Spot Wiggum

@spotwiggum

Research and investing @sourcapital. Former @Delphi_Digital. I write about tokens I like.

ID: 1493407584916840449

https://flipsidecrypto.xyz/Spot-Wiggum 15-02-2022 02:11:38

2,2K Tweet

2,2K Takipçi

802 Takip Edilen

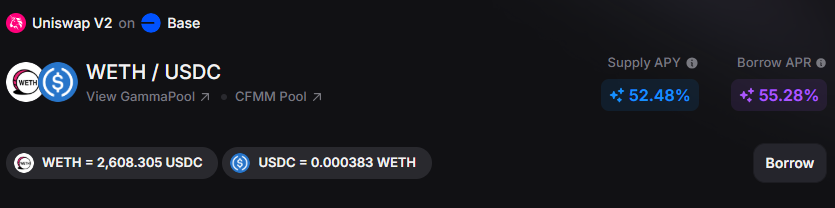

Earning 46% APY on delta neutral WETH/USDC LP positions! GammaSwap 👽 is a revolutionary DeFi protocol that enables traders to hedge impermanent loss from LP positions. By borrowing LP tokens, traders can short LP positions and turn "Impermanent loss" into "Impermanent gain".

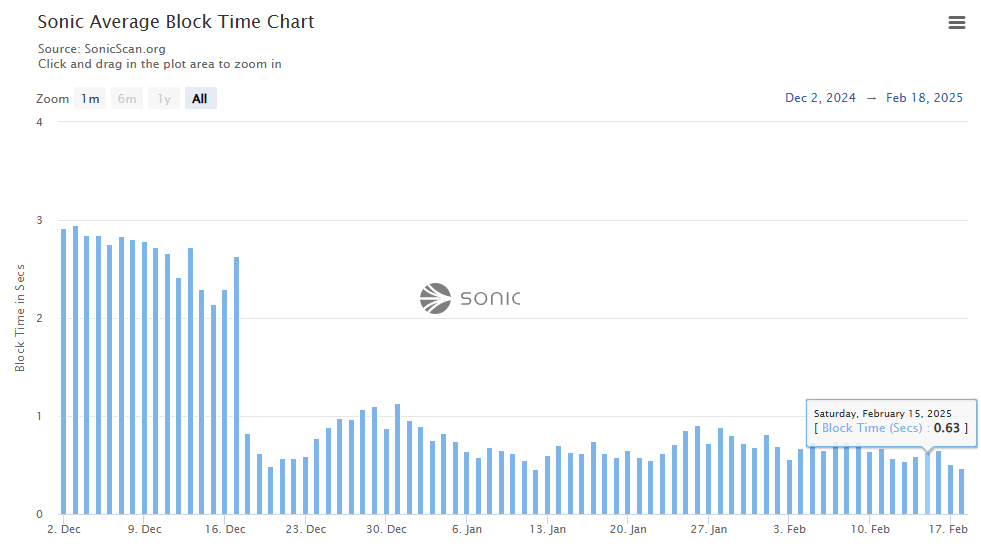

Genuine question: What will Monad do that Sonic from Sonic Labs can't already do? > 10,000 TPS > 500ms block times (Sonic is at 500-700ms live in prod) > Instant finality > EVM compatible What's the hype? Am I missing something?

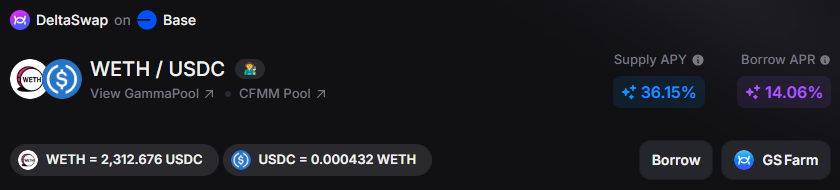

There's some juicy arbitrage opportunities available over on GammaSwap 👽 again You can currently earn 30% APY on a USDC/ETH LP position without any impermanent loss. Supply liquidity to the WETH/USDC Uniswap pool and earn 43% APY (from pure fees). Then borrow (open a

For anyone looking for an intro to GammaSwap 👽 set aside some time to watch this short interview. It covers the team, protocol design and use case, future products (yield tokens), $GS token and more. Gamma