Stefan Dietrich

@stefandietrich4

ID: 2242037455

12-12-2013 08:32:19

0 Tweet

215 Followers

279 Following

I’ll be bringing more educational content to this account. With topics such as understanding risk management, options flow and the underlying, risk/reward and tools to better understand trades & the market. I’ve partnered with unusual_whales Let’s get to work! 👊🏻📝✅😎

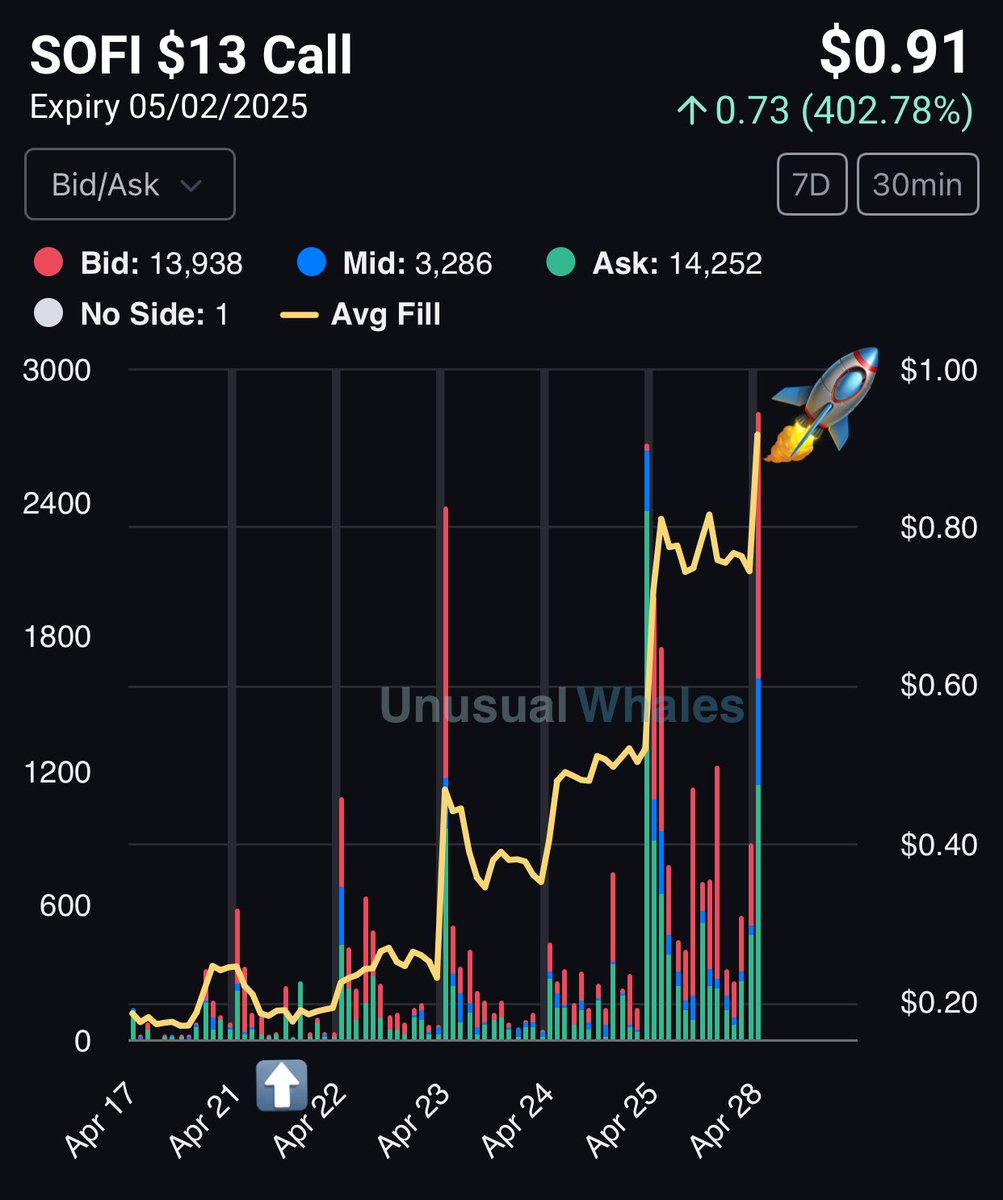

BOOM! $SOFI $13 5/16 calls are up 200% since I shared the trade idea last Monday ahead of the market open following the increase in OI as tracked by unusual_whales 📝✅😎 Alerted at $.38 — now $1.14 High $1.26 Alerted the $13c 5/2 at $.17 — now $.91 unusualwhales.com/referral#wolf

