Pim van Vliet

@paradoxinvestor

Expect the latest research on quantitative investing! Conservative fund manager who likes data, history, and moral philosophy. ⛪️🇳🇱

ID: 779051452111187973

http://www.paradoxinvesting.com 22-09-2016 20:15:15

1,1K Tweet

7,7K Takipçi

293 Takip Edilen

New paper highlights how #AI can not only uncover stock prediction signals but also 'write' the paper after the results are known: Hypothesizing After Results are Known (HARK). A warning to quants: AI just leveled up. Mihail Velikov shorturl.at/GsAFi

Last Friday, the S&P500 surged in the final hours—month-end rebalancing in action? As bonds rallied and stocks dipped in Feb, the shift was clear. Popular new paper by Campbell Harvey (camharvey.eth) eth al reveals this costs investors $16B yearly & enables front-running. shorturl.at/Bp3ZK

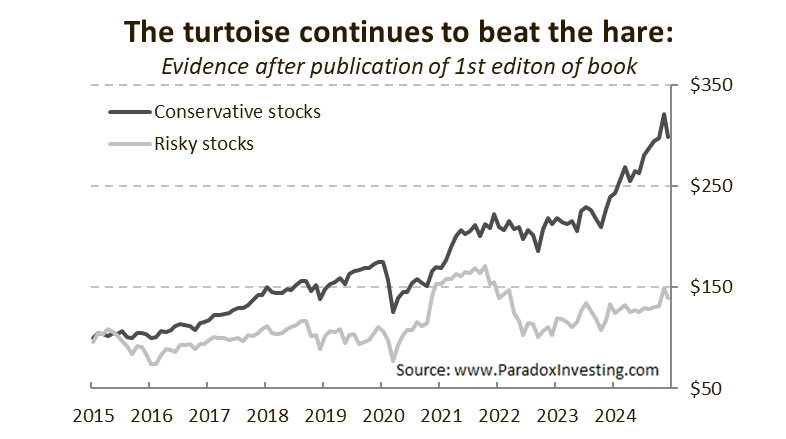

Fresh update: Low-volatility data now 10 years out of sample! The paradox persists. Check the latest data here: paradoxinvesting.com/data Jan de Koning

Ready to rethink risk & return? I’ve shared 5 game-changing books that shaped my perspective, now featured on Shepherd.com 📚 Jan de Koning Dive in! shepherd.com/best-books/cha…

New Blog! When the Equity Premium Fades, Alpha Shines wp.me/p1SgTN-unW via CFA Institute Research and Policy Center

Congrats to Laurens Swinkels on reaching 100,000 downloads on SSRN! 🎉 Highly recommend his work on The Global Market Portfolio — essential reading for any long-term investor.👉papers.ssrn.com/sol3/cf_dev/Ab…

Happy to share our brand new paper, "Factoring in the Low-Volatility Factor," done with Amar and Guido Baltussen! It reveals why the low-volatility factor is missing from standard models, highlighting asymmetry in factor alpha and real-world frictions. Table below shows some key