Preston Cooper

@prestoncooper93

Higher ed, student loans, college ROI. @AEI senior fellow. @Forbes contributor. Hiker, diver, dog appreciator. Usual disclaimers.

ID: 328846215

https://prestoncooper93.substack.com/ 04-07-2011 04:01:57

4,4K Tweet

3,3K Followers

1,1K Following

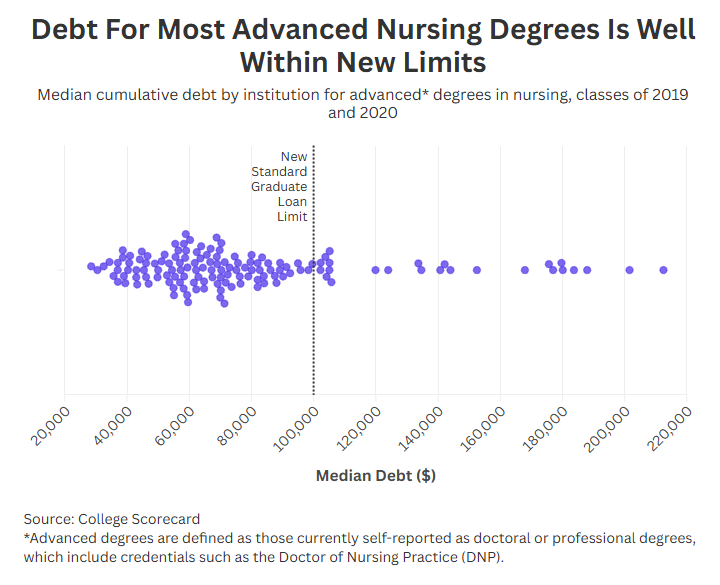

AEI's Preston Cooper: New student loan data show a historic spike in borrowers falling behind. aei.org/education/new-…

New data show historic numbers of student-loan borrowers are delinquent or in default, but many of them are easily paying off other debts, suggesting "that the post-pandemic rise in student loan nonpayment is largely not an affordability issue." From Preston Cooper

California State's direct admissions system is automatically admitting "C" students, per Joanne Jacobs. Direct admission is a good idea for students with strong academic qualifications, but this is taking things way too far.

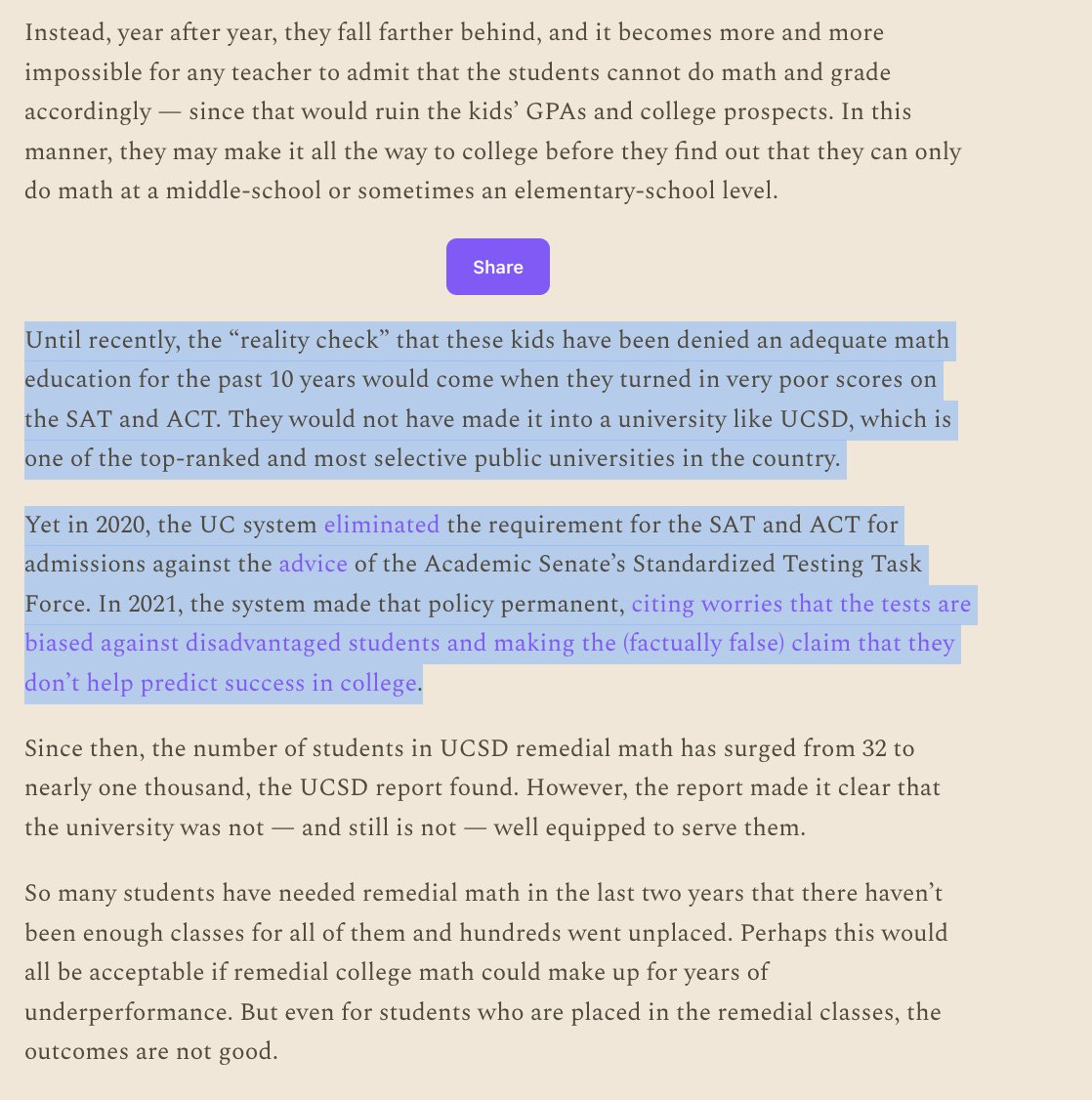

.Preston Cooper: "Student debt often provokes outrage. But the usual complaint is that student debt is too high. Now, nursing associations are angry that nurses’ student debt will be too low." aei.org/education/what…