Steve Clapham, Analyst Author Podcaster Substacker

@steveclapham

Former hedge fund partner. I train professional investors in forensic accounting. Online investing training school. I can help you become a better investor.

ID: 28364479

https://behindthebalancesheet.com/ 02-04-2009 16:07:38

7,7K Tweet

13,13K Takipçi

2,2K Takip Edilen

REPLAY | How to Spot the Next Big Fraud: Steve Clapham’s Forensic Investing Playbook app.hedgeye.com/insights/16370… via @hedgeye Steve Clapham, Analyst Author Podcaster Substacker

Big investors look to sell out of private equity after market rout via Financial Times Pressure is increasing on private equity and economic slowdown will hurt private credit too. on.ft.com/42yCXTm

Join Me for a Live MasterClass on Thursday, April 24 at 1pm BST / 8am EST, where I’ll be diving into one of the most powerful—but underused—frameworks in equity research: the capital cycle. With AlphaSense bit.ly/42kFYW3

Looking forward to this event. Just spent time today with the AlphaSense team to discuss. Should be interesting. Also watch out for my Substack on the capital cycle this weekend

Standards are falling. Financial Times used to be a quality newspaper. Now it’s just priced like one. Ironically any AI checker could pick up spelling errors.

I haven't got 100% in my AI tests so far and I hate ChaptGPT but I can't wait to try this. Thanks AlphaSense

The latest episode of A Book with Legs is here! In this episode, Cole Smead sits down with Steve Clapham, Analyst Author Podcaster Substacker, founder of the London-based investment research and training consultancy Behind the Balance Sheet, to discuss his book “The Smart Money Method: How to Pick Stocks Like a

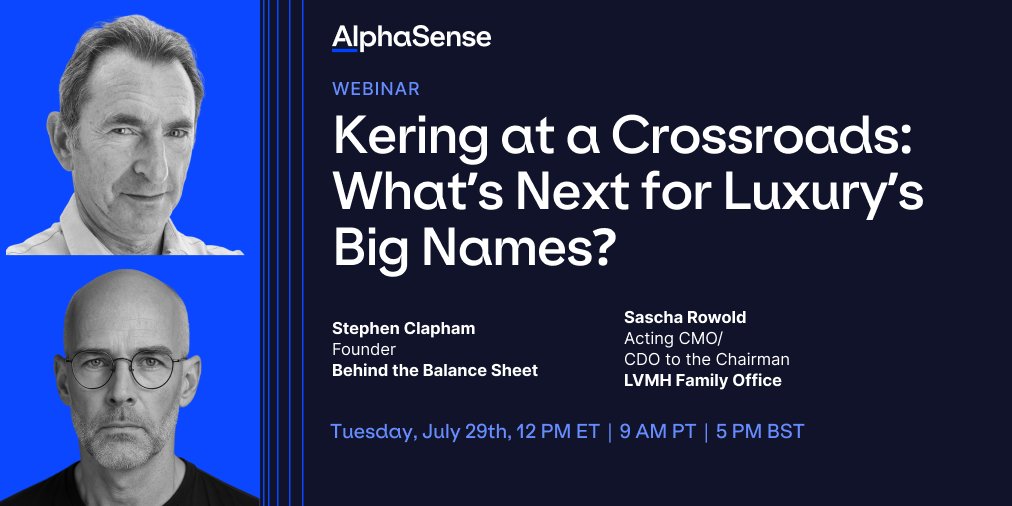

Just a reminder that you can still watch my conversation with Sascha Rowland, former CEO of Birkenstock, on the outlook for luxury and for Kering in particular. Thanks to AlphaSense for hosting. lnkd.in/e9RryBvS