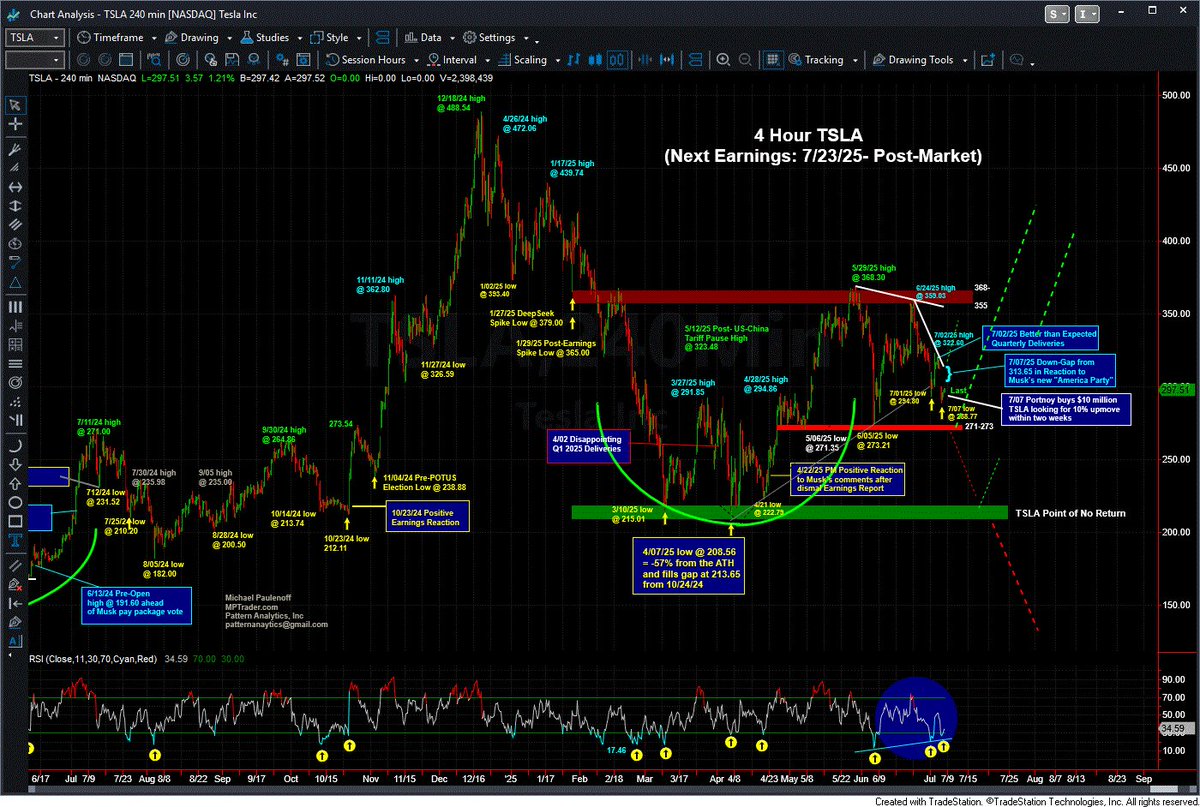

Mike Paulenoff

@mptrader

35 Yrs on Wall Street, Macro & Behavioral Financial Market Strategist, Author, Columnist, Lawrenceville School, Georgetown Univ. SFS '79, Gtown Tennis '76-'79

ID: 40053049

http://www.mptrader.com 14-05-2009 18:25:01

2,2K Tweet

1,1K Takipçi

1,1K Takip Edilen