Zenith

@splash__project

Any Post in this account isn't recommendation.

Please feel free to reach out if you're interested in collaborating. I would be delighted working together.

ID: 1675011809508569088

01-07-2023 05:22:00

987 Tweet

674 Followers

66 Following

![Zenith (@splash__project) on Twitter photo [With Indicator/Strategy Link Below]

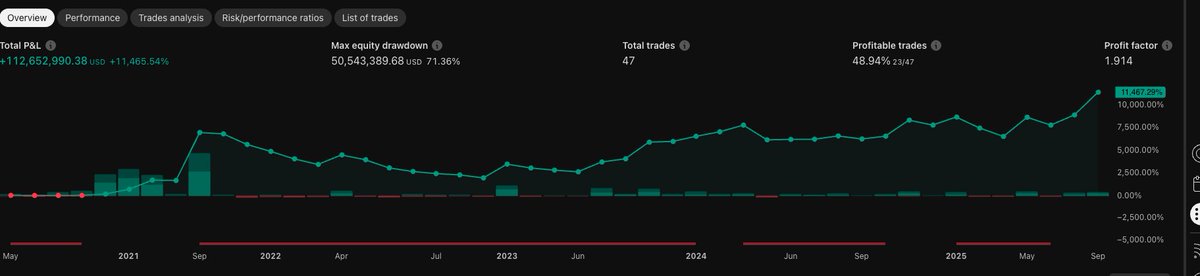

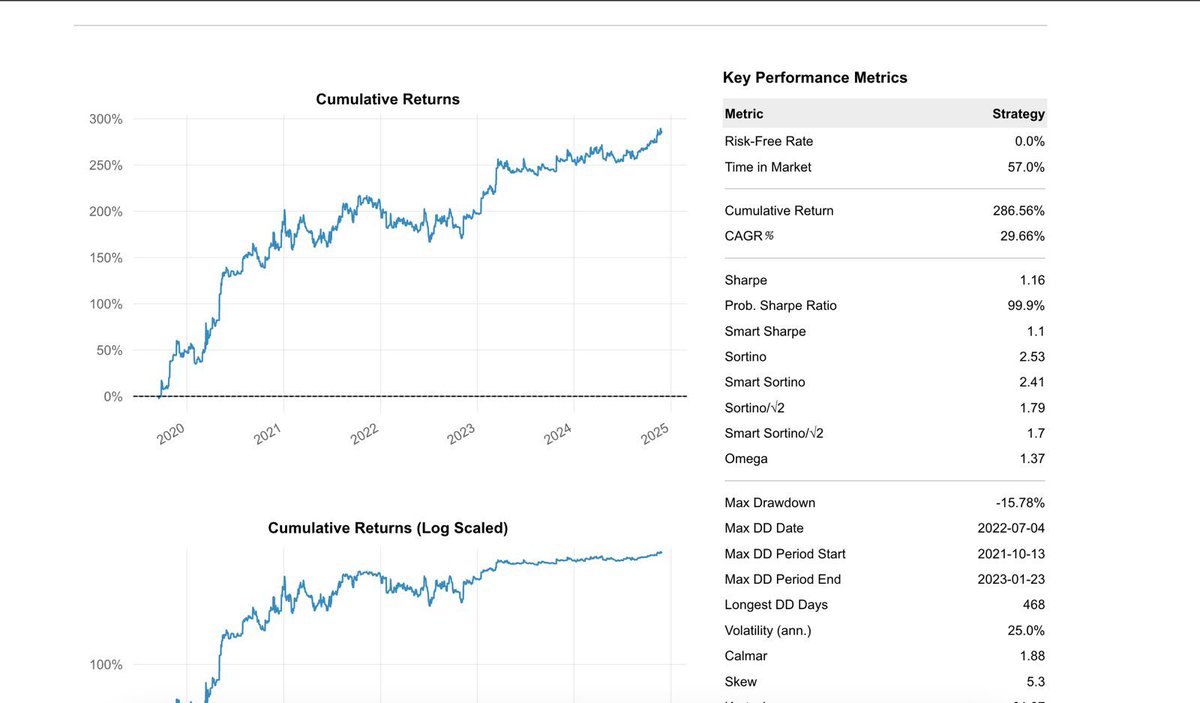

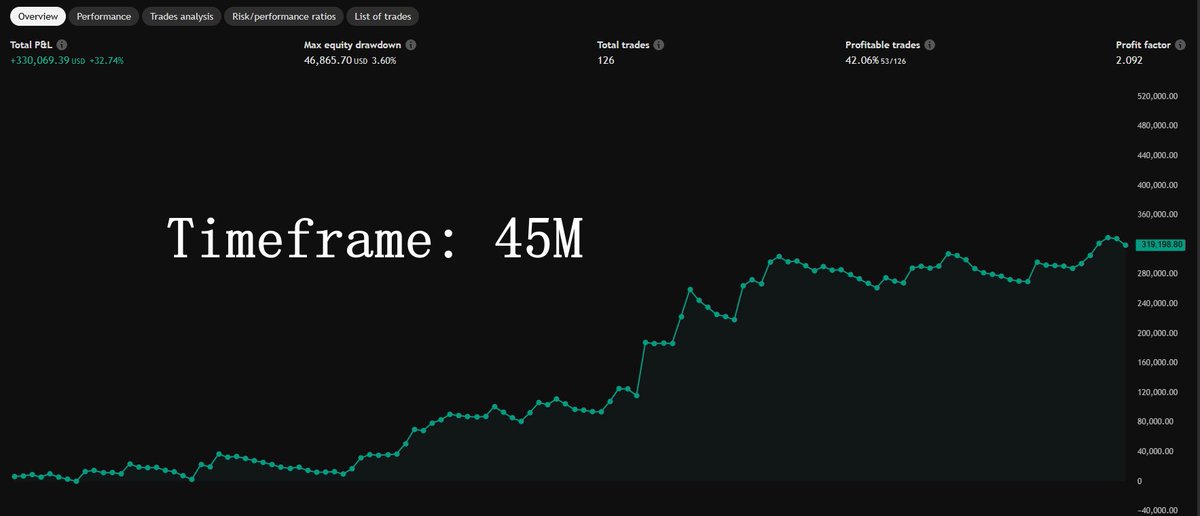

New trading strategy for NQ NASDAQ using advanced ML and Quantitative Analysis!

Unlike static strategies that fail when markets change, ours adapts to stay profitable.

Adapts to Market Shifts: Adjusts to market sentiment and regime [With Indicator/Strategy Link Below]

New trading strategy for NQ NASDAQ using advanced ML and Quantitative Analysis!

Unlike static strategies that fail when markets change, ours adapts to stay profitable.

Adapts to Market Shifts: Adjusts to market sentiment and regime](https://pbs.twimg.com/media/G1iYJJrXYAEGW9u.jpg)