John O'Donnell

@rainmakerota

Pioneer & Former Director Research TradingAcademy.com since 1998 in the Hayek & Mises Tradition. Former Co-Host -- PowerTradingRadio.com

ID: 129525173

04-04-2010 15:45:36

94,94K Tweet

5,5K Followers

2,2K Following

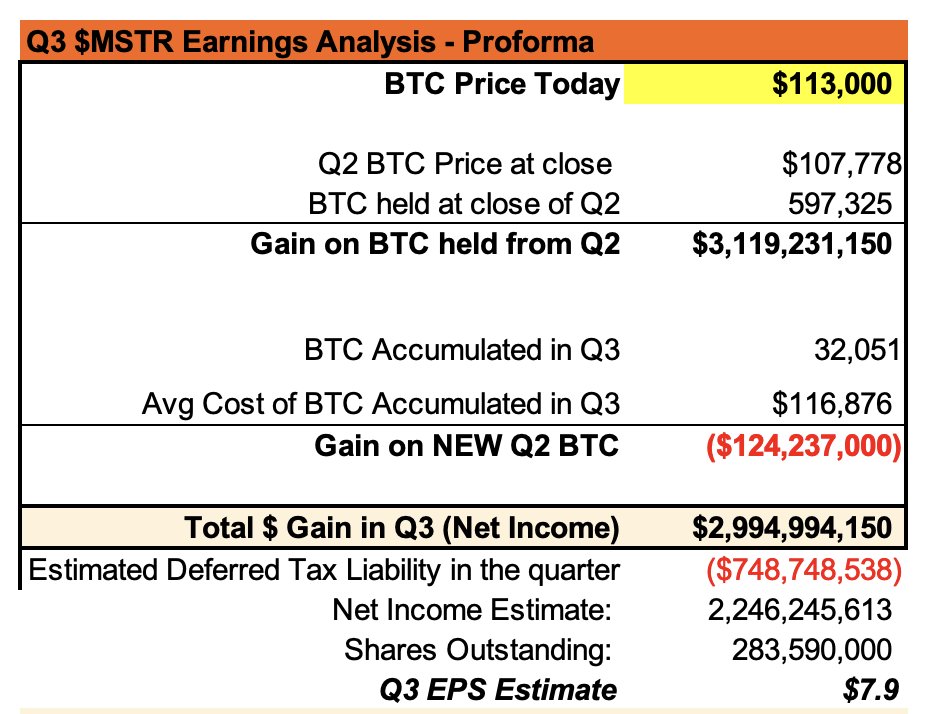

Anyone who owns $MSTR needs to watch this incredible analysis by Ryan Hogue. This is the most bullish video you’ll ever see.