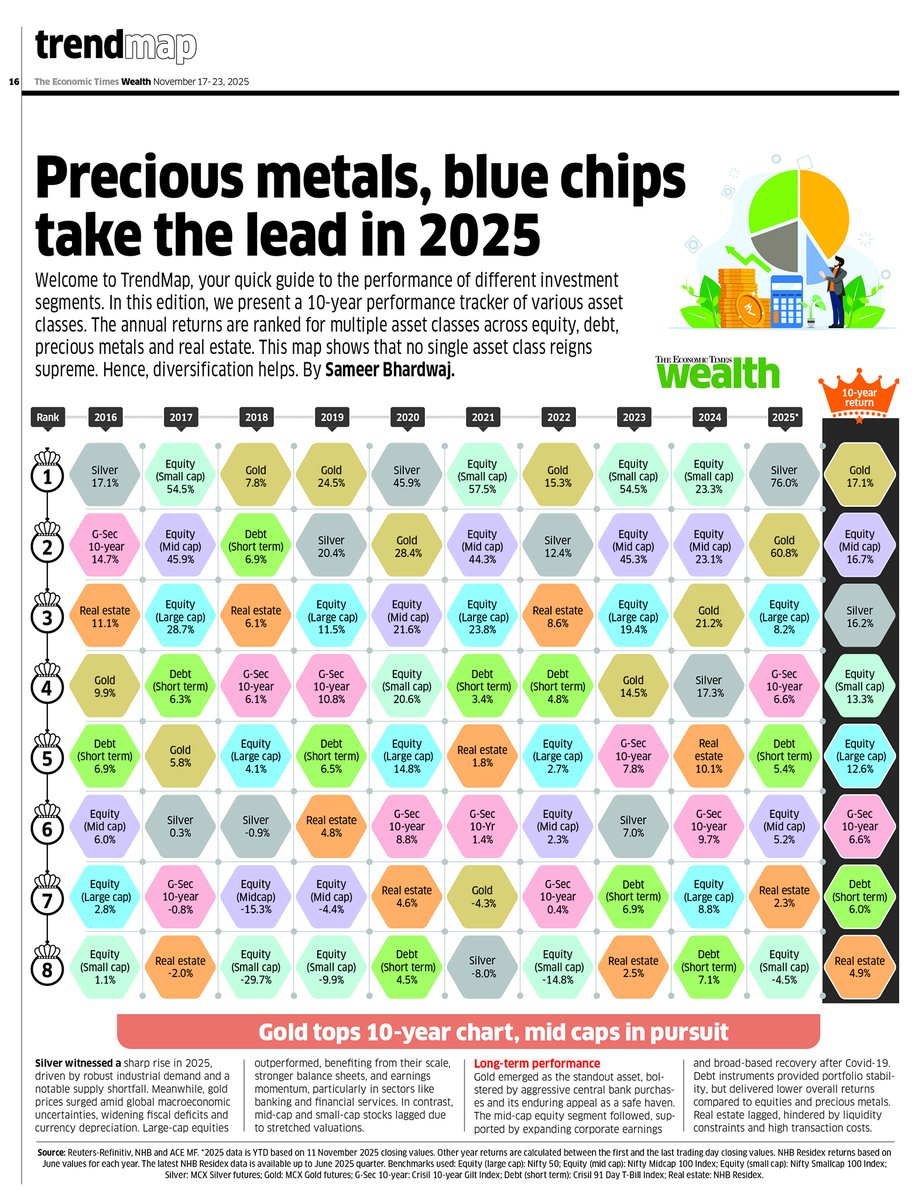

Sameer Bhardwaj

@sameerb_81

Senior Assistant Editor at ET Wealth. Covers stocks, mutual funds and investments. Interests in data analysis and machine learning.

