Max Bonici

@maxbonicifinreg

financial services, financial technology - regulation, supervision and enforcement trends

Attorney Advertising. R/T and mentions do not mean endorsement.

ID: 1484998626199887872

https://www.dwt.com/people/b/bonici-max 22-01-2022 21:18:18

246 Tweet

67 Takipçi

188 Takip Edilen

WATCH: Ann Wagner asks Moved to @MARA CEO Fred Thiel if prudential regulators told their bank that they should refrain from providing services to #digitalasset firms. Mr. Thiel's answer? "Yes." More below⬇️

Stephen Gannon in response to Senator Cynthia Lummis on “reputational risk” in debanking: Stephen Gannon: “It’s in the discretion of the regulators. So what is reputation risk today might be something different tomorrow.”

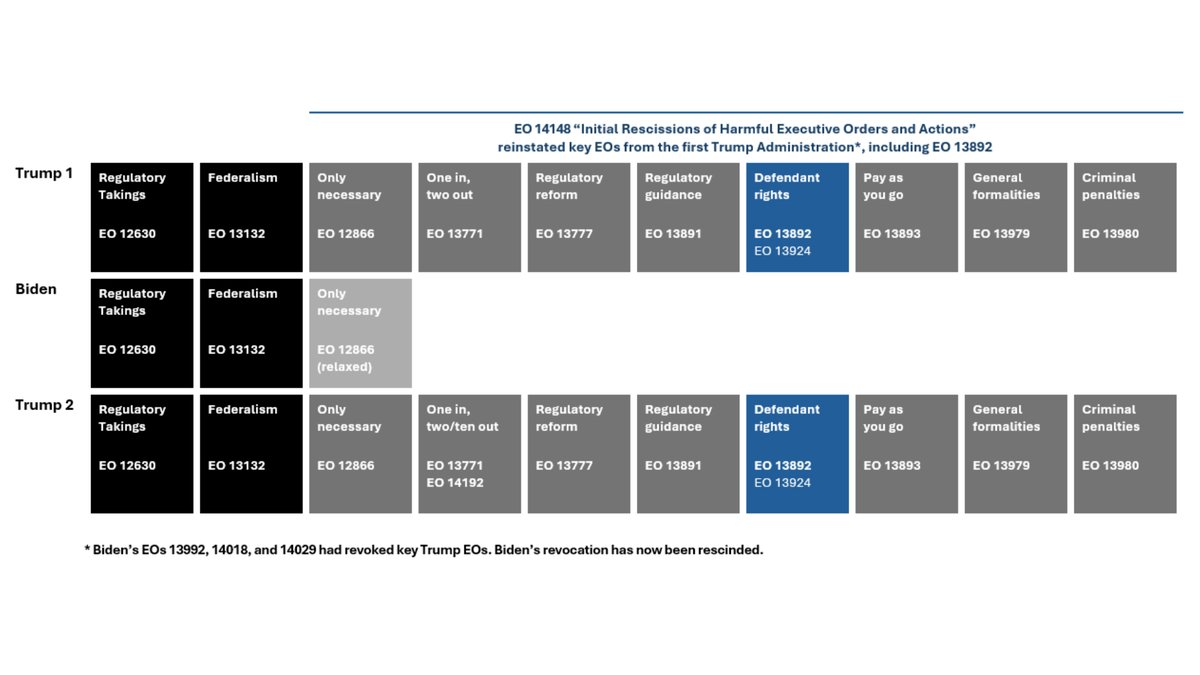

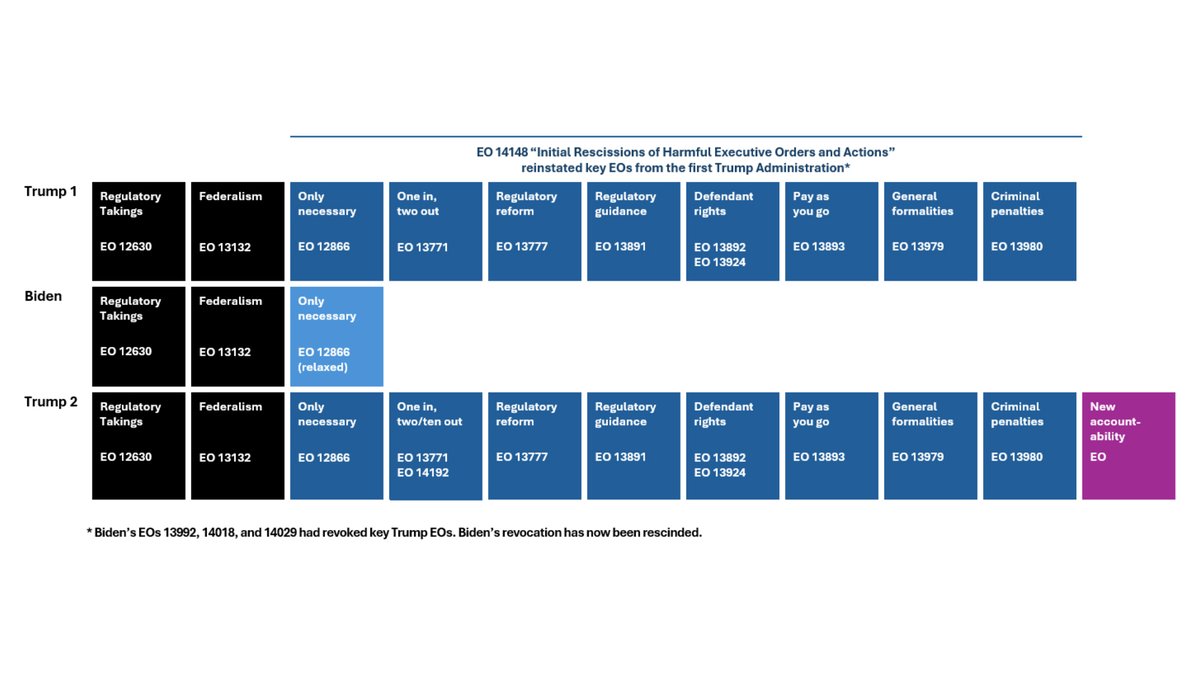

Ambiguous expectations and the opaque processes that accompany federal agency actions have been vexing, particularly for the banking industry, according to Stephen Gannon and Max Bonici. That’s why EO 13892 is so remarkable. Read more: bit.ly/41bSvfn

Asserting the “unitary executive” and its direct impact on federal banking agencies—the latest from Stephen Gannon, Max Bonici, Michael Treves, and E. Paige Knight. Read it here: bit.ly/3X8H8Cw

🪙Our latest #RegReform video podcast on the emerging #stablecoin framework is available ⬇️ vimeo.com/1061039496?ref… Stephen Gannon and I were joined by our colleague and Matt Hoffmann of BGR for an insider's perspective!

Our financial services team launches RegReform with Max Bonici, Stephen Gannon, Kristal Rovira, and Matthew Hoffmann, co-head of BGR Group's financial services practice. They discuss the latest on #stablecoin bills and the evolving regulatory framework. bit.ly/4kkPsJd

