Zack Morris

@proof_of_zmo

I write No Conflict No Interest, an investing and #Bitcoin focused blog. Views my own. ∞/21m

ID: 798833372

https://noconflictnointerest.substack.com/ 02-09-2012 18:48:53

1,1K Tweet

648 Followers

1,1K Following

In tandem with its maturation as a monetary asset, bitcoin’s custodial solutions must continue to evolve, as Peter McCormack 🏴☠️🇬🇧🇮🇪 & Eric Yakes discuss on @WhatBitcoinDid. Onramp's Multi-Institution Custody solution will help facilitate the next leg of bitcoin's adoption as a

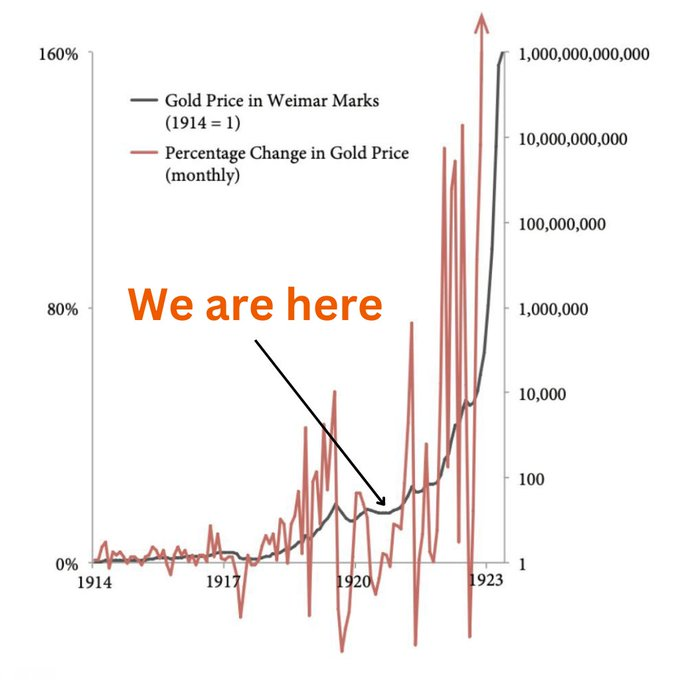

The TLDR on what's going on in Japan. Excellent analysis. In the video, Roberto Rios says that at 263% debt-to-GDP, Japan can't support 5% rates. Well, they raised rates from 0% to 0.25% last week, and it turns out they can't even support that. But, they arguably had to do