Realtor.com

@realtordotcom

To each their home. #realestate

ID: 17351940

http://realtor.com 12-11-2008 23:41:21

75,75K Tweet

296,296K Takipçi

565 Takip Edilen

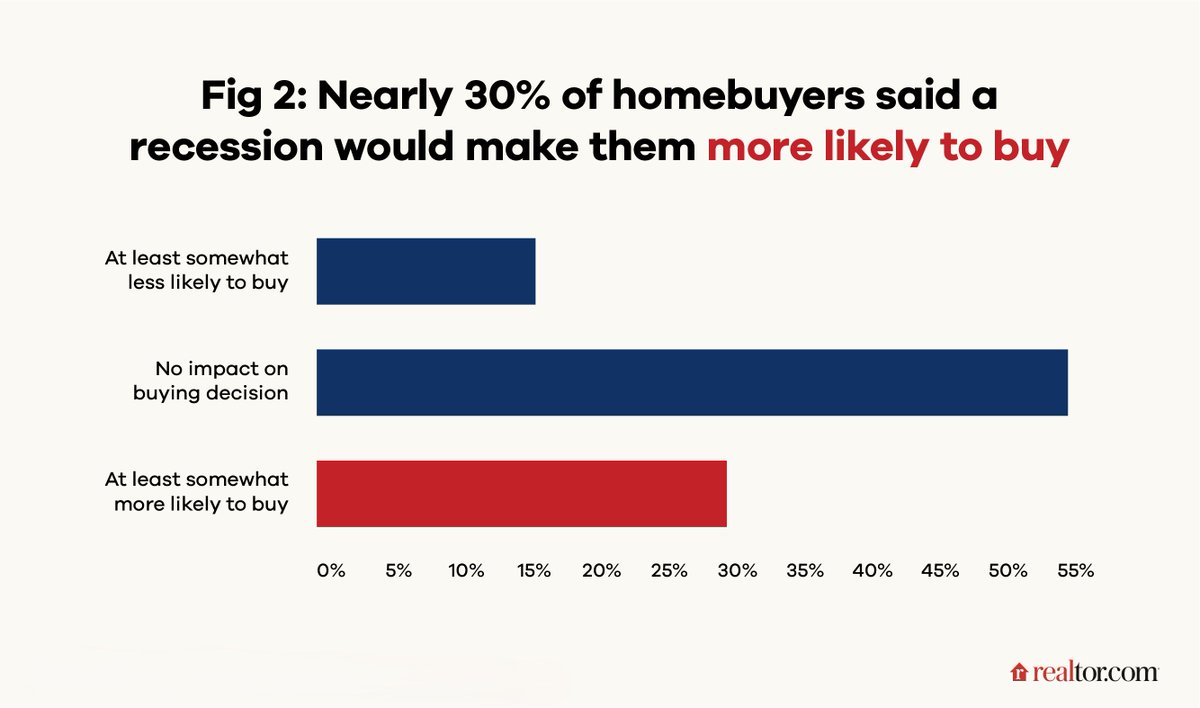

Concerns on recession are rising. According to Realtor.com’s Q1 2025 Site Visitor Survey, 63.4% of U.S. homebuyers expected a recession within a year—the third-highest level of concern since 2019, after the pandemic and 2022–2023 rate hikes. An economic downturn isn’t