Matt

@matt_uutxo

ID: 468770746

http://beacon.ai/alanjackson 19-01-2012 22:09:29

333 Tweet

199 Followers

7,7K Following

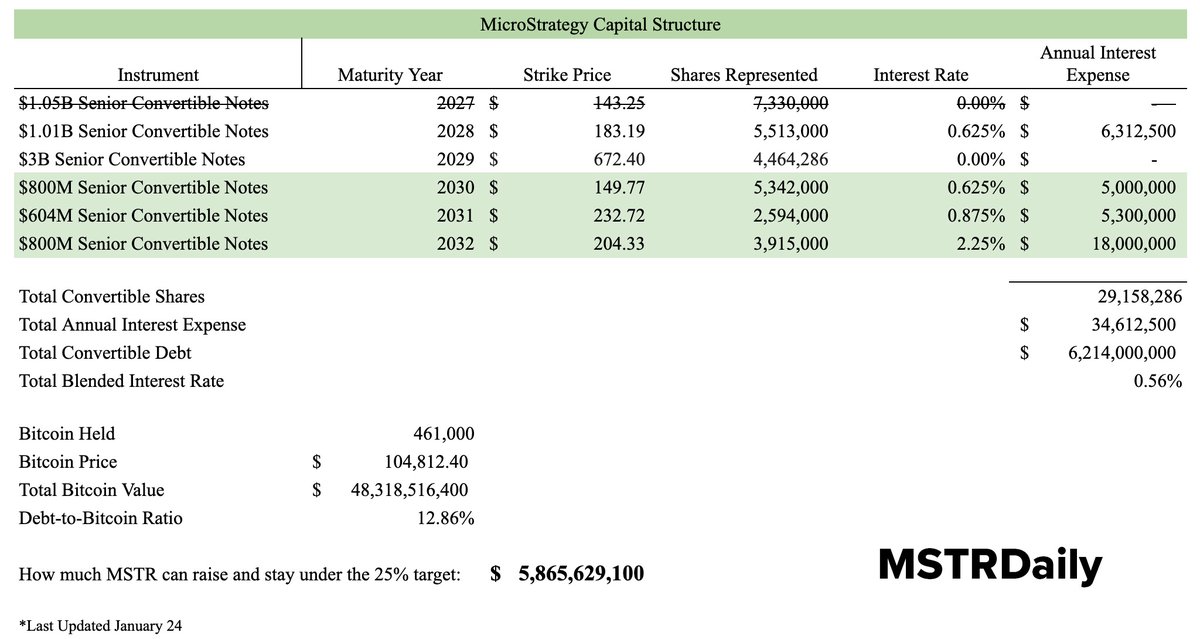

🚨MicroStrategy's leverage ratio has dropped below 13% Historically, the target has been 20-25% (h/t Ben Werkman). This is why the stock is "underperforming" compared to Bitcoin. But do not fear. The management team is in the process of clearing the cap structure to lever-up

Tbh, I would trust Chad Slime ® over myself.