Allahyar Rehman

@rehmcap

Analyst (Investment/Political/Systems and everything in between)

Building @MortimusOrg w/ @admiralbohan

ID: 1402709912455684107

http://www.mortimus.substack.com 09-06-2021 19:32:05

673 Tweet

244 Takipçi

888 Takip Edilen

To better prep for this AMA, send any questions to [email protected] and see you at 1pm tomorrow (Friday October 4th) on youtube.com/@alixpasquet91…

Just finished The Humble Investor by Daniel Rasmussen (Dan Rasmussen). Astounding insights. Ending quote: “The best attitude towards a volatile and ever-changing market is that of a perpetual student.” Key lesson: Watch the High Yield Spread.

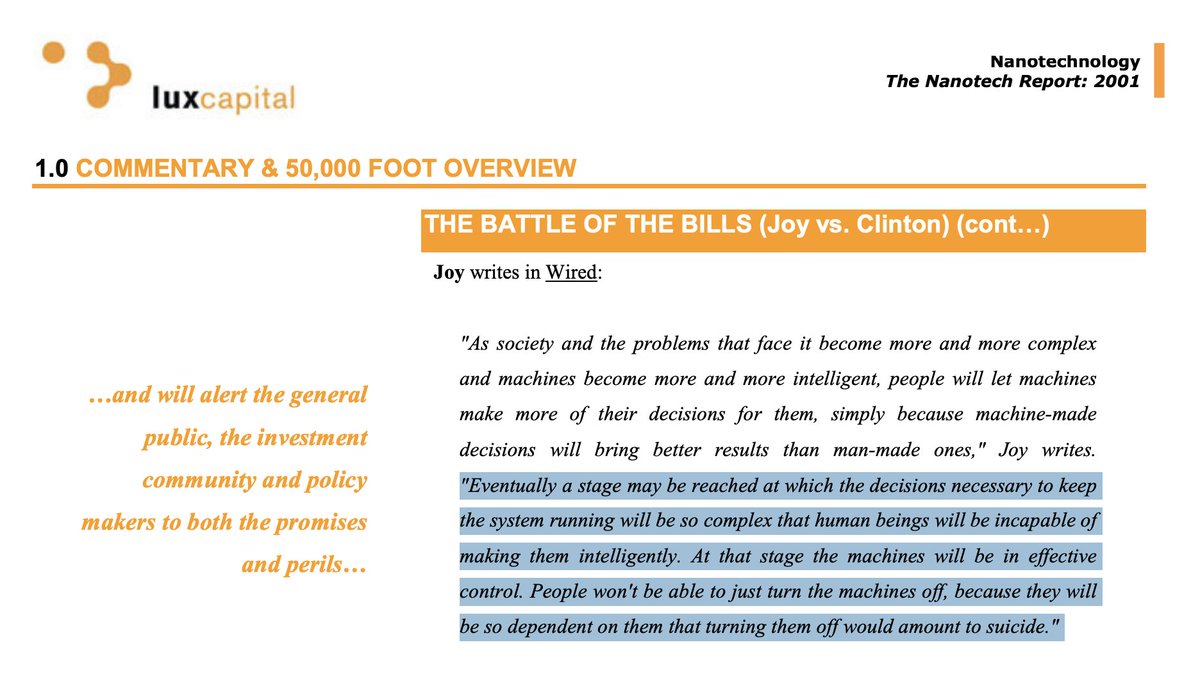

The more things change, the more they stay the same. Doing some research and found the old Nanotech Report from Josh Wolfe published in 2001 - I'm sure if I told you this was about AI discourse today you would believe me