SentimenTrader

@sentimentrader

The Sentimentrader Advantage: Over 20 years of exclusive, data-driven insights and unrivaled market sentiment tools.

ID: 7557352

http://www.sentimentrader.com 18-07-2007 12:22:30

3,3K Tweet

255,255K Followers

652 Following

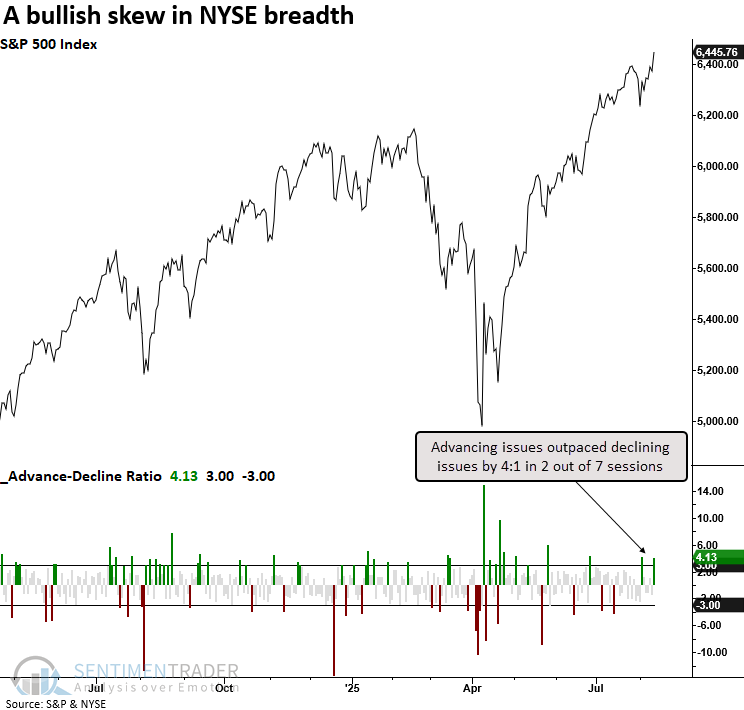

Following a four-day pullback, buyers regained control, propelling the S&P 500 to fresh record territory on Tuesday. Market breadth was equally impressive, as NYSE advancers outpaced decliners by a 4-to-1 margin in two of the last seven sessions. 🔗 Read Dean Christians, CMT's Aug 13

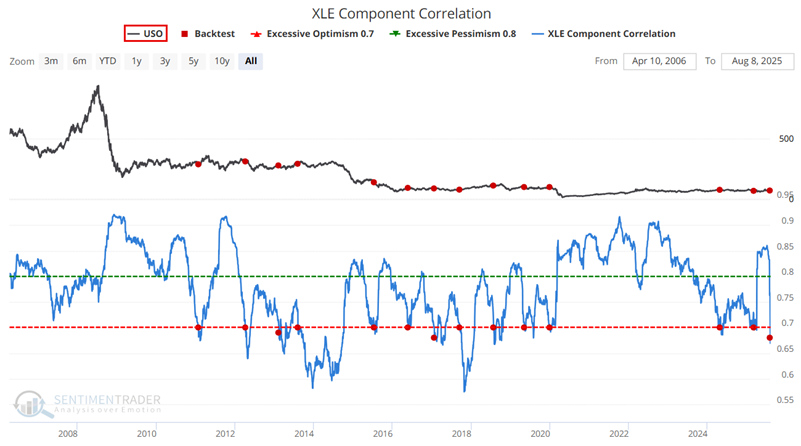

Crude oil has traded lower within a long sideways channel. Conventional wisdom argues for another bounce. However, Jay Kaeppel pointed out in a recent note that under the surface, various factors suggest that playing the long side of crude oil is a questionable bet. 🔗Read

Wait, NOW green energy is starting to flex? I'm guessing most didn’t have that on their bingo card. SentimenTrader

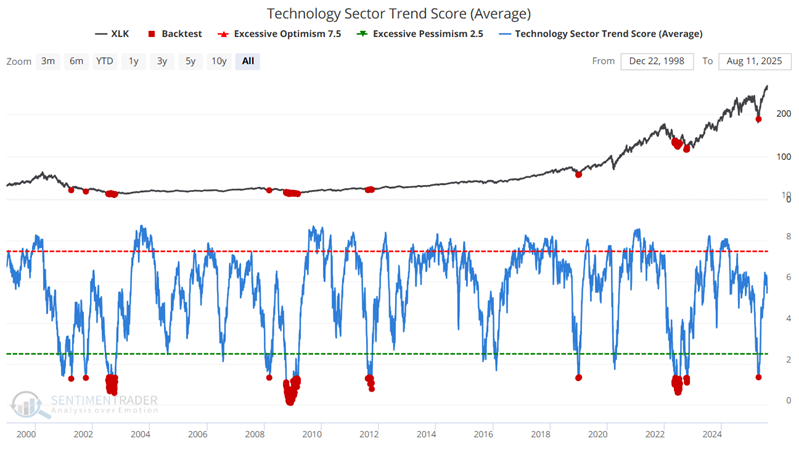

The technology sector has roared higher following an early-year sell-off. Oversold signals in April followed by recent continuation signals suggest the rally could continue longer than many may suspect according to Jay Kaeppel. 🔗Read Jay Kaeppel's Aug 13 article "The continuing

Human nature never changes. When bad economic news arises, investors become more fearful as things worsen. Two little-known datasets have highlighted significant recent concerns regarding monetary policy and inflation. According to Jay Kaeppel, history suggests that this is a