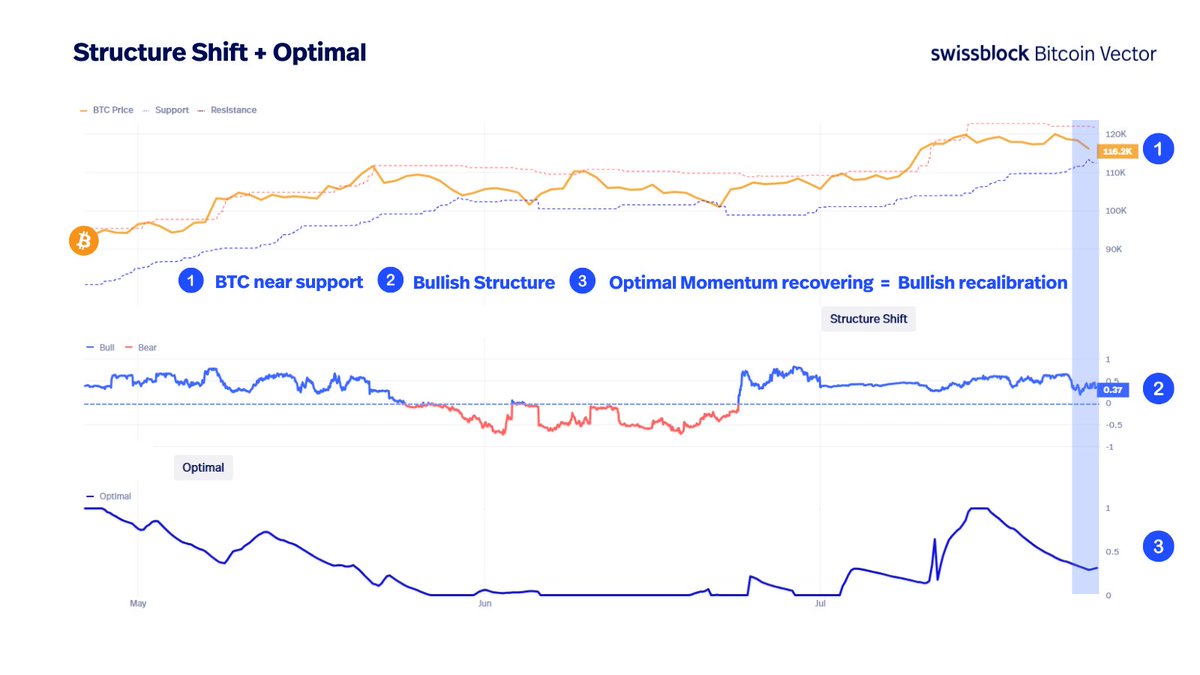

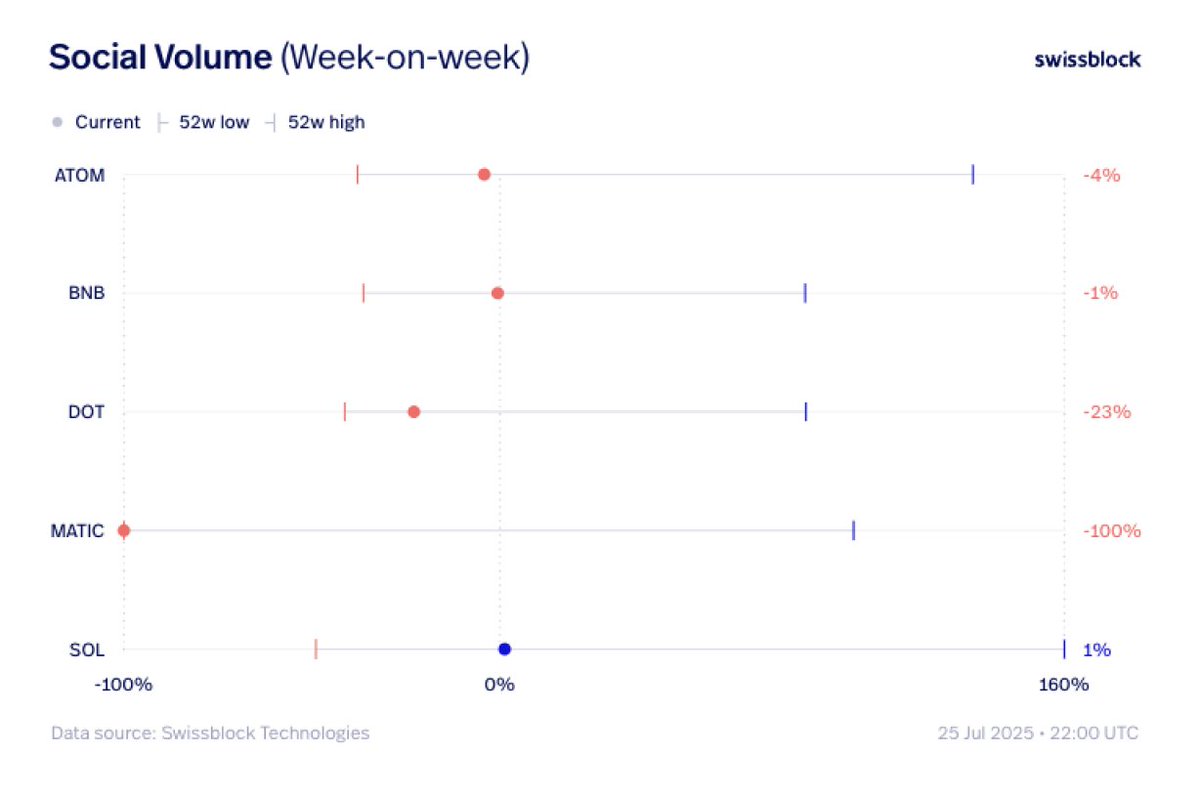

Chart via Altcoin Vector BTC is acting as the structural anchor, not the explosive leader. The bid is rotating into ETH, SOL, and high-impulse altcoins. BTC holds. Alts move. The cycle isn’t ending. It’s evolving. x.com/altcoinvector/…

Proud to be given this opportunity! Hope you want to come meet me at this event🙏 TEDx Swissblock 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 linkedin.com/posts/speak-2-…

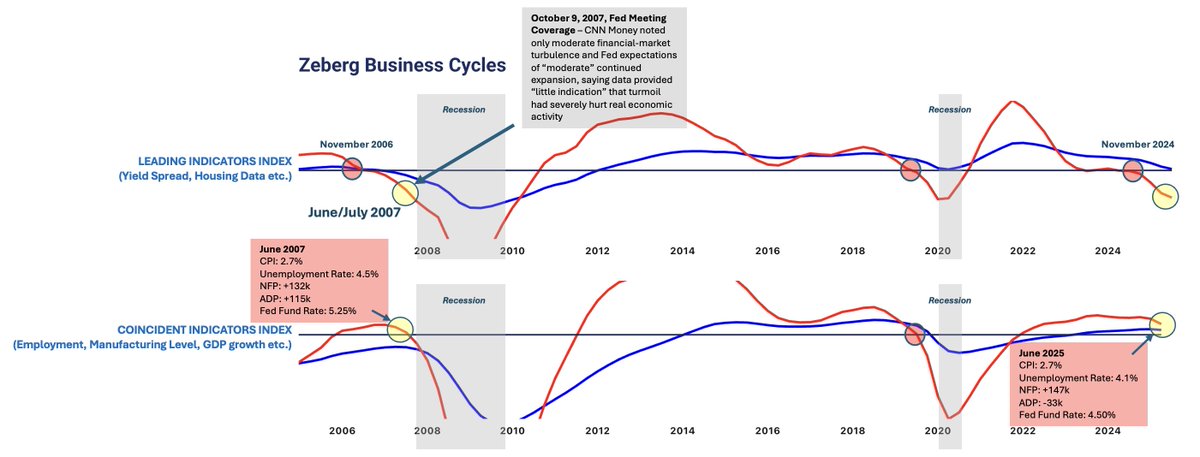

Last Chart of the Week with Henrik Zeberg “DXY – maybe not collapsing after all?” 🔹 Rising wedge + bearish divergence = reversal confirmed 🔹 Bearish sentiment is now extreme 🔹 Momentum is shifting — bottoms are rising 🔹 A short-term bounce may come before the final leg

Hi After the Bull Run, there will be more trades ALTCOIN VECTOR, alongside Henrik and I will evaluate the market There will be trading opportunities on the way down We will maximise these with all the available information Altcoin Vector Henrik Zeberg Paul Webborn 2025

I just joined Altcoin Vector with Swissblock Henrik Zeberg Paul Webborn make for a strong team dynamic.