Peter Gaffney 🌴

@pgaff_digital

Director of DeFi & Digital Trading @InveniamIO

#GoBlue

ID: 1348754552661618693

https://www.amazon.com/Blockchain-Explained-Ultimate-Tokenization-Finance/dp/B0CH28XFSD/ref=sr_1_1?c 11-01-2021 22:12:07

3,3K Tweet

1,1K Followers

610 Following

Centrifuge is launching RWAs on Ozean — @clearpoolfin’s new chain for tokenized assets. First up: JTRSY, the tokenized Treasury fund by Anemoy and Janus Henderson Investors, entering Port, Ozean’s yield vault, driving millions to the fund TVL. Learn more: centrifuge.mirror.xyz/FXX_AnVSBXI-nb…

A rarity in the space ZKsync (∎, ∆) has more RWA TVL ($2.1 billion) than FDV ($1.2) What are the best metrics for determining an RWA chain's value as things get more specialized?

SEC crypto task force met w/ Ondo Finance today to discuss tokenization… “Issuing & selling wrapped, tokenized versions of publicly traded US securities.” *SEC* is giving this an audience. Hope you’re paying attention.

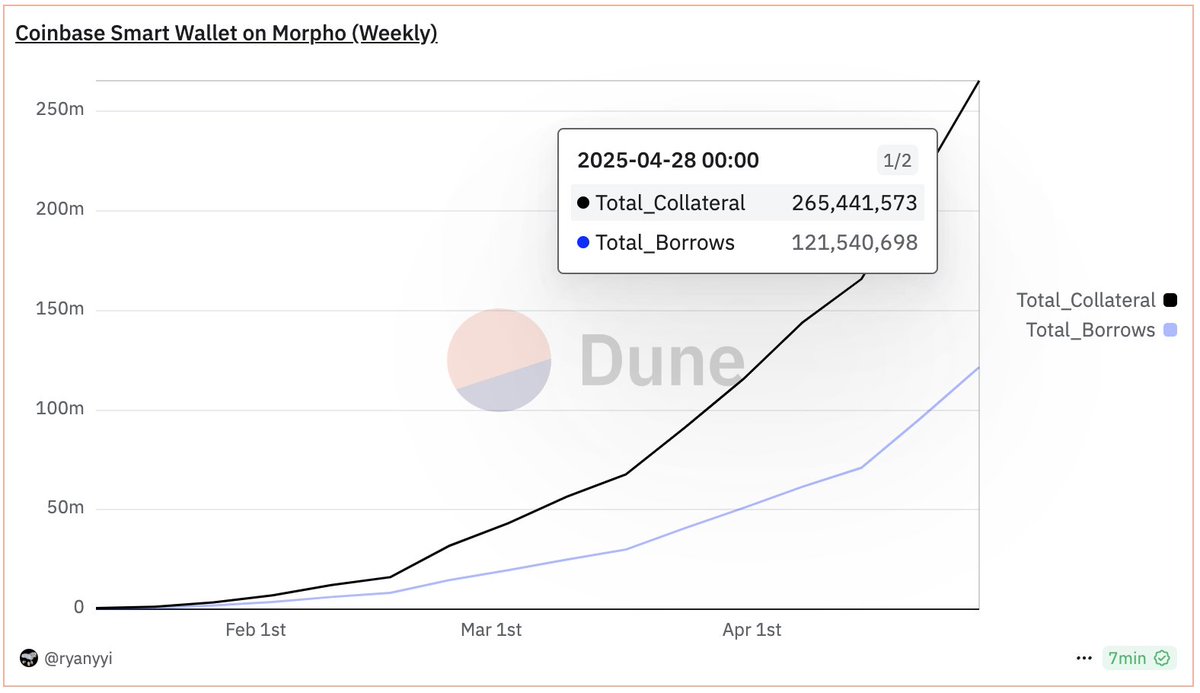

USDC loans on Coinbase 🛡️, powered by Morpho Labs 🦋: May 2 - $120,000,000 Apr 2 - $45,000,000 Mar 2 - $14,000,000 Feb 2 - $2,000,000 Jan 2 - $0 Just $265M BTC being put to work as collateral >100x more BTC sitting idle

In today’s Crypto for Advisors newsletter, Tedd Strazimiri from Evolve ETFs explains why Ethereum is the leader in tokenization. Then, Peter Gaffney 🌴 answers questions about tokenization. Thank you to our sponsor, Grayscale. Edited by MortonInsights trib.al/VpcCiYc

“Because blockchain allows an asset to move more freely, a money market fund could be used as collateral on a prime brokerage, eliminating the need to exit from that position thus still earning yield for the investor,” says Jason Barraza | STM.co 🟢 Security Token Advisors 🌴 trib.al/g49YIKY