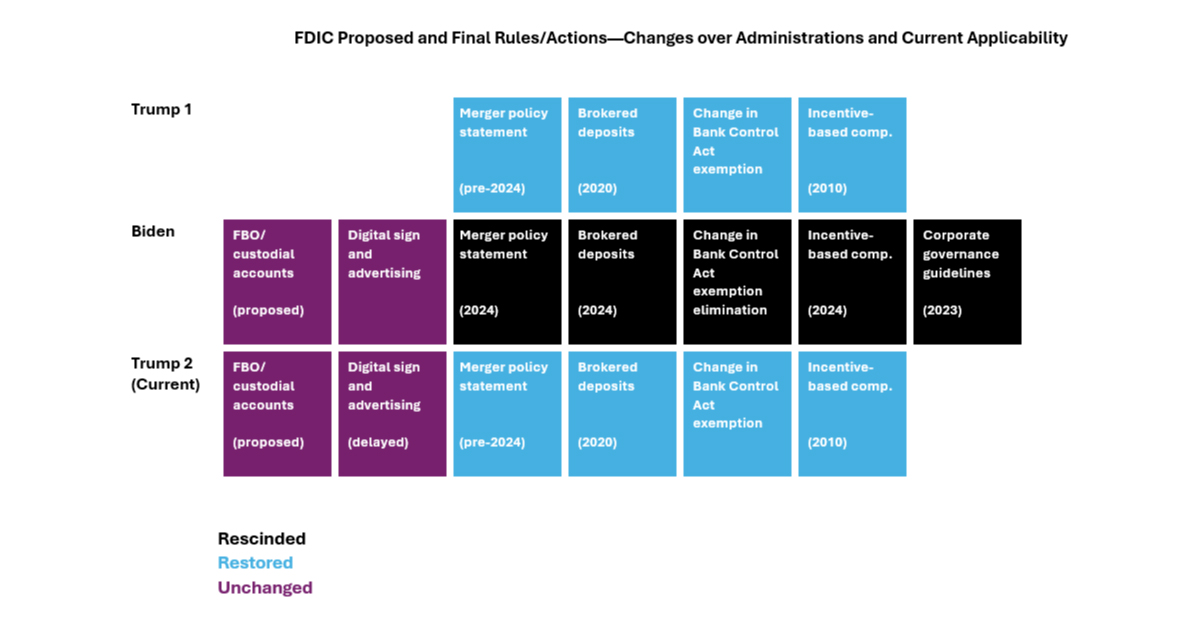

The FDIC has signaled the reversal of key, controversial proposals from 2024—providing clarity on important areas that implicate banks of various sizes and charter types. By Max Bonici, Stephen Gannon, and E. Paige Knight. Read it here: bit.ly/4ilOUB1

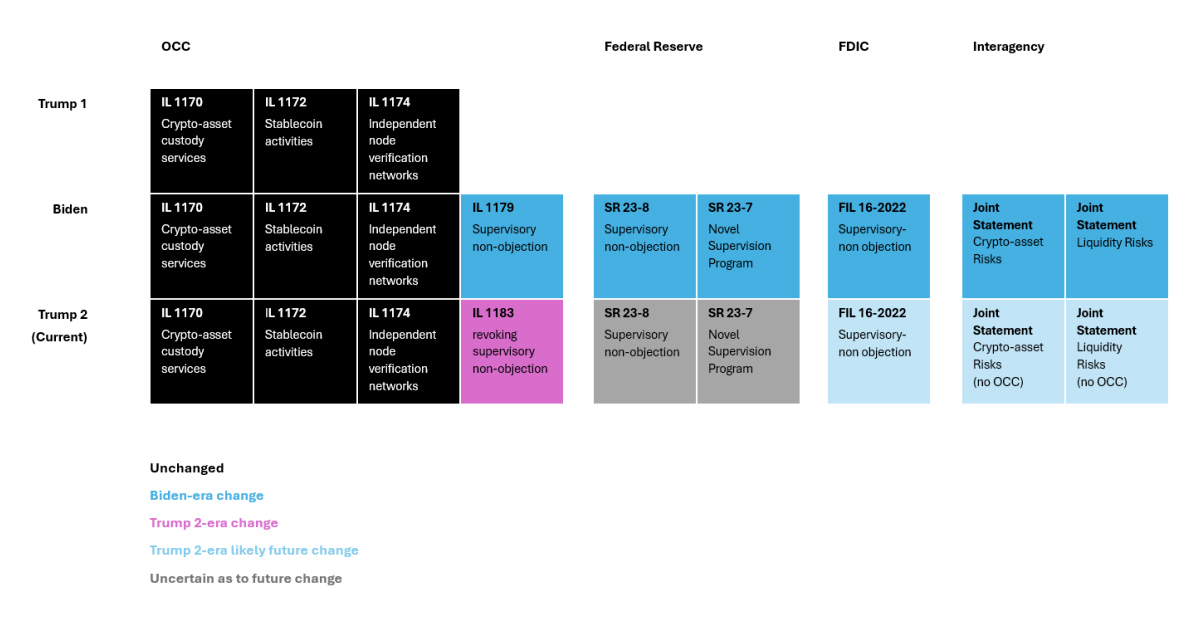

The OCC confirms that certain crypto-related activities remain permissible and rescinds a Biden-era preclearance process, effective immediately for all national banks, including national trust banks. By Max Bonici and Stephen Gannon Read it here: bit.ly/3Fkylan

In episode 2 of #RegReform, Max Bonici, Stephen Gannon and Kristal Rovira, alongside Matthew Hoffmann, co-head of the Financial Services Practice at BGR Group, explore federal financial regulator reform and Congressional priorities. Watch it here: vimeo.com/1063296707?sha…

Sen. Tim Scott’s FIRM Act is a powerful step toward safeguarding financial inclusion and creating a fair banking system. But more is needed to address due process and CAMELS concerns. By Kristal Rovira, Stephen Gannon, and Max Bonici. Read it here: bit.ly/3FCTuN1

The Trump Administration has made clear that it intends to lessen the barriers to bank merger and acquisition activity. Now, Congress is stepping in—Max Bonici, Stephen Gannon, and E. Paige Knight outline HR 1900. Read it here: bit.ly/3DLMD3p

Register for a great upcoming virtual public policy lunch with the awesome Caitlin Long 🔑⚡️🟠 and Women in Housing and Finance! Consider becoming a member today! #DigitalAssets #Crypto #Fed #Payments #SPDI #NovelCharters #Fintech #BankReg