Murray Gunn - EWI

@murraygunnewi

Head of Global Research @elliottwaveintl

Technical analyst - MSTA, CFTe, CEWA

Editor of EWI's "Global Rates & Money Flows" + "European Short Term Update"

ID: 1752430592514297856

30-01-2024 20:37:20

148 Tweet

877 Takipçi

39 Takip Edilen

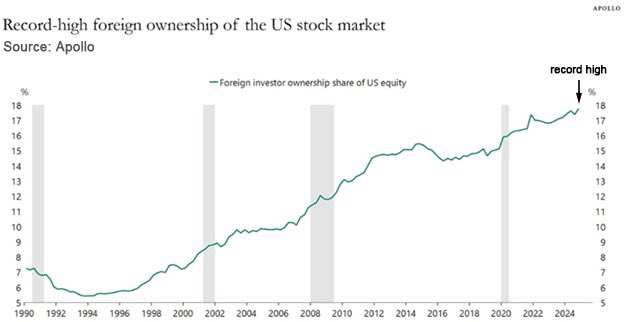

“Foreign investment in U.S. equities has climbed to unprecedented levels.” Robert Prechter breaks down the implications inside the June Theorist: bit.ly/45BTsjK #StockMarket #SPX500 #ElliottWave

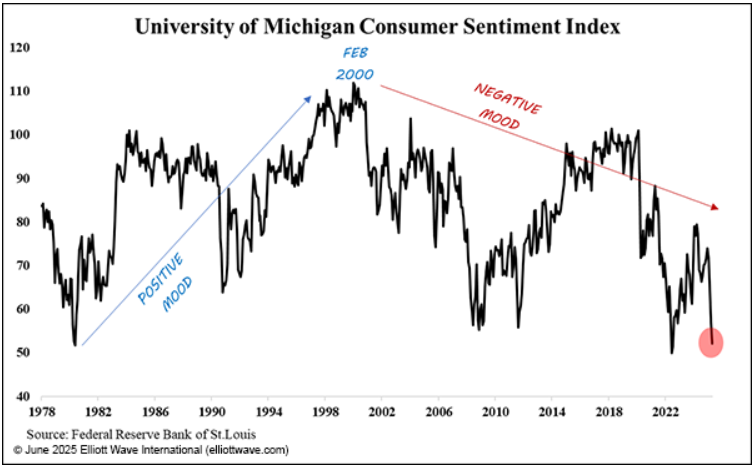

🚨 Consumer confidence is lower than the 1980s! Consumer confidence remains in the doldrums. The chart shows the University of Michigan Consumer Sentiment Index. According to this data, consumers are even more pessimistic than they were in the early 1980s. From a Socionomics