passie

@passieintel

crypto researcher II onchain analyst II researching finance and tech II writes @ passieintelligence.medium.com subscribe 👇

ID: 1321968381189410817

https://passieintelligence.substack.com/ 30-10-2020 00:13:57

6,6K Tweet

420 Followers

429 Following

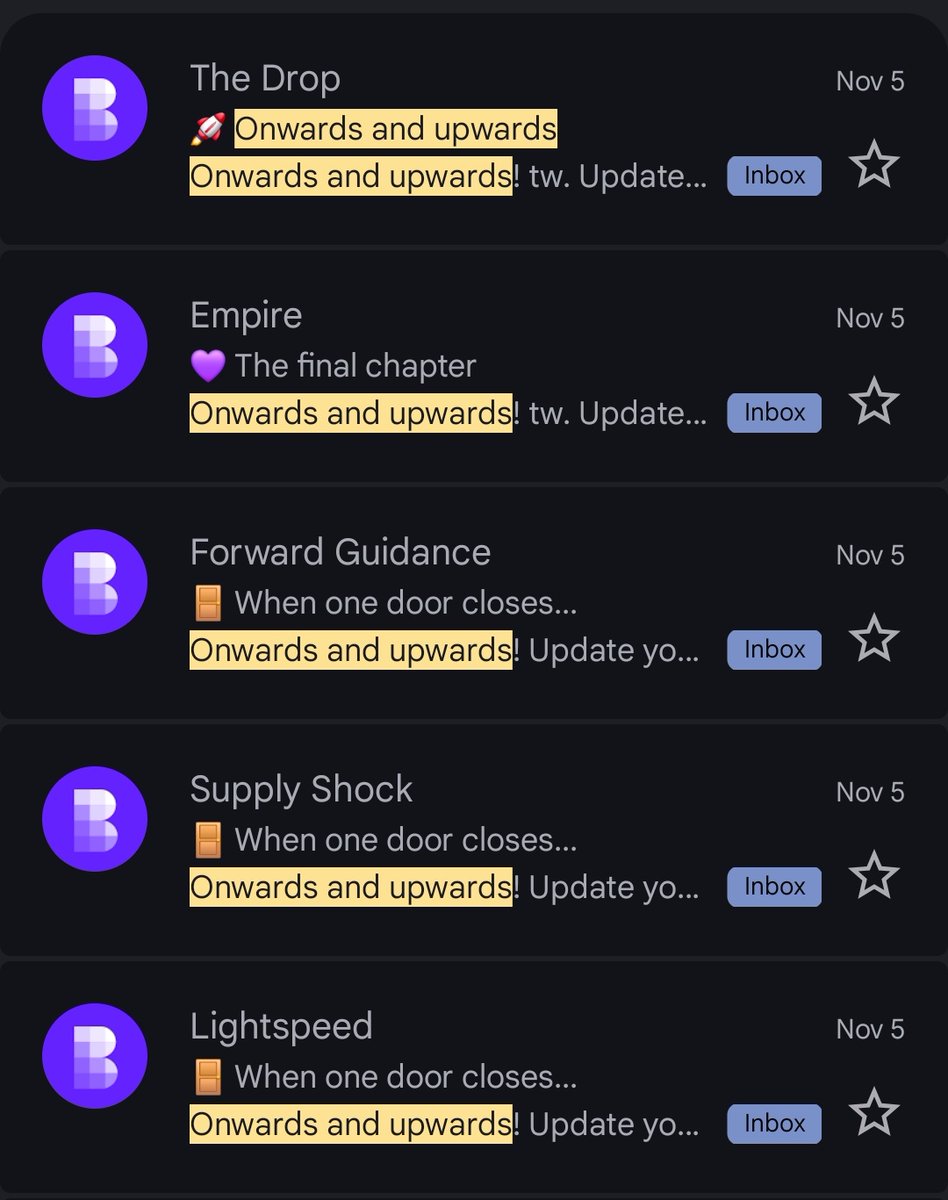

catching up on my mail just to see that some of my favorite newsletters by Blockworks is shutting down. this is a sad day for me, as not only were these top tier newsletters, i also relied on it for personal research, as i also write a newsletter. these were my lens to nfts,

sui dexs recorded $2.4b in volumes last week, with MomentumⓂ️Ⓜ️T accounting for 42% of that at $1b.

about a month ago Bankless had Thomas (Tom) Lee (not drummer) FSInsight.com and Arthur Hayes on the pod calling for $15k $eth by EOY. a week later, had Michael Nadeau | The DeFi Report says the cycle is over. so far, micheal has been right on the money. is why you never miss an episode.

maybe we have gone past that chasm where solana was the leading network in terms of revenue as its share has shrunk from 21% to 12% in the last 2 months. perhaps this is no longer a casual flip, and Hyperliquid is now the new leader.