Tears of Satoshi 🥹

@satoshi_tear

Top crypto analysis into simple words | FULL TIME REPLYING

ID: 1884162998056501248

http://t.me/satoshi_tear 28-01-2025 08:54:09

4,4K Tweet

749 Followers

1,1K Following

Whales don’t buy fear – they buy value. According to Lookonchain, large wallets have accumulated 323,523 $ETH (~$1.12B) over the past 48 hours. It’s easy to dismiss this as “just another dip,” but when capital of this size moves against the trend, it usually signals

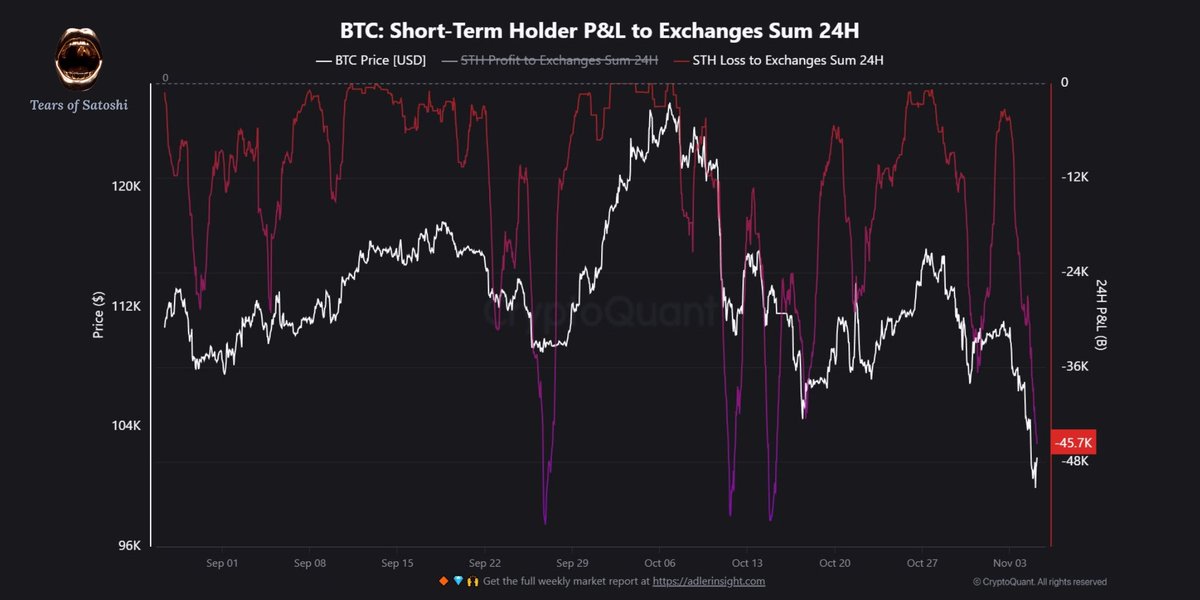

. CryptoQuant.com just showed what smart money already knew - short-term holders panic sold 45,700 $BTC (~$4.6B) at a loss in 24h. When prices fly, small players start dreaming of $200k Bitcoin. Big wallets know this - so they quietly sell into the hype. They dump their

. Sandeep | CEO, Polygon Foundation (※,※), CEO of Polygon Foundation, says stablecoins are not weakening the dollar → they’re spreading it. Instead of U.S. dollars flowing mainly between big institutions (like governments and corporations), digital dollars now reach individuals directly through

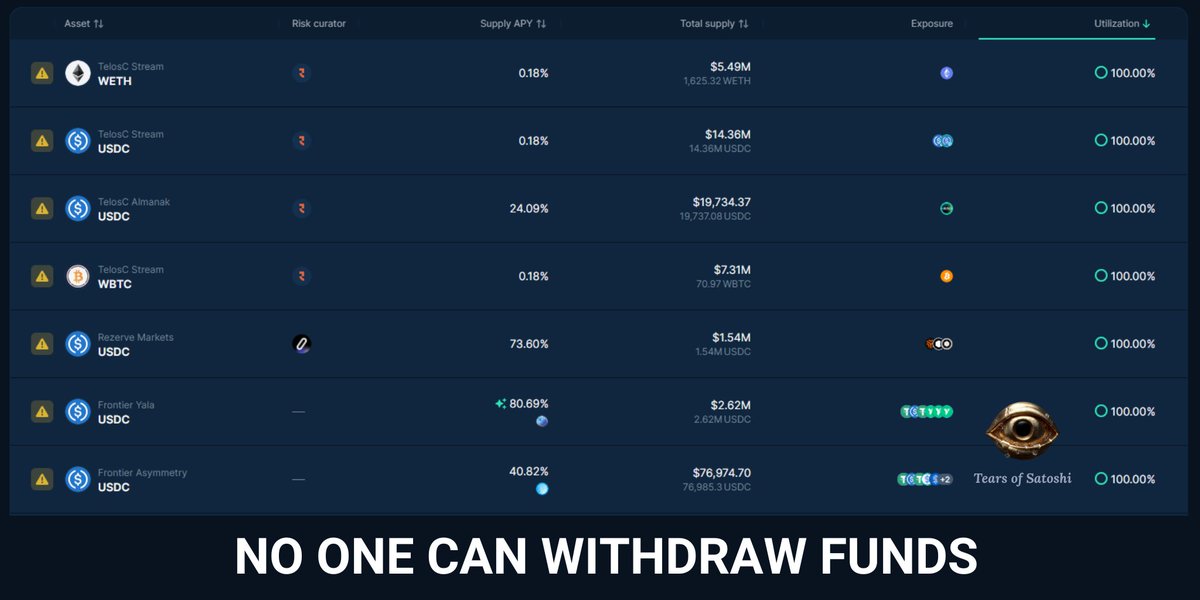

$deUSD stablecoin collapsed by 97% after reports of major losses inside the project. About 65% of the collateral (approximately $68 million) was held as a loan in Stream Finance.

What if the CEO of J.P. Morgan, Jamie Dimon, who called Bitcoin “worthless” had simply bought a few coins instead of talking it down? 2017: Dimon reportedly called Bitcoin a “fraud … worse than tulip bulbs” and said he would fire any trader at JPMorgan caught trading it. 2018: