David Alexander II

@mega_fund

Partner @anagramxyz | prev MD @BinanceLabs, OG @ConsenSys | Research @MetricsDAO | Chaotic Neutral 🌑

ID: 384688725

https://www.anagram.xyz/ 04-10-2011 04:20:12

7,7K Tweet

2,2K Takipçi

596 Takip Edilen

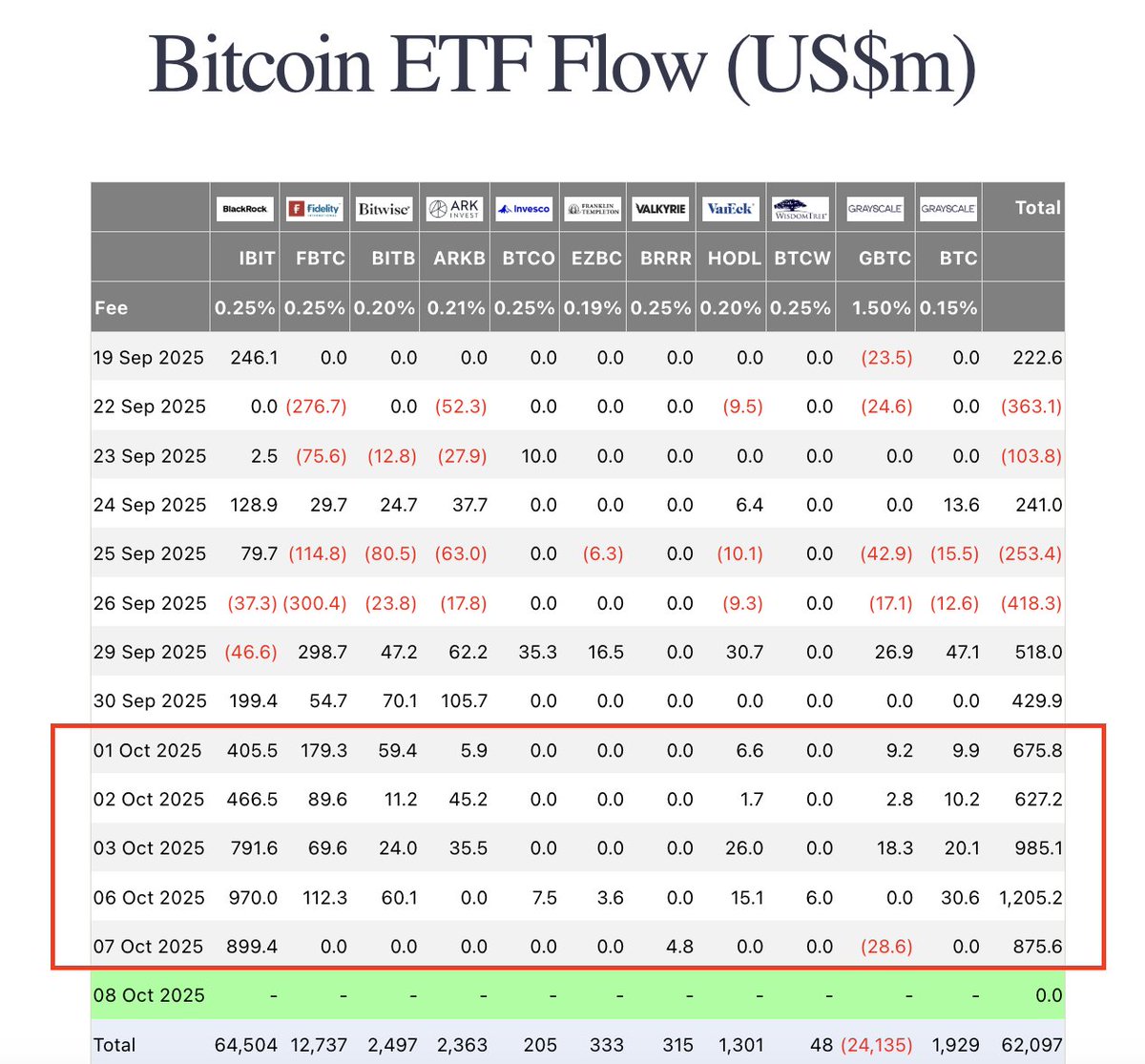

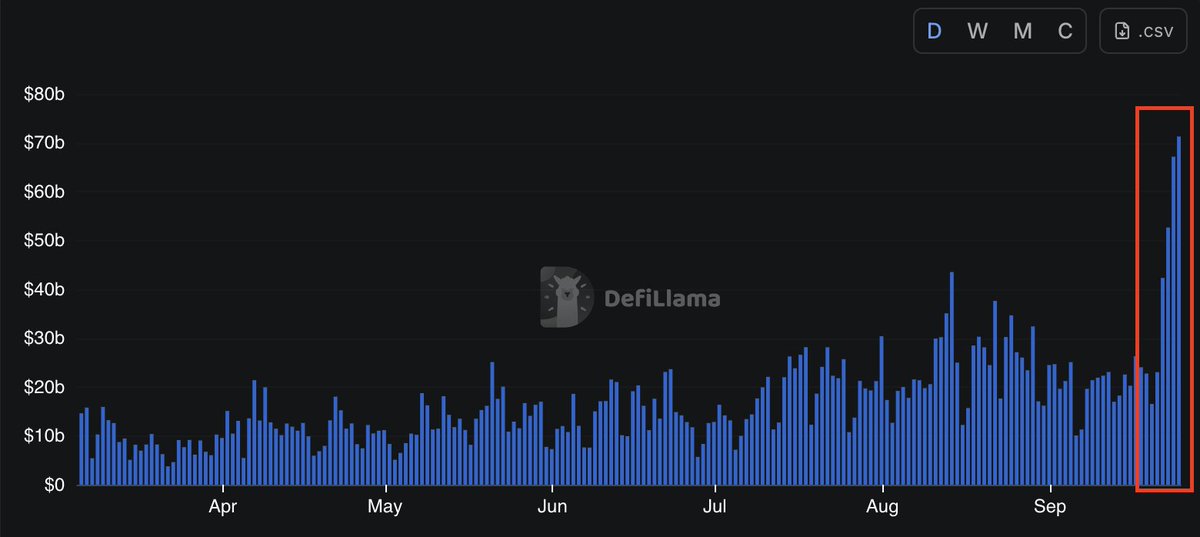

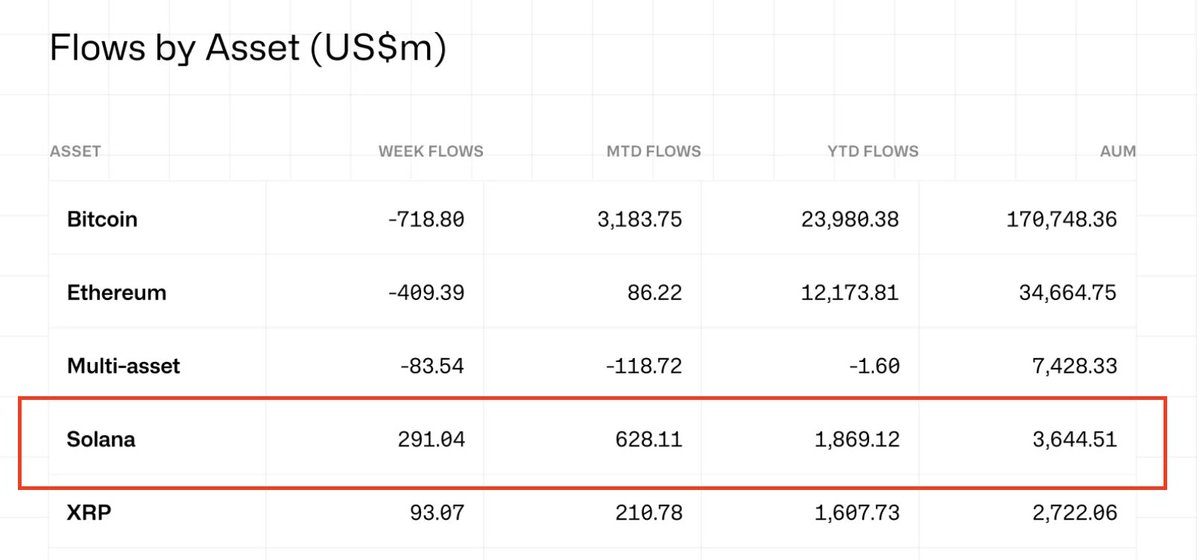

