Ertan Can

@rtancan

Investor in micro VC funds. Founder of @MultipleCapital. Constantly looking for the #underdog in Venture Capital.

ID: 2457923748

http://www.multiple.capital 22-04-2014 10:15:53

1,1K Tweet

2,2K Takipçi

1,1K Takip Edilen

Adam Small KSL NewsRadio America is brain draining itself.

Republicans against Trump For context, this was Bruce Springsteen

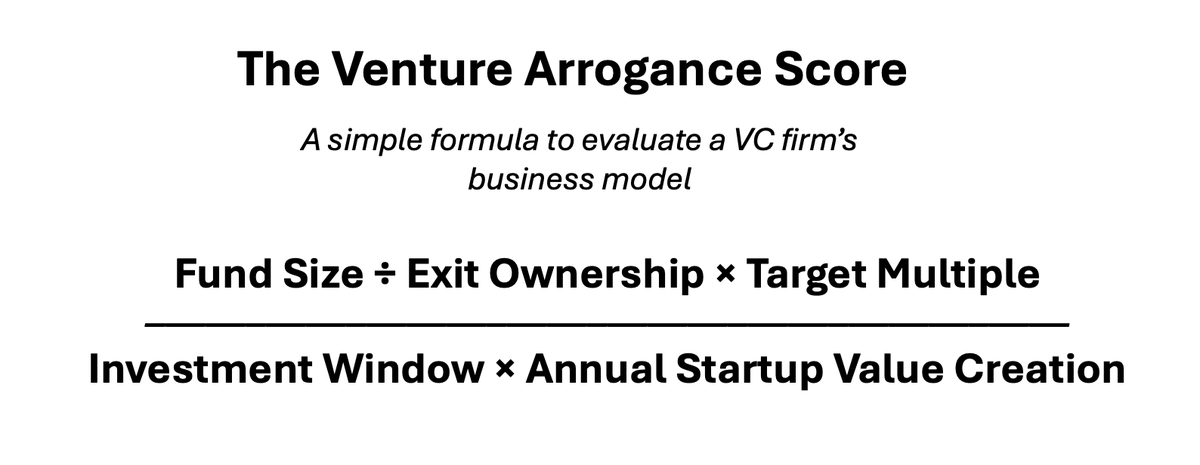

This is basic math for most European LPs hunting large US brand VC funds. Add the fees that most European LPs pay to get access to those Super Brands by using feeder funds and "access-FoFs" and you understand it's even way harder than Josh Kopelman rightly said. 🤷😌 #LPreturns #VC

World of Statistics 🇯🇵 Japan's population change, by year: 2013: -238,621 2014: -269,416 2015: -284,789 2016: -330,916 2017: -394,421 2018: -444,085 2019: -515,854 2020: -531,816 2021: -628,205 2022: -798,214 2023: -831,872 2024: -898,000