CA Rishab Bhandari

@rishabbhandari

Practicing CA 🖋at Rishab Bhandari & Co.(Beawar) || Ex-KPMG (BSR & Co. LLP) (Mumbai) || Ex-AA at JKS (Ahmedabad) || Learning More || The Universe has my back 🔥

ID: 460990509

https://www.linkedin.com/in/ca-rishab-bhandari/ 11-01-2012 10:11:52

245 Tweet

57 Takipçi

362 Takip Edilen

Request to Institute of Chartered Accountants of India - ICAI - Please strongly represent to Ministry of Finance for a timely Tax Audit Due Date extension. ✉️ Only sending letters by mail or courier won’t make any impact. ✅ A direct meeting with #CBDT Chairman or Finance Minister Nirmala Sitharaman is the need of the hour.

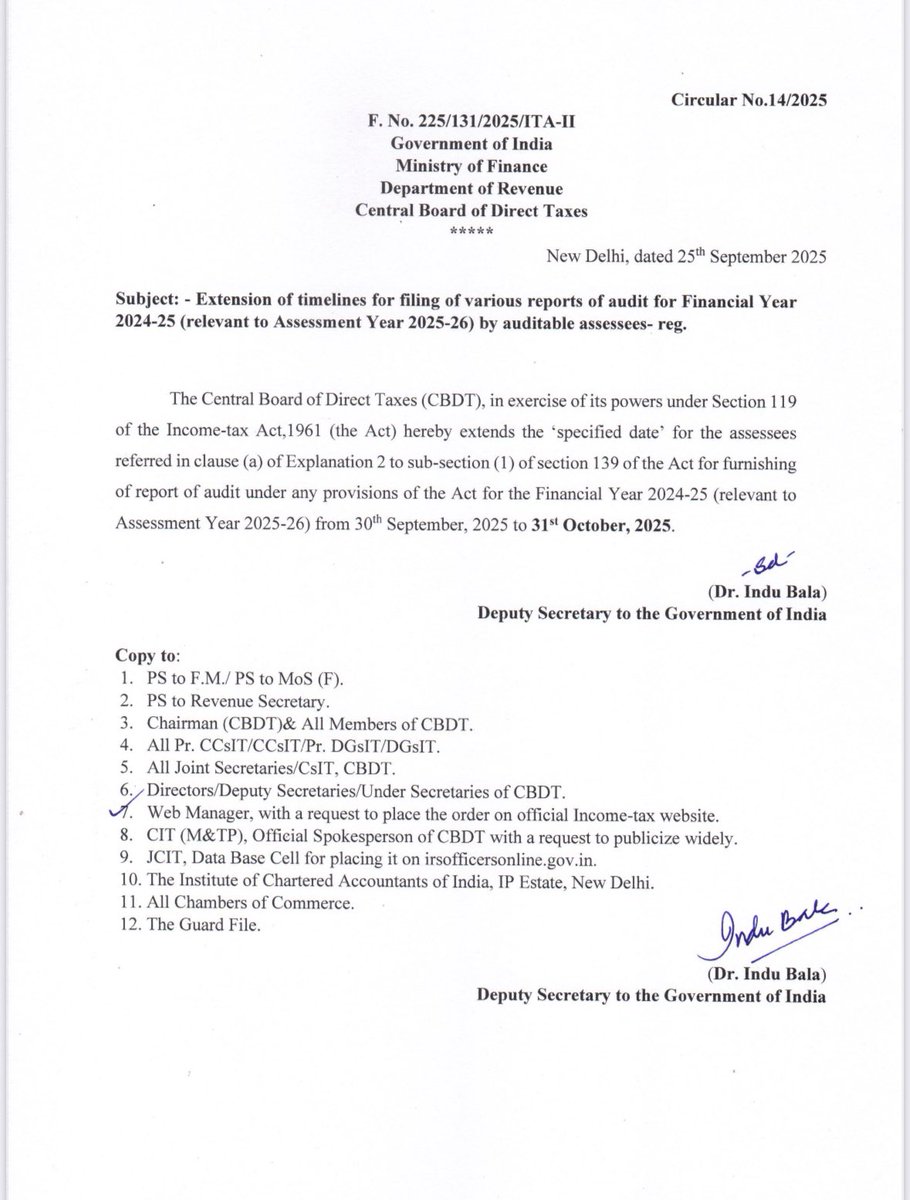

📢 Important Update | Tax Audit Due Date to be Extended 🔥 📌Hon’ble Raj. High Court (Jodhpur Bench) has directed UOI & CBDT Income Tax India to extended the due date for filing of Tax Audit Reports from 30th Sep to 31st Oct in case of:- Tax Bar Association Bhilwara vs UOI