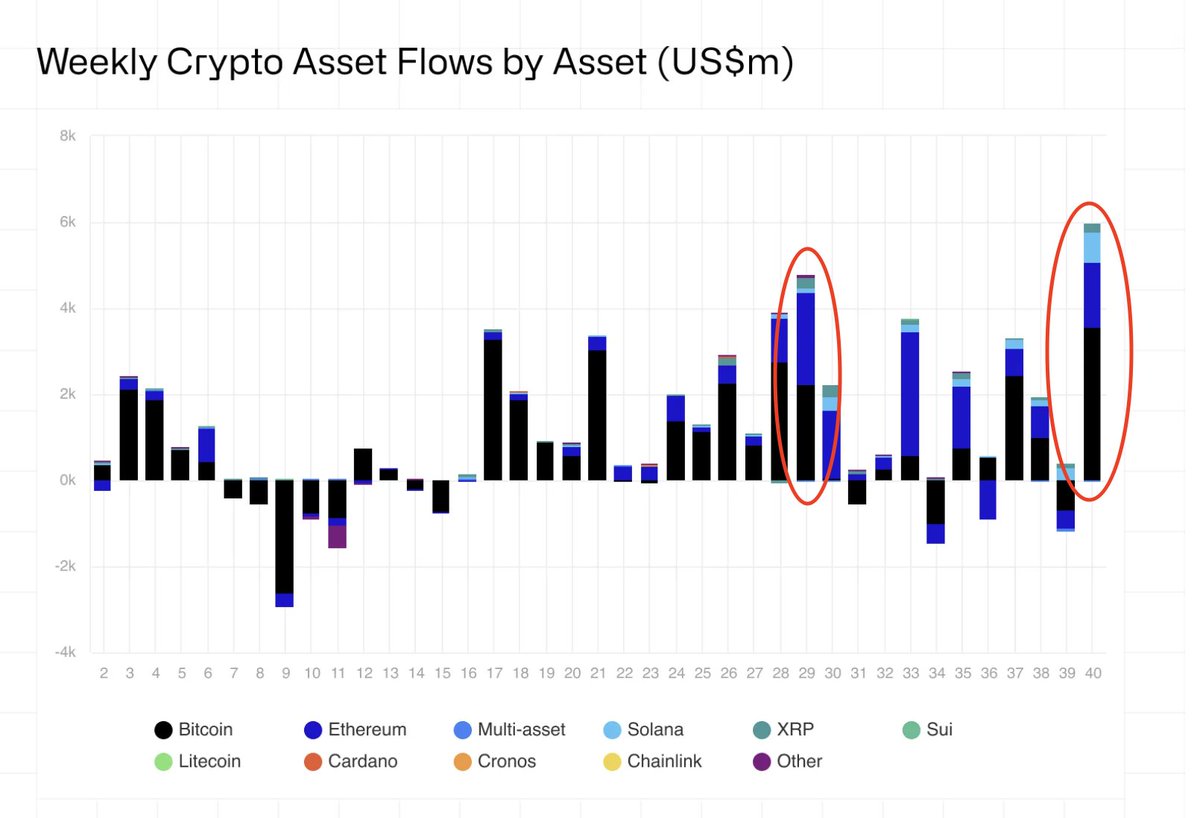

In just the first week of October, $BTC ETF inflows ($4.37B) have already surpassed the entire months of September and August, combined ($2.78B). h/t Farside Investors