Ankit Mittal

@mittalankit2003

"Seeking hidden gems in the world of small & micro caps 🚀 | Passionate about India's growth potential 🇮🇳 | Value investor on a mission 📈” RECIPE

ID: 2167839564

http://www.delistedstocks.in 01-11-2013 05:49:38

136 Tweet

836 Followers

60 Following

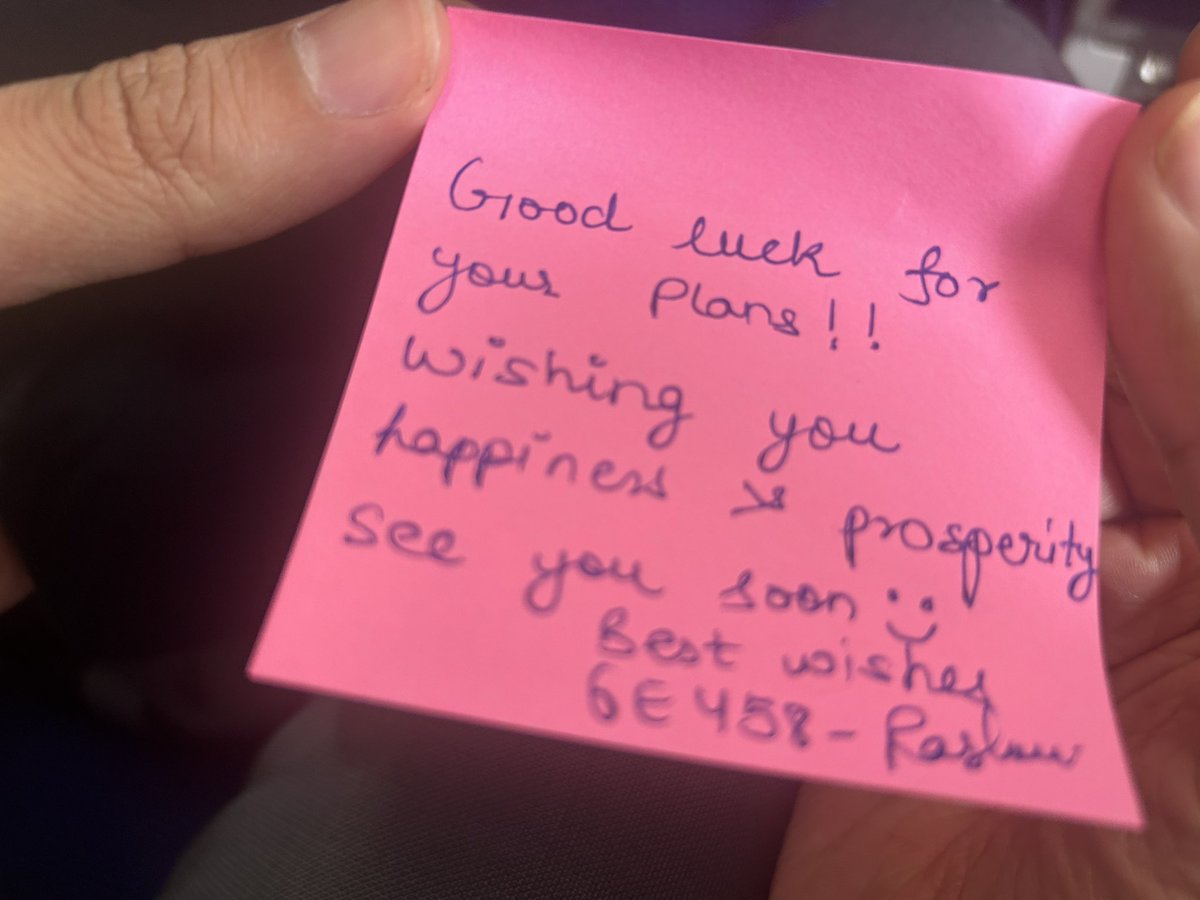

I had an exceptional experience at Anardana (restaurant chain), thanks to my dear friend Dr. Ritesh Malik Dr Ritesh Malik and the fantastic team there. **Food: 5/5** Every dish was a delight, bursting with flavors and beautifully presented (Dahi Kabab & Anardana Special