Richard Barkham

@richardjbarkham

Chief Economist, Global @CBREResearch. Specialist in macro and real estate economics. Would-be artist/photographer.

ID: 809033301738524676

14-12-2016 13:52:25

1,1K Tweet

2,2K Followers

1,1K Following

'Debt financing is still available, but lenders are underwriting more conservatively and at higher rates' Brian Stoffers CBRE Capital Markets #CRE #Fed cbre.co/3cGIkZk

“You have to look at the value of the U.S. dollar and hedging costs, which have rocketed upward since the start of the year...it’s more difficult for foreign investors to deploy capital in the U.S” Darin Mellott #realestate #investment #CRE cbre.co/3zEOGS0

How will economic and pandemic headwinds impact APAC’s commercial real estate sector for the rest of 2022 and beyond? Henry Chin discusses how rising inflation and interest rate hikes are shaping investment sentiment across the region. Read more here: cbre.co/3PeLGAj

What capital markets trends are we monitoring in 2023? Listen to Darin Mellott, Senior Director of CBRE Capital Markets Research, for insights to help guide your real estate investment decisions this year. Find out more in our 2023 U.S. Real Market Outlook: bit.ly/3X0u8wF

Final preparations are underway in Scottsdale, AZ for the 2023 #CBREInvestorSymposium. Our annual client conference kicks-off this week and features keynote speakers Hitendra Wadhwa, Professor at Columbia University Business School & Edward Glaeser, Professor of Economics at Harvard University

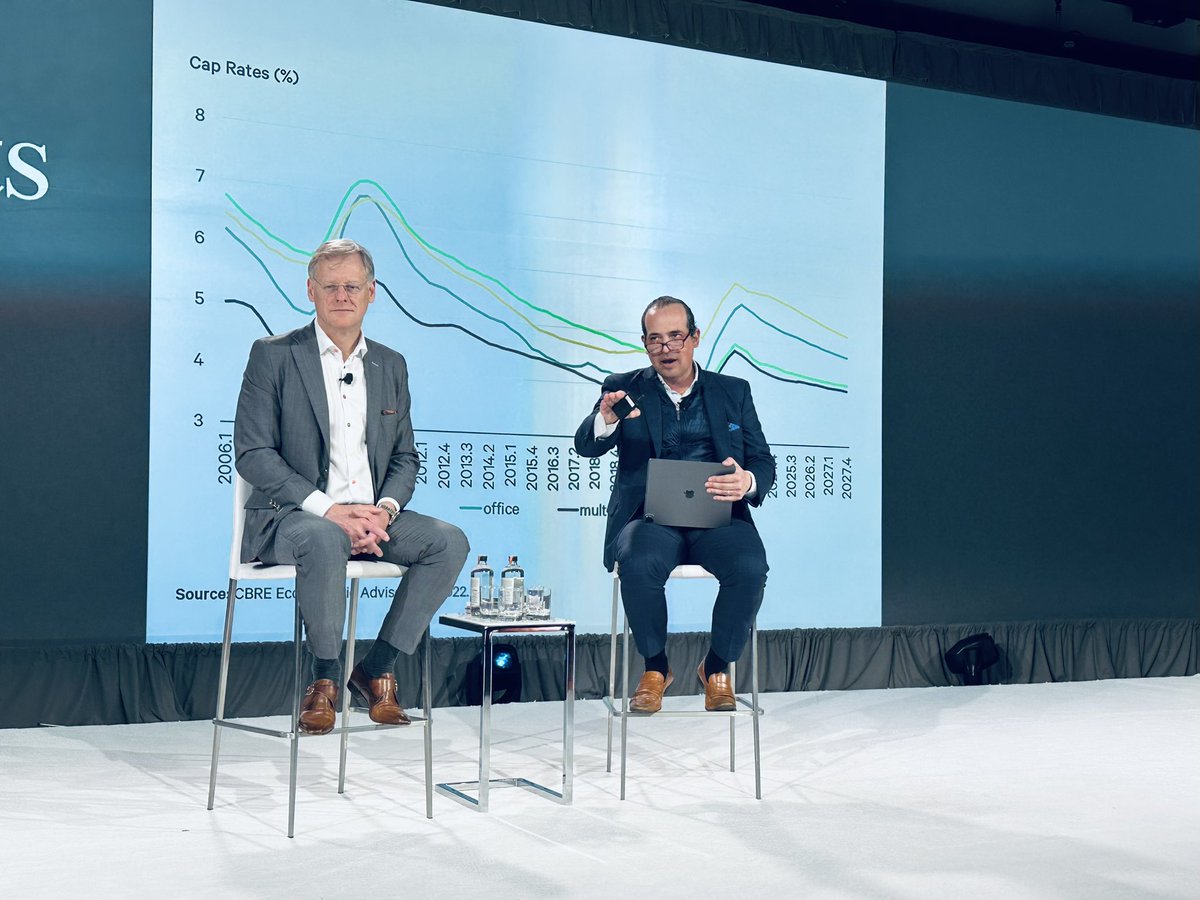

“A lot has happened in the last 24 hours…our forecast has not changed because of recent volatility and we’re here to tell you why…” Richard Barkham Spencer Levy #CBREInvestorSymposium

“While the banking crisis is short-term unhelpful and worsens sentiment, there are positive consequences as well - it acts as a force multiplier for the Fed and does a little bit of the work for it” Richard Barkham #CBREInvestorSymposium

“Private real estate has outperformed just about every major asset class in different types of environments, so keep the faith!” Spencer Levy #CBREInvestorSymposium

CBRE Global Chief Economist Richard Barkham delivers the keynote this morning at the National Association of Real Estate Editors, NAREE annual conference. His outlook for US commercial real estate challenges popular narratives. Read more: cbre.co/3WUolcD #NAREE2023