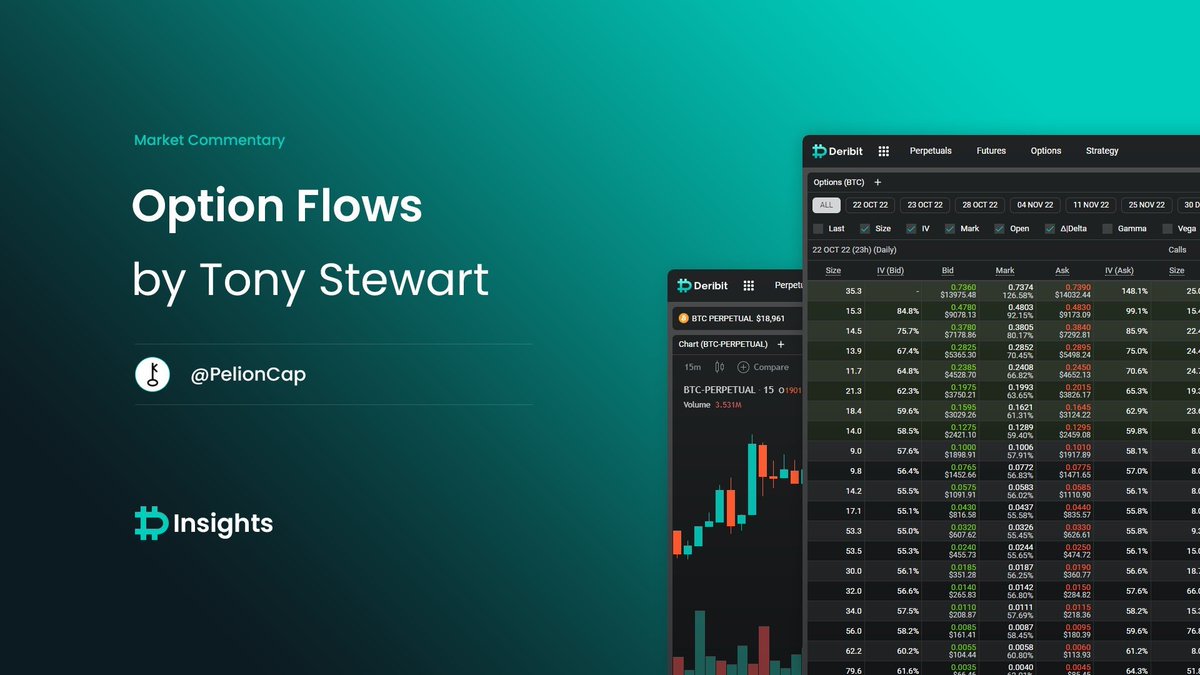

Tony Stewart

@pelioncap

Crypto Vol | Founder Pelion Capital (FO) | Deribit Forensics | AD Advisor. 30+yr Options | Ex-MS-Head of Trading desk. Tweets my opinion not financial advice.

ID: 985457400596652032

https://yaps.kaito.ai/referral/985457400596652032 15-04-2018 09:58:47

4,4K Tweet

21,21K Takipçi

812 Takip Edilen