Kim Seifert - The Mortgage Firm

@mortgageregina

Canadian Mortgage and housing market information.

Mortgage Associate (license #316147) / DLC - The Mortgage Firm (brokerage license # 316454)

ID: 372411623

https://kimseifert.ca 12-09-2011 18:36:46

9,9K Tweet

580 Takipçi

1,1K Takip Edilen

Being a first-time homebuyer in Canada isn’t as straightforward as it sounds. Programs like the RRSP Home Buyers’ Plan, FHSA and Ontario’s Land Transfer Tax Rebate all define it differently. Ross Taylor explains 👉 canadianmortgagetrends.com/2025/09/first-…

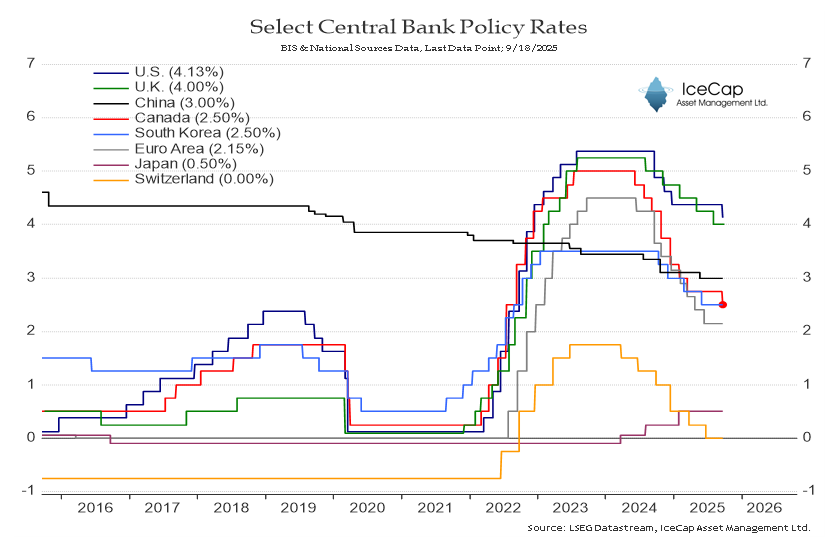

NEW: Headline inflation rose 1.9% in August, softer than expected. That boost the chances of a Bank of Canada rate cut tomorrow. #CPI #CdnEconomy #CdnMortgages 🔗 canadianmortgagetrends.com/2025/09/core-i…

La Banque du Canada abaisse son taux directeur à 2,50 %, marquant le huitième ajustement depuis le début du cycle. Elle avance prudemment face aux risques liés à la croissance économique, au marché de l’emploi et aux perturbations commerciales. 🔗 canadianmortgagetrends.com/fr/2025/09/la-…

💡 The Bank of Canada’s latest rate cut shifts the balance: variable-rate borrowers could save about $15 a month per $100K of mortgage debt, while fixed-rate holders still face renewal risks. 🔗 canadianmortgagetrends.com/2025/09/bank-o… #MortgageRates #FixedVsVariable