Matt Casto

@mcasto_

Liquid asset strategies @CMT_Digital | Intern @InternDAO | Contributor @ournetwork__ | Tweets ≠ advice

ID: 1101308917311778817

01-03-2019 02:31:21

2,2K Tweet

4,4K Takipçi

533 Takip Edilen

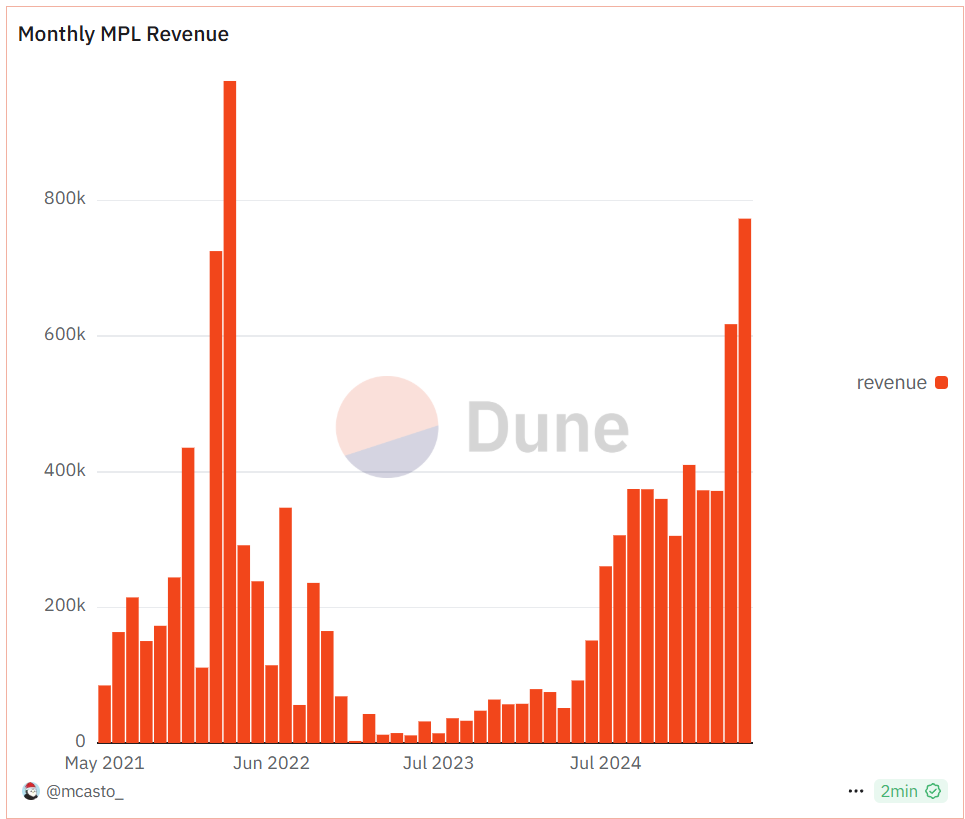

Quite certain this protocol is currently mispriced, as identified about a week ago by Matt Casto

spent the morning reading the Euler Labs EulerSwap whitepaper pretty interesting stuff. made me realize how much dex liquidity just sits idle when it could be earning yield elsewhere thread on what i learned 🧵