Minumbra Risk Management

@notmyrecession

Global risk-based. Just here for the charts.

ID: 1185398347173105664

19-10-2019 03:32:57

2,2K Tweet

129 Followers

567 Following

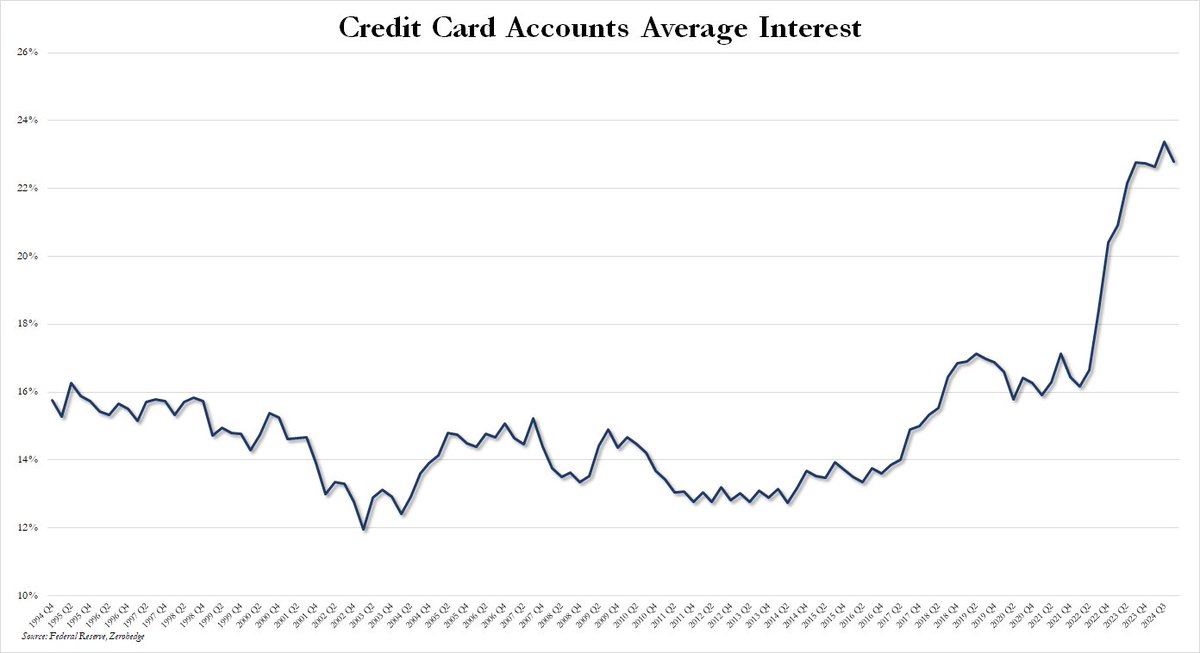

Danielle DiMartino Booth Three months after the Federal Reserve initiated interest rate cuts, the average credit card APR has reached the second-highest level on record, decreasing by 57 basis points from its all-time high. Banks have once again neglected to reduce APRs, yet proceeded to slash savings

BREAKING: US margin debt jumped +$30 billion in November, to a record $1.21 trillion. This marks the 7th consecutive monthly increase. During this time, margin debt has surged +$364 billion, or +43%. Adjusted for inflation, margin debt rose +2% MoM and +32% YoY, to the highest pic.x.com/YEqbuOsE02