INCREDIBLE! $MSFT trader taking some gains on those $417.50 calls Alerted into the close at $3.47 a contract & trader just unloaded two blocks of them at $17.42 and $17.26 — 400% on short-dated OTM calls ✅💰 Find trades like this with unusual_whales unusualwhales.com/referral#wolf

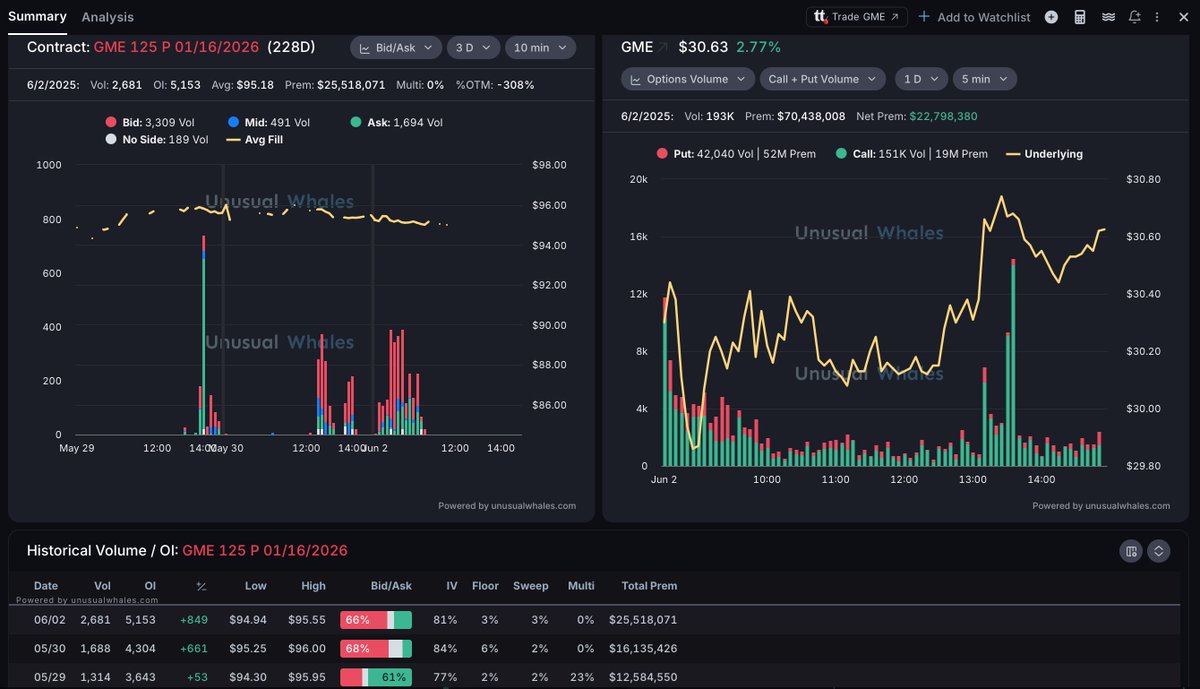

$GME Option Flow Report May 1 - let's break down the unusual_whales option flow as GameStop saw net premium over $1M on Wednesday. Take a closer look at the gamma that is built into May & June as traders are betting on continuation and/or upside & what you need to know #GME📝😎

