Manny4sure (💚,🫛)

@manny4sure

ID: 1525813566

17-06-2013 20:42:24

153 Tweet

25 Followers

49 Following

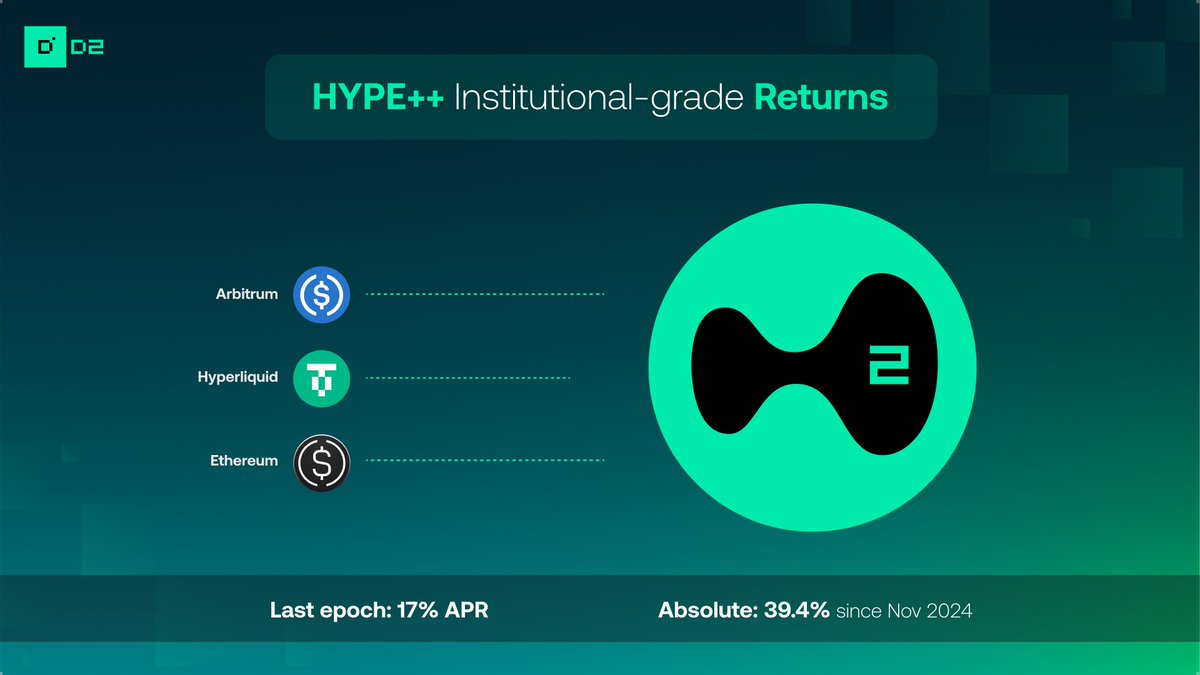

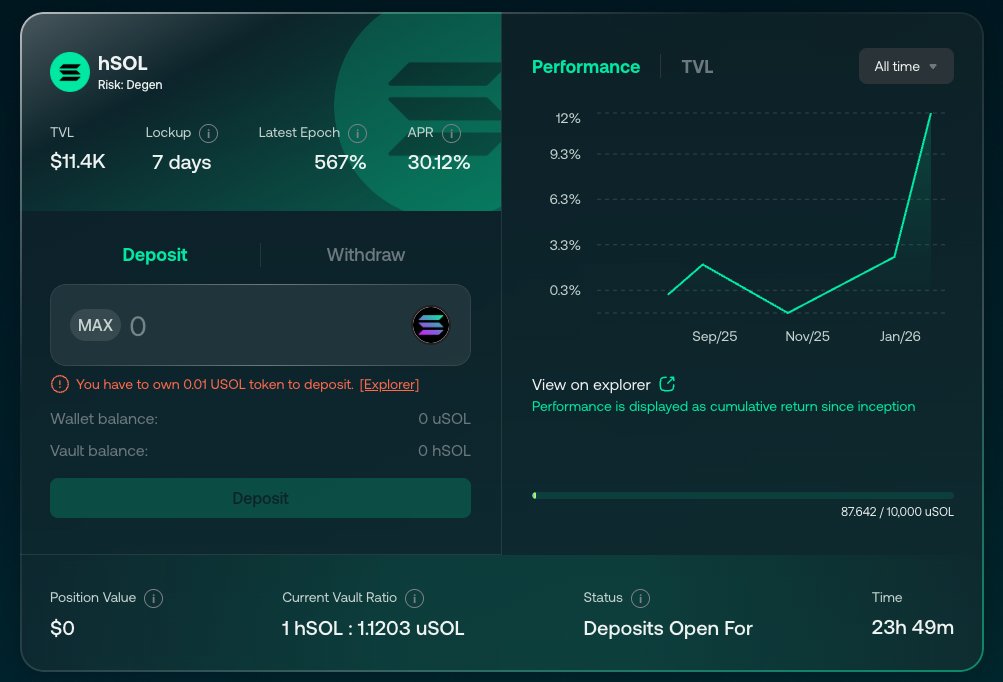

D2 Finance making moves 👀 With 2+ years on-chain track record, D2 Finance is growing TVL step by step with solid APRs and now they’re slowly migrating to Hyperliquid See some of the strategy APRs in the next post 👇

