Professor Mark W Guthner

@mguthner

Associate Professor @ Rutgers Business School, Reformed Portfolio Manager, Options Guru, Best Selling Author, Public Speaker, U of Michigan Grad BSE(ME) & MBA

ID: 2924274199

http://www.TheOptionsEdge.Com 09-12-2014 17:59:02

3,3K Tweet

3,3K Takipçi

2,2K Takip Edilen

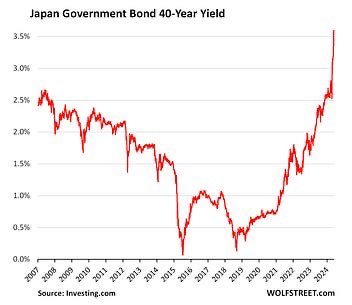

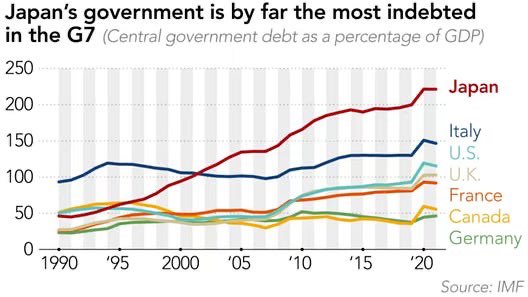

40 year JGBs have lost 65% if their value since 2019. This is a permanent loss of wealth making it devastating for investors. How will this impact US markets? Michael C. Khouw and I will discuss this and other important issues today at 12:30 on Open Interest.