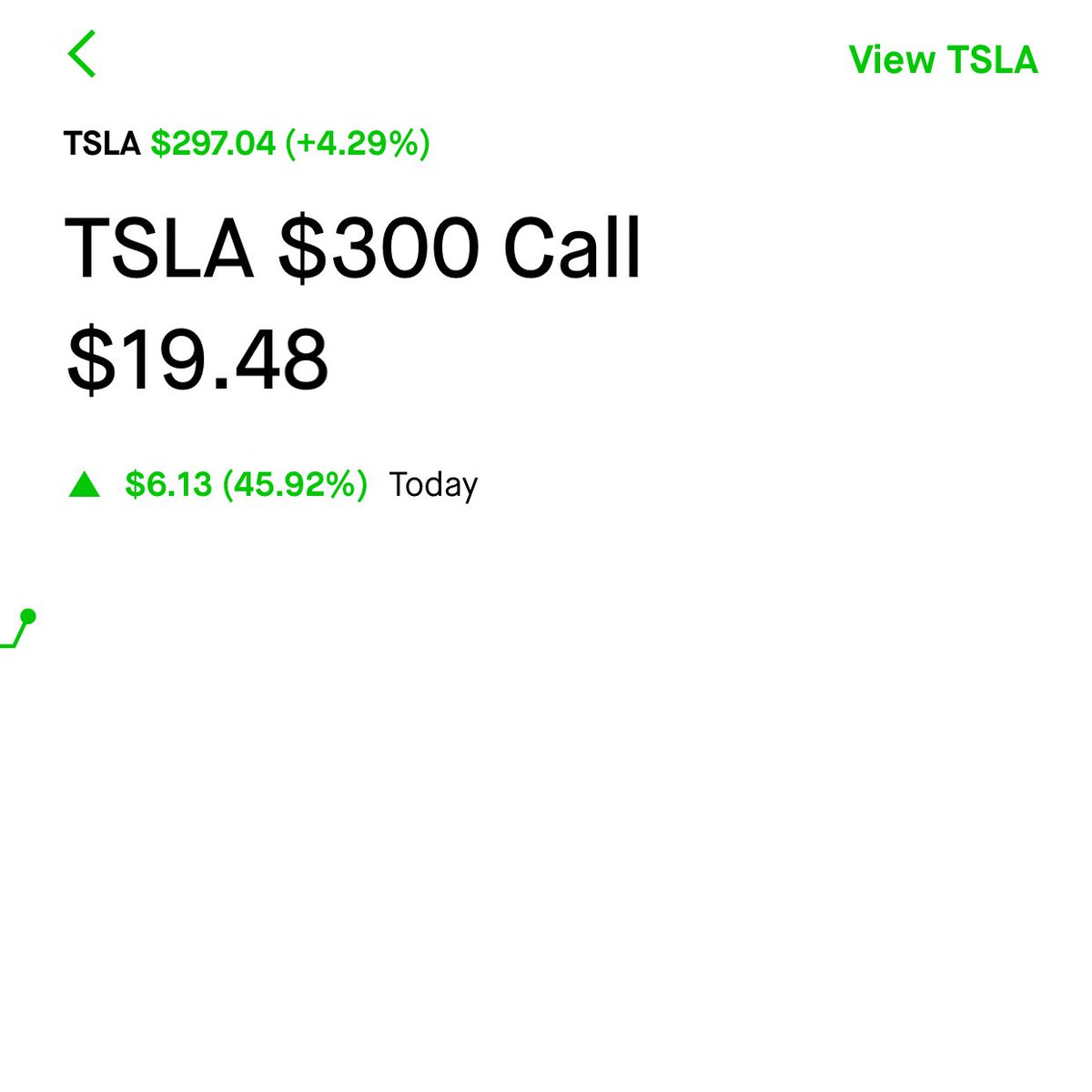

Up 36% today on those $TSLA $300 calls 6/6 — alerted on unusual_whales on Thursday morning at $12.64 shortly after the open. Open interest expanded today from yesterday’s $70M in premium — nice call Alex Jones Industrial Average 📝✅😎

Over $3M on GameStop in-the-money $20 calls for 6/20 — juicing that net call premium on unusual_whales this morning as $GME high of day of $27.67 & seeing that upside gamma pressure Follow this contact unusualwhales.com/flow/option_ch… Real-time option flow data unusualwhales.com/referral#wolf

WHOA! GameStop buys 4,710 Bitcoin, call options are pouring in, bullish call debit spreads being traded and nearly $170M in total option premium on Tuesday $GME traders are betting on continuation & upside as this continues to gamma squeeze as shown with unusual_whales flow

$25M in $GME $125 puts? $22M in $120 puts? Let’s break down the math, the intrinsic value & the possible strategies behind those puts and what they ACTUALLY MEAN - we'll use unusual_whales data & take a deep-dive as only half of those appeared in new open interest today #GME