Simon Mikhailovich

@s_mikhailovich

Contrarian, entrepreneur, sailor. TBR manages global private bullion reserves; TBS helps buy & store bullion in the US.

Independence, Endurance, Scarcity

ID: 563146131

http://www.bullionreserve.com 25-04-2012 17:45:41

14,14K Tweet

43,43K Takipçi

351 Takip Edilen

Gold Confiscation Risk Explodes; EU Seizes Chinese Chip Giant, Mikhailovich Says it’s Act of War Watch now: youtu.be/7yrBZK1fbeQ #gold #china #economy #finance #money #usd Daniela Cambone-Taub

Roger Mitchell Simon Mikhailovich Mo Licker 🛡️ Grant Williams Matt Zeigler The Mad King Santiago Capital Live look at US policymakers ending reliance on the Chinese industrial base that has supported the UST market & USD for 25 years 👇

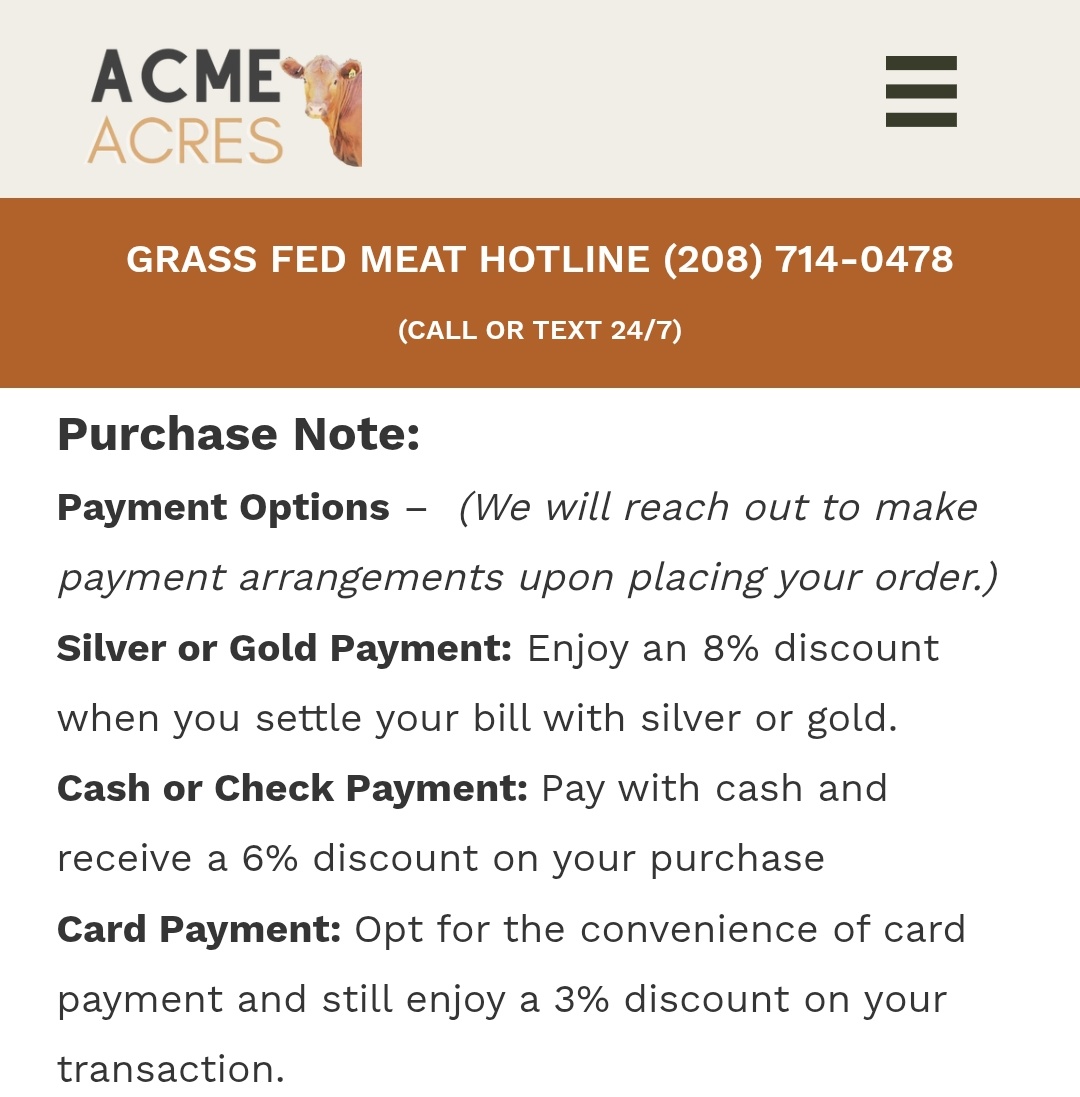

Simon Mikhailovich Interesting ...independent ranchers are now accepting gold and silver as payments...and you get a discount

Simon Mikhailovich The “safe haven trade” is a curious idea: Buy lifeboats now, Sell them when everyone sees icebergs ahead. A good way to make money. A bad way to stay afloat. What if the iceberg actually hits?