😎MixedMagic007😎

@nat_liburd

Twitch Streamer

twitch.tv/mixedmagic007

3k Followers

ID: 386773307

07-10-2011 21:41:25

10,10K Tweet

697 Followers

370 Following

🚨 IncomeShares EU just changed the game They've quietly switched 19 ETPs from covered calls to a new strategy: 📊 25% Equity + 75% Cash-Secured Puts Here's why this matters for your income portfolio: OLD STRATEGY (Covered Calls): • Held stock, sold calls • Capped your upside

🚨 IncomeShares EU just changed the game for income investors They quietly switched to a NEW options strategy that could solve the biggest problem with high-yield ETFs: NAV decay. Here's the full breakdown (and real results) 🧵👇

IncomeShares EU For 18 months I've been warning you: Yield ≠ Returns Most high-yield ETFs pay you 50-100%+ yields... while your capital slowly bleeds to zero. They're not paying you income. They're returning your own money back to you. It's a wealth destruction machine disguised as passive

IncomeShares EU The OLD covered call strategy: Hold 100% of the stock Sell call options against it Collect premium, pay it out as income The problem? Your upside is CAPPED at the strike price. When stocks rally, you miss most of the gains. And over time... NAV erodes.

IncomeShares EU The NEW cash-secured put + equity strategy: 25% direct equity exposure 75% selling in-the-money puts Rolls positions once enough theta decay is captured The key difference? NO hard cap on upside. The equity portion can run freely when stocks rally.

IncomeShares EU Here's how the mechanics work: The ETP sells ITM puts → collects higher premium upfront If stock rises → puts expire worthless, ETP keeps premium + equity gains If stock falls → ETP buys shares at a discount (premium offsets the cost) Then it rolls and repeats.

IncomeShares EU But does this strategy actually WORK? Let's run 3 Income Shares ETPs through my 5-part framework: ✅ Bullish sector conviction ✅ NAV stability/growth ✅ 10-20%+ total returns ✅ Yields below 40% ✅ Smart options strategy

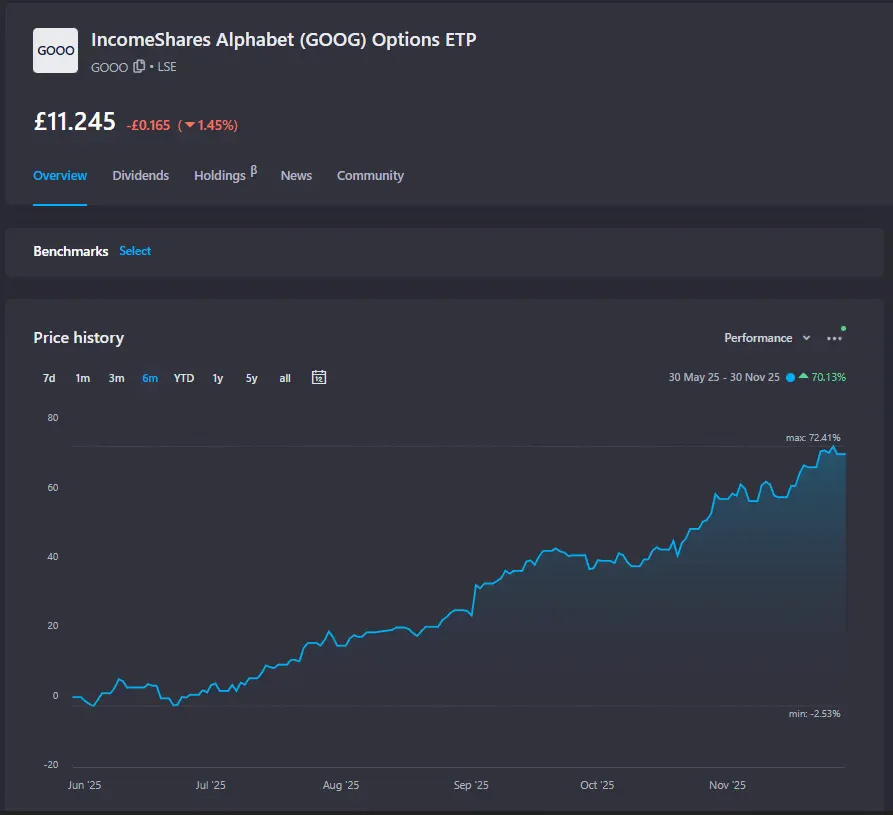

IncomeShares EU First up: $GOOO (Alphabet) NAV Performance: +55.02% Total Return: +70.13% Look at that NAV chart. Steady uptrend for 6 months straight. This isn't yield destroying your capital. This is yield ON TOP of capital growth.

