CA Sambhav Daga

@sambhavdaga

CA.✍️To Simplify Tax & Legal Compliances for Individuals & Startups || Personal Finance || NRI Taxation || For Consultations: https://t.co/WFrNGd4Mxh

ID:63118987

https://topmate.io/sambhavdaga 05-08-2009 12:35:43

5,9K Tweets

6,8K Followers

397 Following

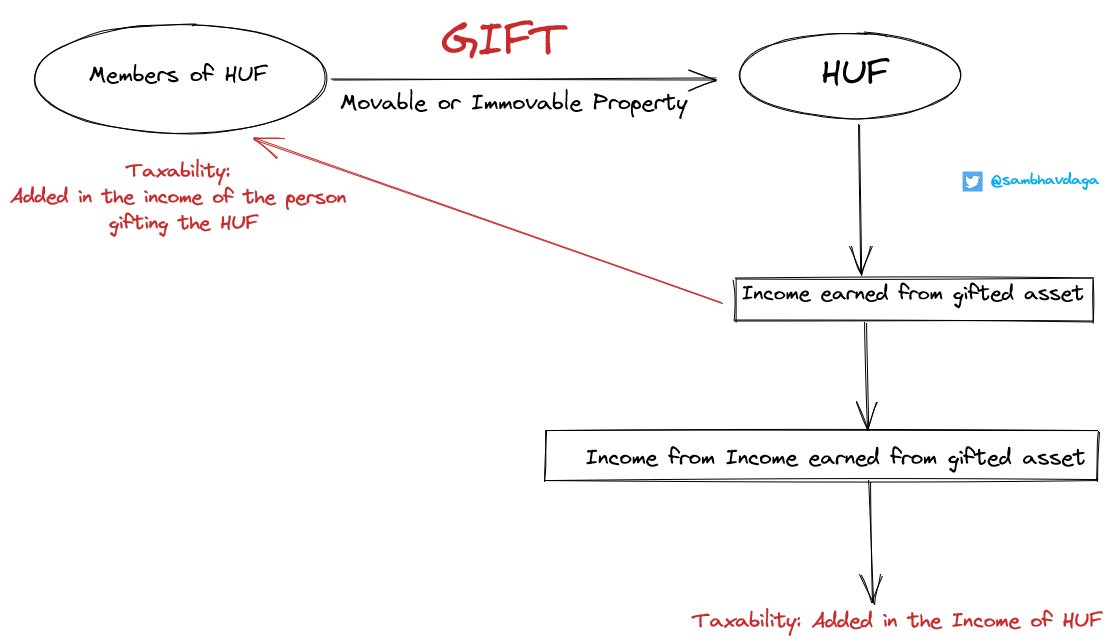

If you're transferring assets to your HUF

↪️Without consideration/Gift; or,

↪️ Inadequate consideration (i.e. at a value less than fair market value)

#IncomeTax

Dear GST Tech, Einvoice excel is not downloadable since 3rd april. We have strict deadlines by CBIC of 11th, without reconciling it with books, G1 is impossible. It needed ASAP. Don't expect grievance, issue is in every login.

CBIC Ministry of Finance National Informatics Centre Services Inc.

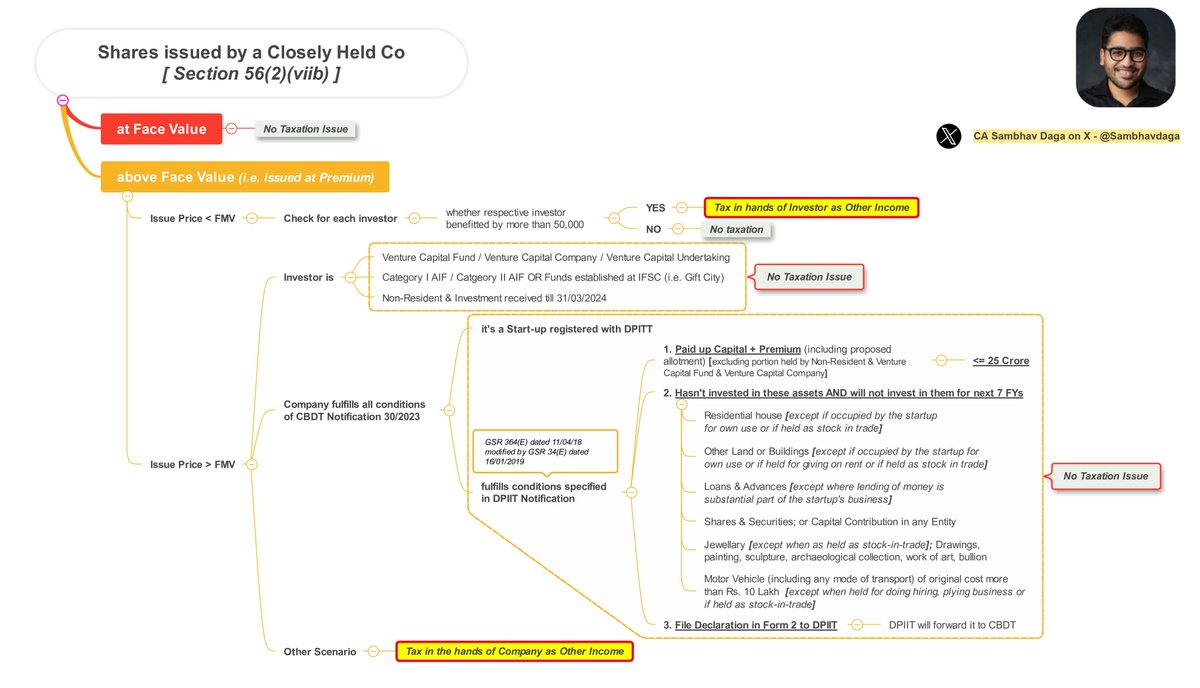

Can you issue shares of a private limited/closely held company at a value lesser or higher than fair market value?

Yes, you can, but it comes with these income tax implications!

Startups, Watch Out!

#IncomeTax

Everybody is posting today about the 2011 WC win and I feel more bad for the 2023 WC loss.

#Throwback

If you’re in a job, ask your employer to contribute to NPS if they are not doing it.

This will help you get deduction under section 80 even in the new tax regime.

The best time to start this is now for the new financial year 2024-2025.

#IncomeTax

This is one of the reasons new tax regime was introduced wherein deductions and exemptions are very very limited.

Going forward, old tax regime will be completely removed in few years.

#IncomeTax