michael mackenzie

@michaellachlan

Financial journalist at Bloomberg. Cycle, swim & ski. Views are my own.

ID: 1180009339

http://www.bloomberg.com 14-02-2013 18:43:21

6,6K Tweet

6,6K Followers

1,1K Following

The uncertainty likely to be injected into markets this year by President-elect Donald Trump promises to be yet another driver of attractive bond returns, according to Pimco bloomberg.com/news/articles/… via Bloomberg Markets

Nvidia tumbled 17% Monday, the biggest drop since March 2020, erasing $589 billion from the company’s market cap. That eclipsed the previous record — a 9% drop in September Carmen Reinicke bloomberg.com/news/articles/…

Some good news for the Washington Post! Peter Spiegel is one of the industry's best leaders (also, the toughest beat reporter I've ever had to compete against). And a really good guy, to boot. washingtonpost.com/pr/2025/01/30/…

Bond traders can’t predict what US President Donald Trump will do next, but that uncertainty can be exploited to generate strong returns, according to Pimco’s chief investment officer bloomberg.com/news/articles/… via Bloomberg Markets

Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth bloomberg.com/news/articles/… via Bloomberg Markets

Rising potential for a US recession has Pimco touting the attractiveness of “stable sources of returns” in global bonds bloomberg.com/news/articles/… via Bloomberg Markets

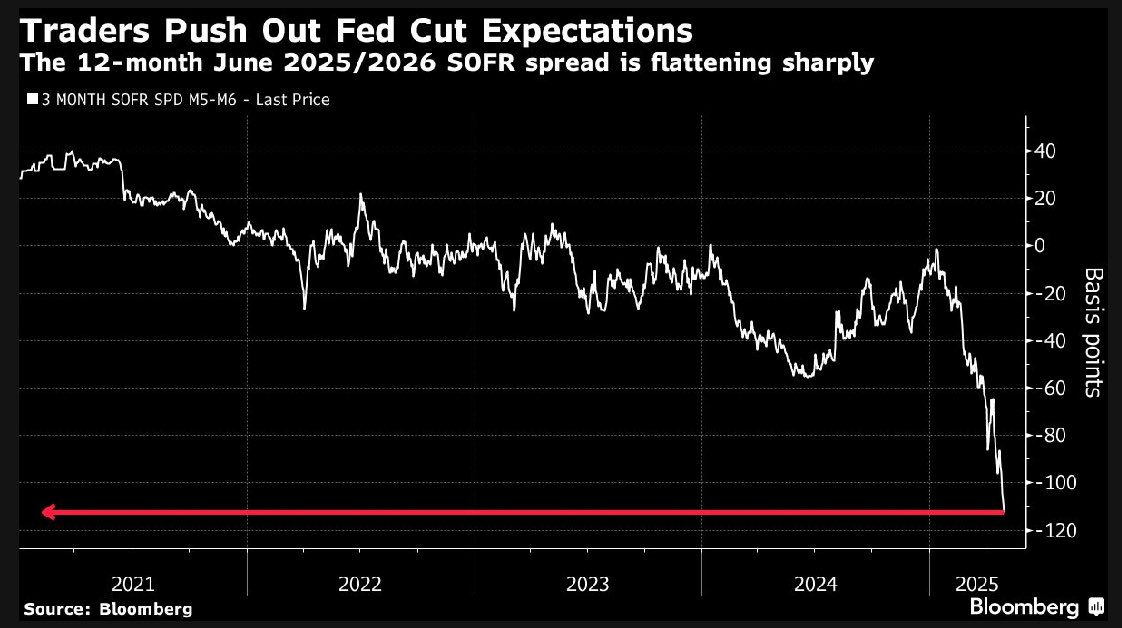

Bond traders have lifted bets on interest-rate cuts from the Fed bloomberg.com/news/articles/… via Bloomberg Markets

In the first rush for investment safe havens in years, US Treasury bonds are facing serious competition as a destination for global funds bloomberg.com/news/articles/… via Bloomberg Markets Greg Ritchie & Mia Glass

The “Sell America” trade that gripped markets this month has left a potentially lasting dent in investors’ willingness to hold the US government’s longest-maturity debt, a mainstay of its deficit-financing toolkit bloomberg.com/news/articles/… via Bloomberg Markets