Mark

@markthetutor

ID: 502334703

25-02-2012 01:31:51

1,1K Tweet

255 Followers

327 Following

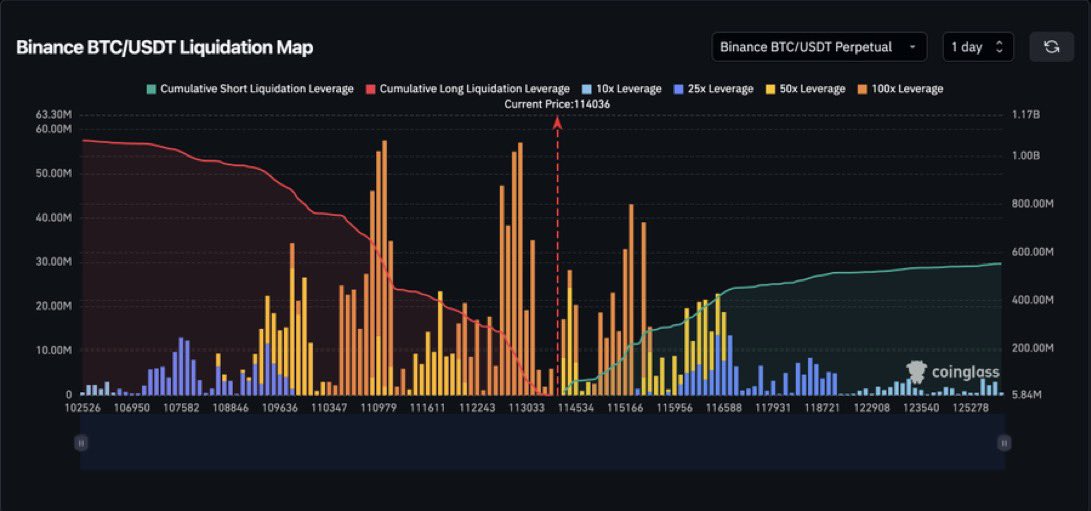

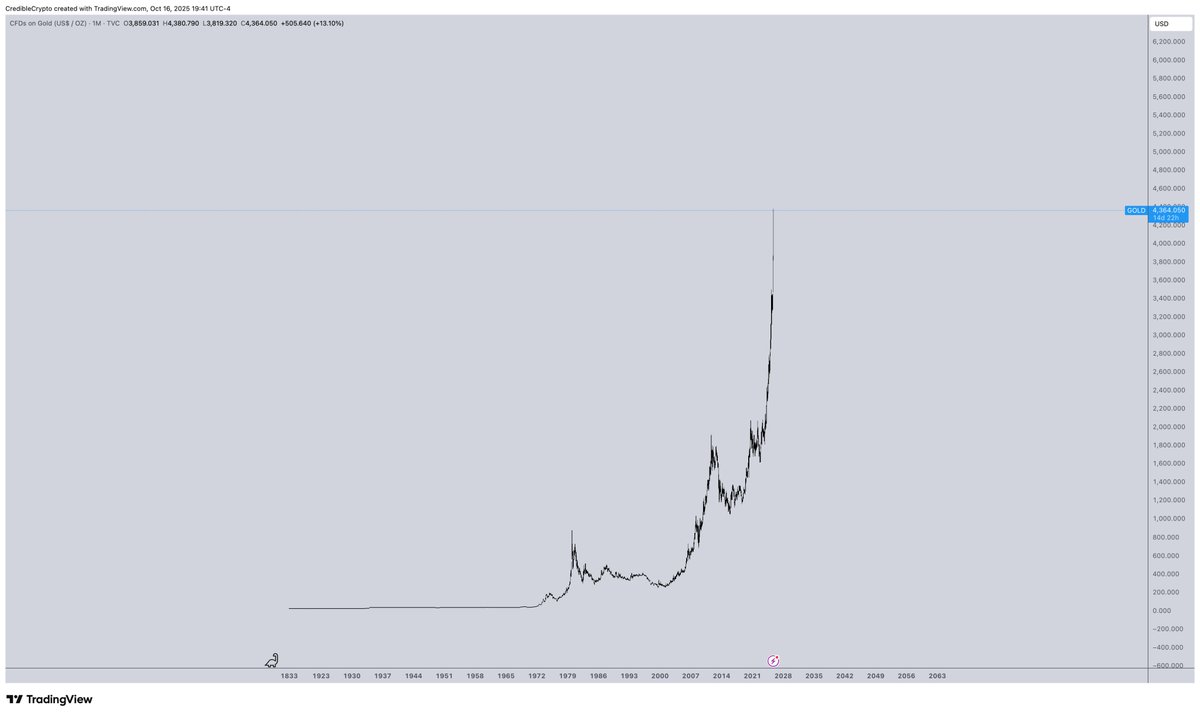

Anthony Pompliano 🌪 Yeah, we’ve seen this before. November 2021 – new ATH, then a crash. Back then they were preaching 100k “next month” too.