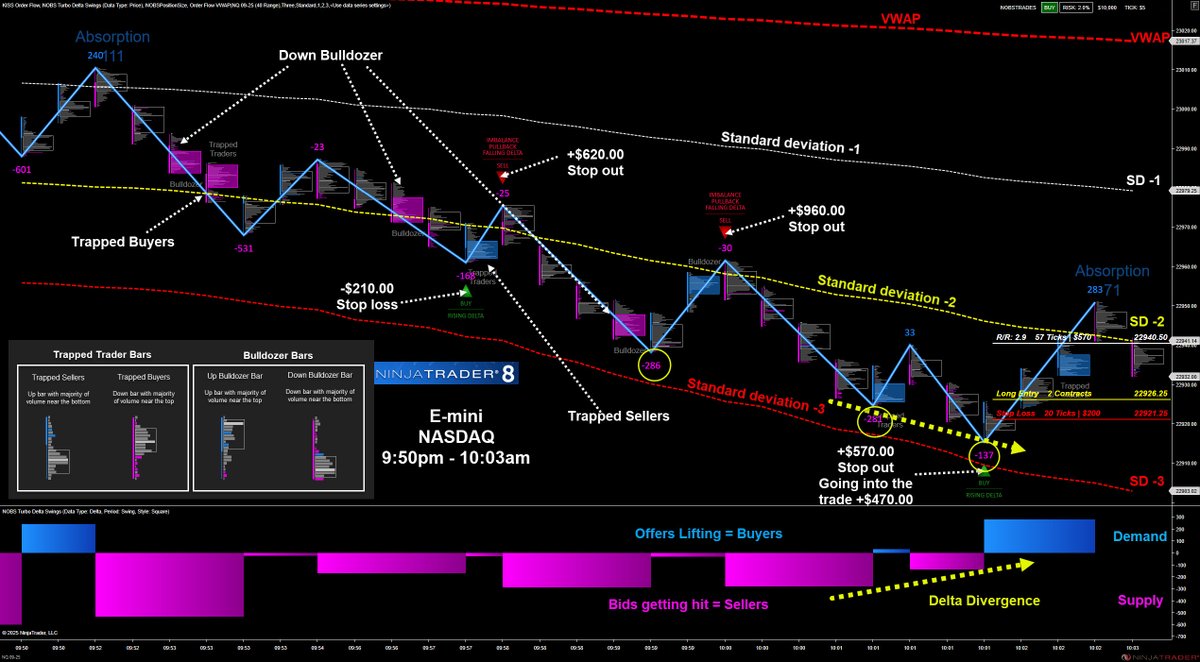

NOBS TRADES 🇺🇸

@nobstrades

A trading veteran since 1988, teaching traders to master market flow through relentless persistence and emotional discipline.

ID: 710489850651283456

https://www.nobstools.com/nobs-mastermind-trading-room 17-03-2016 15:35:55

14,14K Tweet

12,12K Takipçi

64 Takip Edilen