Kurtis The Quant

@quant_kurtis

📈I design banger equity strategies as a freelance consultant. A long/short of mine is set to launch as an ETF sometime in 2025.

ID: 837037741636399104

http://www.portfolio123.com 01-03-2017 20:32:03

10,10K Tweet

3,3K Followers

2,2K Following

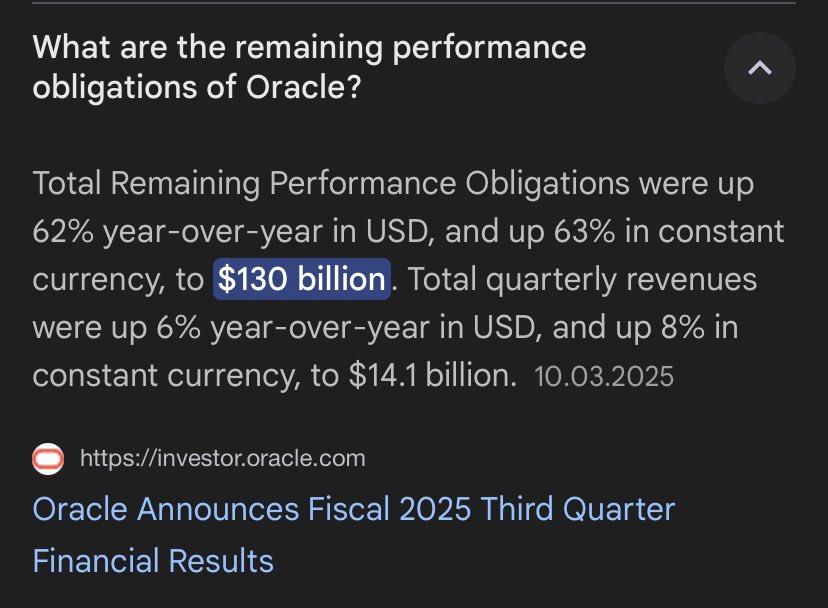

Everyone is yappin' about Oracle and all of a sudden order backlog becomes a topic. I remind you that Fintwit's most humble G told you years ago to pay attention to backlog - because no one does it. 💅 cc: Kurtis The Quant Thirty Days To X Barry Ritholtz Article: open.substack.com/pub/onveston/p…

Very good article from Systematic Microcaps ⚙️ "System Weighting Schemes, Strategy Considerations and the Universe..." systvest.substack.com/p/quick-though… Portfolio123

Cyclically Adjusted Price/Earnings ratios for S&P 100 (largest, black) vs S&P 600 (smalls, red). Largest (black) only exceeded by late Dot Com blow-off top. Smalls (red) trading below 30-year average. The jaws are open wide. via Callum Thomas and Topdown Charts

"Insider Ownership - The Misunderstood Factor" New Research post MicroCapClub 👇 * Performance of microcaps with low, medium and high Insider Ownership (IO) * How IO performance varies with microcap quality * IO trend in microcaps over the last 20 yrs community.microcapclub.com/forums/topic/5…

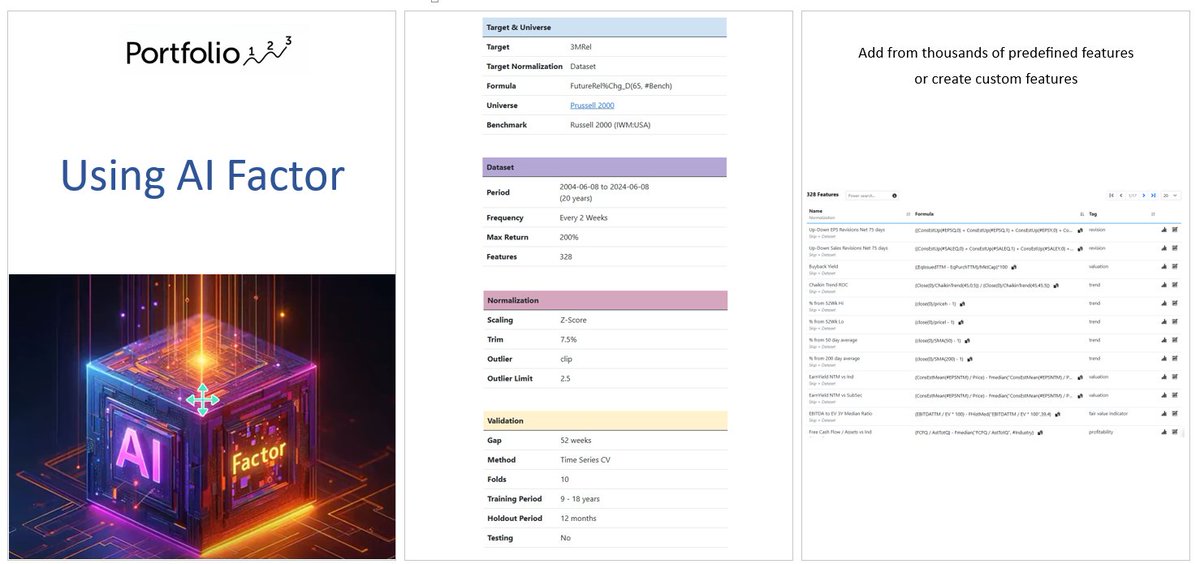

Overfitting exercise complete ✅ Call me crazy but yes that's how I will invest my money going forward. All usual disclaimers. No guarantees OOS. A lot of faith involved. So far pre-ML Portfolio123 gave me >60% in EUR despite substantial US exposure. Pre-P123 CAGR 15%.