Nir Kaissar

@nirkaissar

Columnist, @opinion. Founder, Unison Advisors. Hoosier. (KAY-sarr)

ID: 3903115580

15-10-2015 13:27:30

4,4K Tweet

3,3K Followers

632 Following

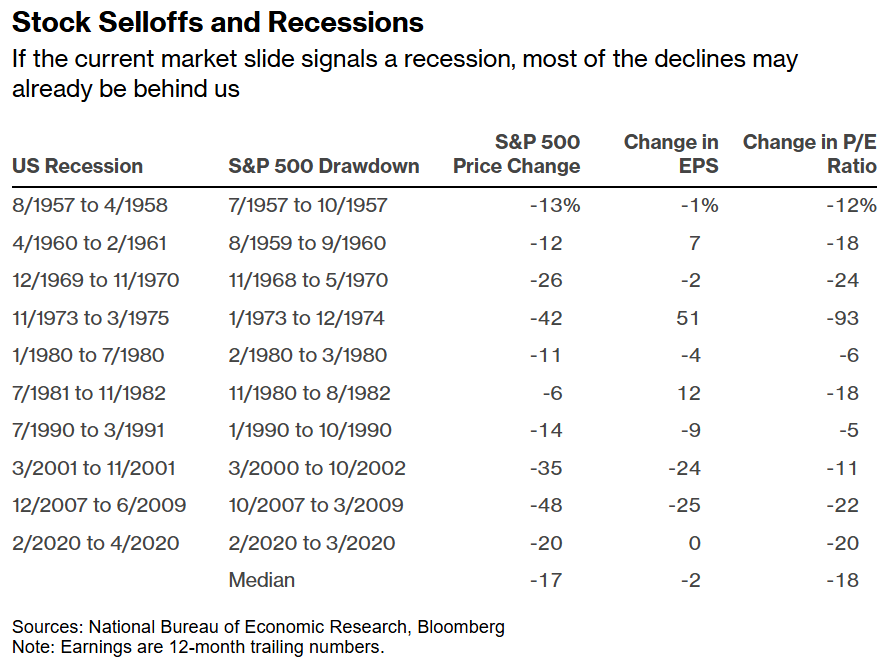

Markets are signaling a slowdown and possible recession, not a crisis. If they're right, history suggests that the worst of the stock market selloff may already be behind us. My latest Bloomberg Opinion. bloomberg.com/opinion/articl…

The best protection in a bumpy market is to know your drawdown tolerance: How much pain can you stomach? Diversified portfolios can dip lower than people expect before they recover. My latest Bloomberg Opinion. bloomberg.com/opinion/articl…

My tribute to Warren Buffett, the philosopher king of investing. 🐐 bloomberg.com/opinion/articl… via Bloomberg Opinion

“Any discussion of Buffett must start with his astonishing track record. He is the greatest investor of all time. No one has even come close to what he has achieved, and I doubt anyone ever will.” - Nir Kaissar bloomberg.com/opinion/articl…

Will there ever be a better investor than Warren Buffett? 🎙️ Join Tim O'Brien, Jonathan Levin, Allison Schrager and Nir Kaissar for a Live Q&A: Monday, 12:15pm EDT bloom.bg/3EO1Bqe

Warren Buffett is a rare investor and a rare man, writes Nir Kaissar. And there may never be another money manager like him bloomberg.com/opinion/articl…

An elevated VIX, known as the fear gauge of markets, doesn’t signal that equities are going to fall. It does say we live in uncertain times, Nir Kaissar says bloomberg.com/opinion/articl…

Institutional investors are looking to sell illiquid private assets. Meanwhile, fund companies are looking for new ways to justify high fees. The solution? Sell private asset funds to unsuspecting individual investors. My latest Bloomberg Opinion. bloomberg.com/opinion/articl…

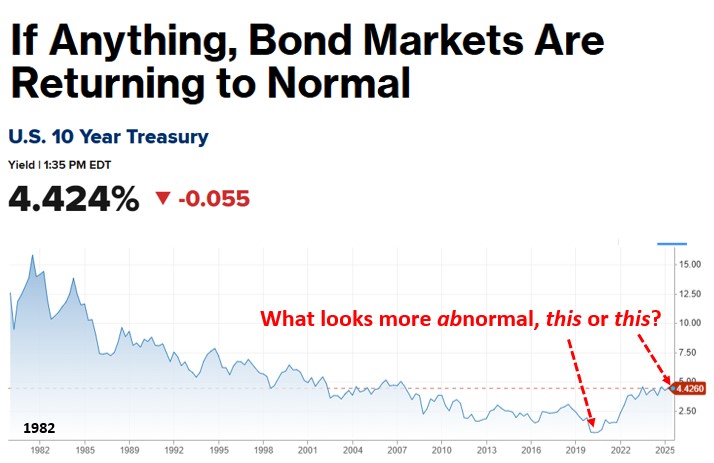

There is nothing unusual about the current level of US interest rates or their recent movement. If anything, this is a yawningly normal interest rate environment. My latest Bloomberg Opinion. bloomberg.com/opinion/articl…

𝗕𝗼𝗻𝗱 𝗠𝗮𝗿𝗸𝗲𝘁𝘀: 𝗧𝗵𝗲 𝗡𝗲𝘄 𝗡𝗼𝗿𝗺𝗮𝗹 𝗶𝘀... 𝙉𝙤𝙧𝙢𝙖𝙡 In his BBG article today (linked below), Nir Kaissar makes a good point: 𝗜𝗻 𝗺𝗼𝘀𝘁 𝗿𝗲𝘀𝗽𝗲𝗰𝘁𝘀, 𝘁𝗵𝗶𝘀 𝗶𝘀 "𝗮 𝘆𝗮𝘄𝗻𝗶𝗻𝗴𝗹𝘆 𝗻𝗼𝗿𝗺𝗮𝗹 𝗶𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗿𝗮𝘁𝗲

#Opinion | Bond yields aren’t flashing red—fiscal policy is. As Nir Kaissar argues, today’s 10-year yield near 4.5% is historically unremarkable. The real threat is runaway deficits and political bets on growth that may not materialise. mybs.in/2en94x1

Private equity has been slowing for years. But without public markets to dictate prices, it’s been easy to ignore the impact on valuations, Nir Kaissar says bloomberg.com/opinion/articl…