Robin J Brooks

@robinbrooks_j

Senior Fellow. Previously Chief Economist and FX strategist. Official interactive page. Main backup page.

ID: 2883329377

30-10-2014 12:19:24

352 Tweet

78 Takipçi

622 Takip Edilen

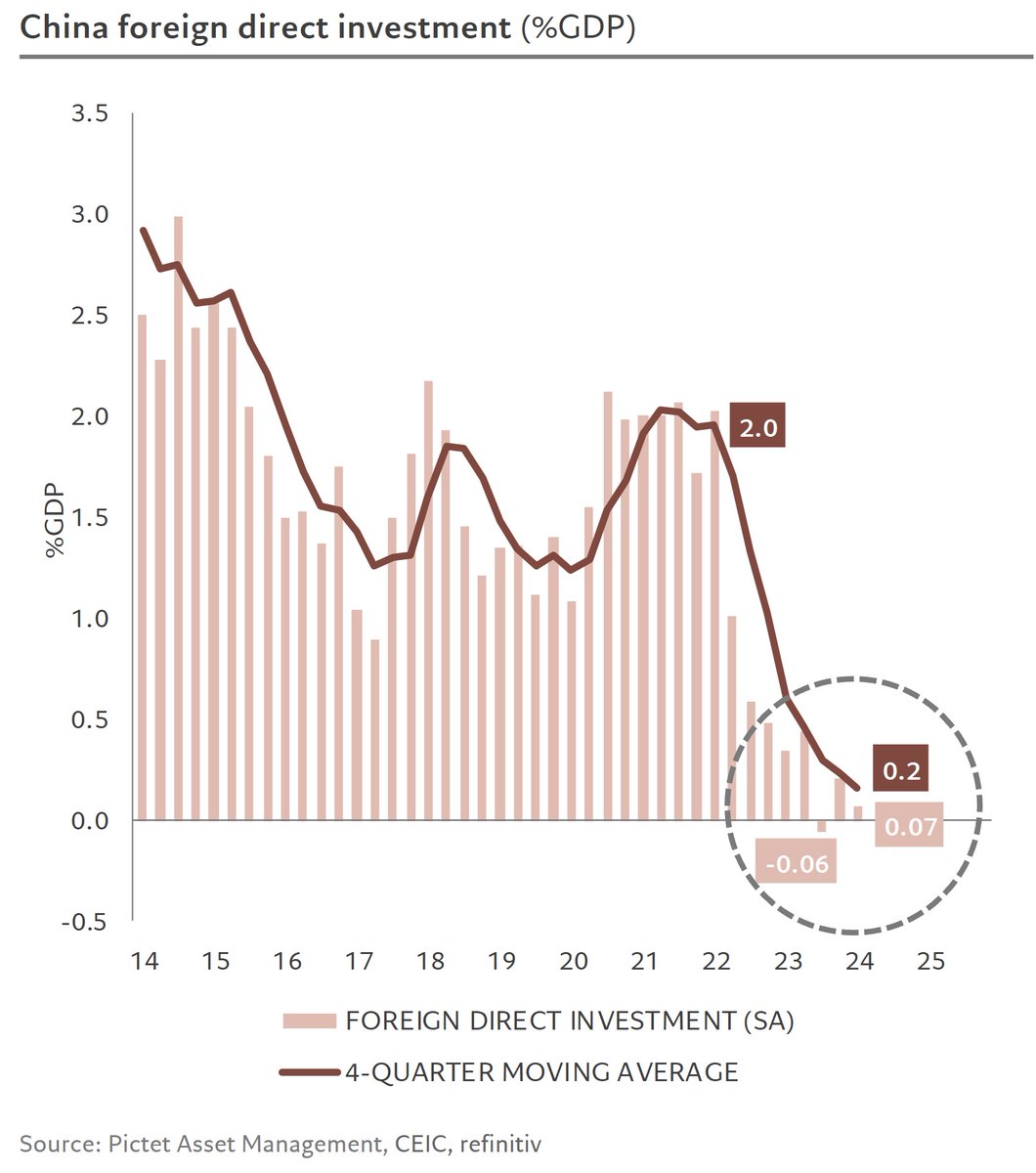

1/ China’s FDI for Q1 remained extremely low (<0.1% GDP) I won’t go into the granularity of this data, already brilliantly explored by Brad Setser & Robin Brooks, but content myself with a few simple structural observations, beyond the arguments of deglobalization or not

The Thames Water 💧 debacle, covered for years by gillplimmer for the Financial Times, is now being debated in Germany, following a report by Sascha Zastiral for DER SPIEGEL. (1/7) spiegel.de/wirtschaft/unt…

Concetti che, ahimè, aveva già ampiamente illustrato in una live con Michele Boldrin e Alberto Forchielli. Più che essere la #Russia ad aggirare le sanzioni, sono le imprese europee ad aggirarle. Schifo