ID: 926372697747070976

03-11-2017 08:57:17

46 Tweet

39 Takipçi

99 Takip Edilen

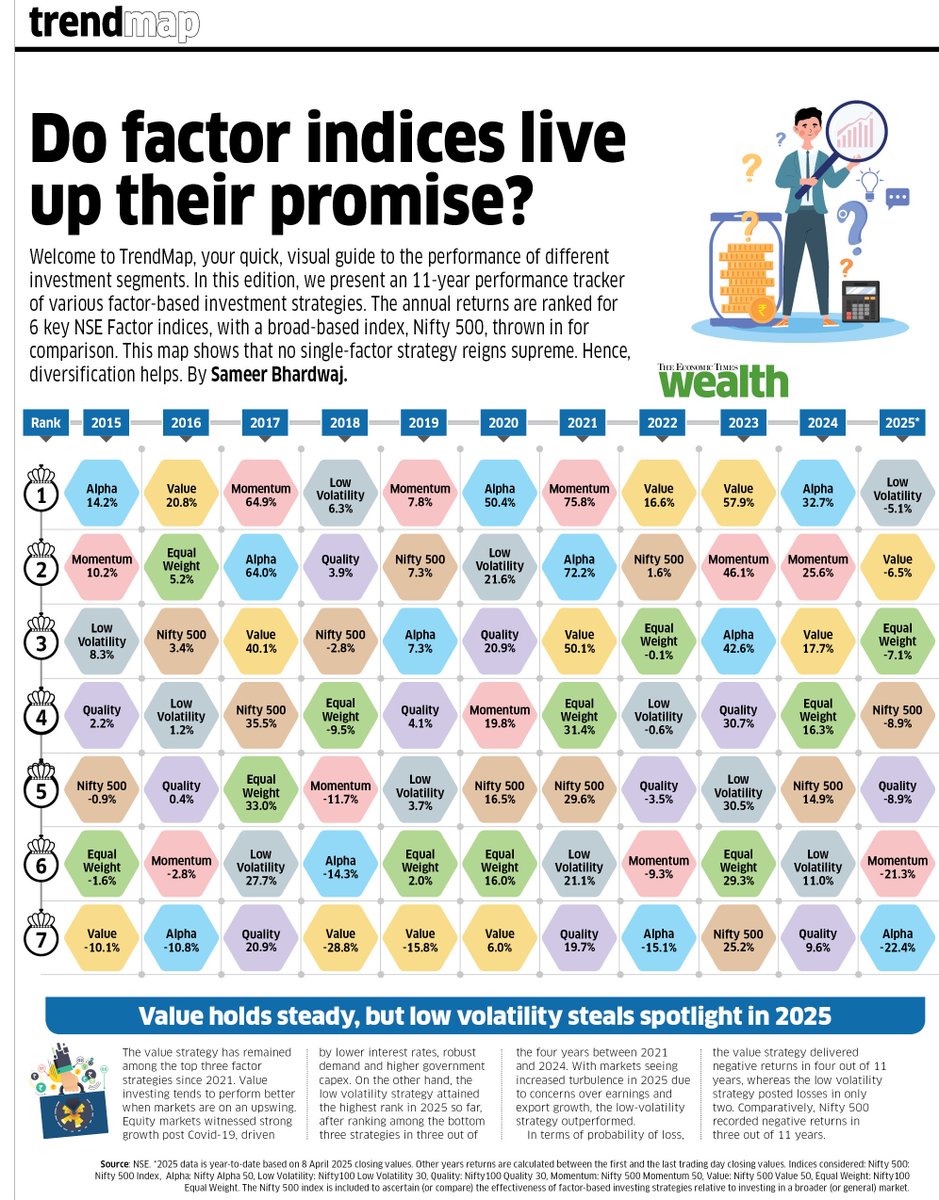

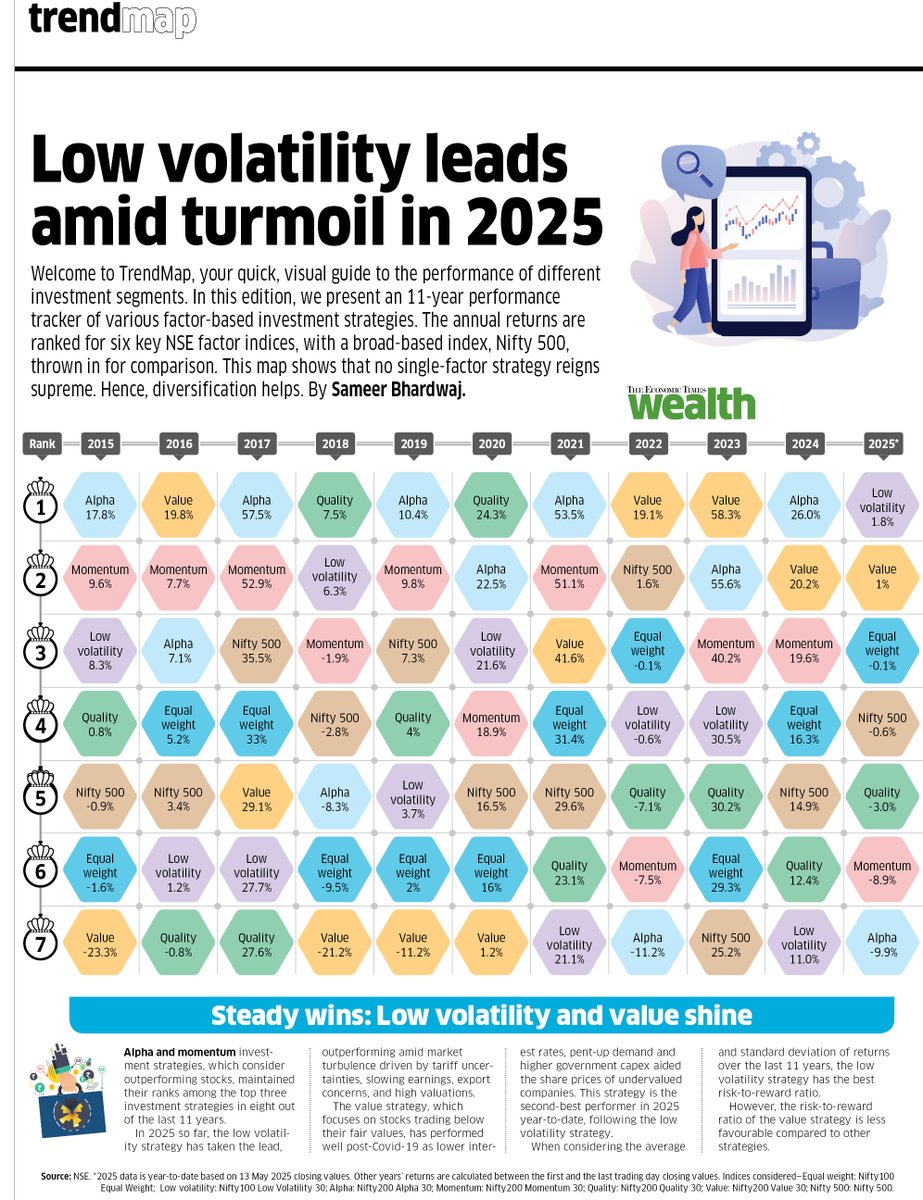

📊 In 2025, Low Volatility tops the charts amid market chaos! Over 11 years, no single strategy dominated—but Alpha, Momentum & Low Vol stood tall. 👉 Factor investing = diversification in action. Our weekly TrendMap from ET Wealth Economic Times, put together by Sameer Bhardwaj

The real action is in mid-caps and alternative credit, says Vikaas M Sachdeva, MD of Sundaram Alternate Assets. 3 moves from Sachdeva: 1/ Mid-caps still have juice - Trading at 50% premium to Nifty 50, but quality names in power/cables can deliver 15%+ growth. Aug '24 froth has