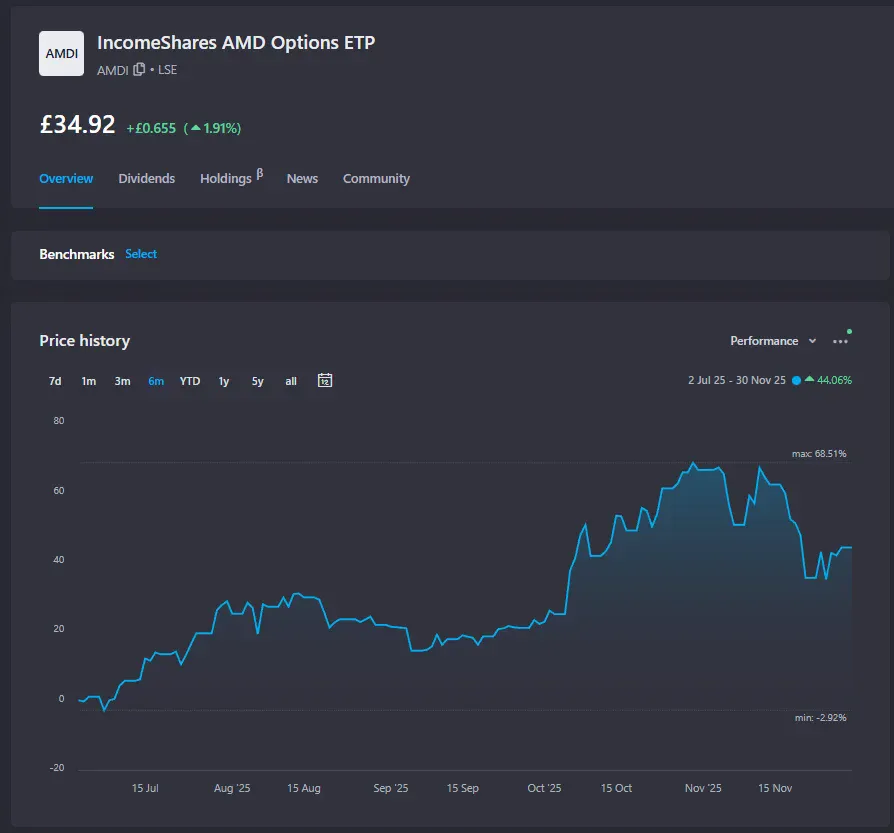

IncomeShares EU Next: $AMDI (AMD) NAV Performance: +22.06% Total Return: +44.06% More volatile than Alphabet (it's AMD), but still holding NAV while generating serious income. The ~22% gap between NAV and Total Return? That's your distributions working.

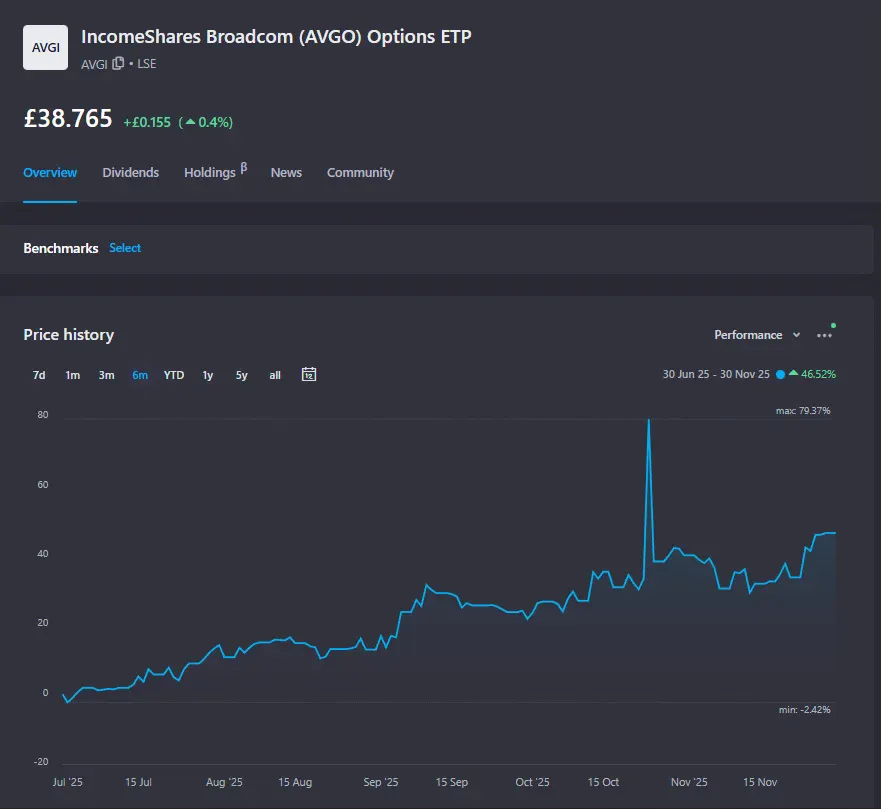

IncomeShares EU Finally: $AVGI (Broadcom) NAV Performance: +29.15% Total Return: +46.52% See that spike in October/November? Broadcom rallied hard. Under the OLD covered call strategy, gains would've been capped. The new strategy? It captured a significant chunk of that move.

IncomeShares EU 5-Part Framework Verdict: ✅ Bullish conviction - All 3 are quality tech names ✅ NAV stability - All 3 showing NAV GROWTH ✅ Total returns - 44-70% in 6 months ✅ Yields - Not bleeding capital to pay distributions ✅ Smart strategy - New put-writing approach These pass.

IncomeShares EU The lesson here isn't "buy these ETPs" It's this: Strategy matters more than yield. A 30% yield with growing NAV will make you rich. A 100% yield with decaying NAV will make you broke. Know the difference.

IncomeShares EU I break down income ETFs like this every week. If you want: My full watchlist NAV tracking spreadsheets Deep dives on what to buy (and avoid) Join the community 👇 patreon.com/c/CashflowKing The yield trap ends here. 👑

Me and Cashflow King Wear USA 🇺🇲 Well don't we? 🇬🇧💪👊🏾.

Can't lie this list from Dividendology has suprised me. The Top performing stocks over a 30 year period x.com/dividendology/…