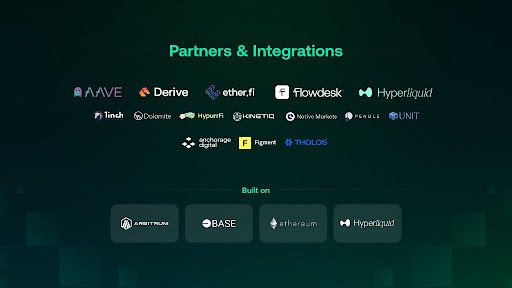

At D2 Finance we wear many hats as a Hyperliquid-centric protocol — by TVL, deployment, millions traded on HyperCore daily, and CoreWrite integration (where we’ve dedicated all our limited resources as a bootstrapped team). We expect all our strategies will evolve alongside

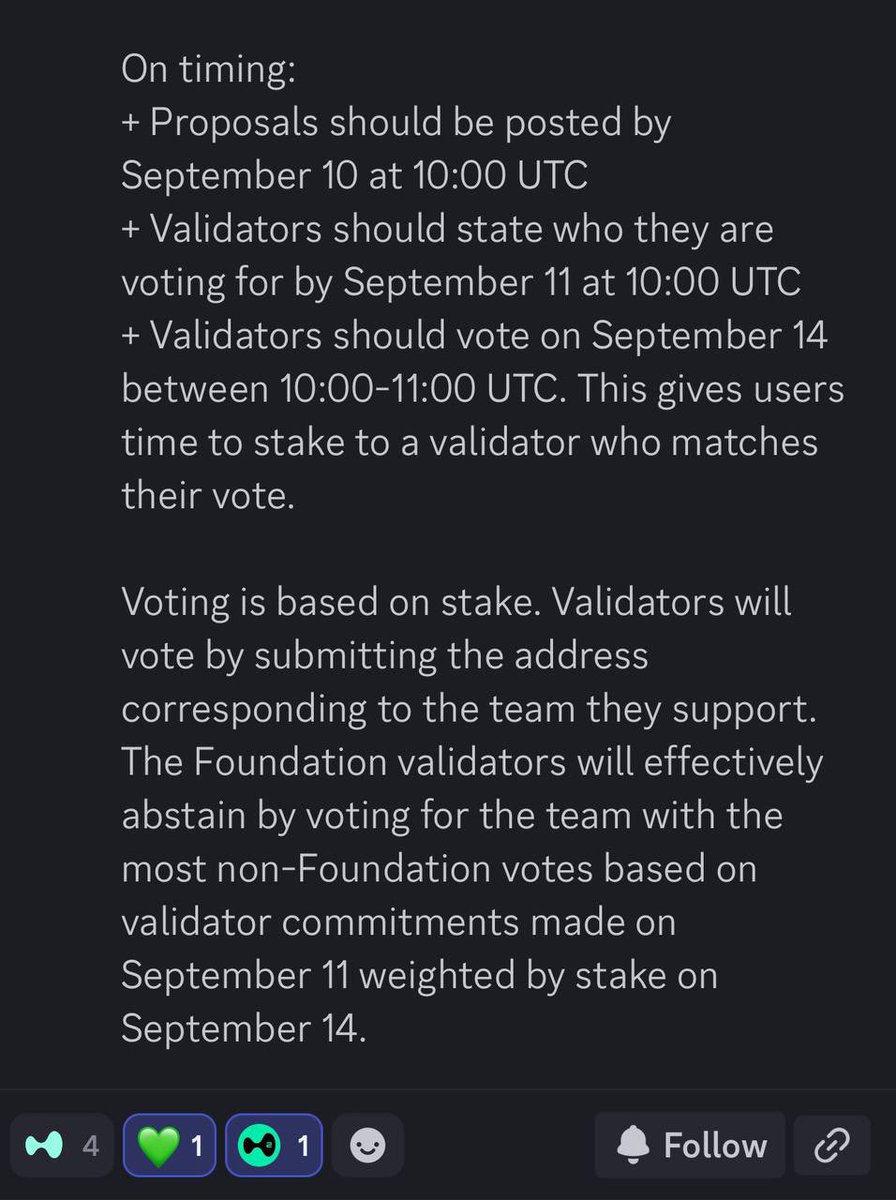

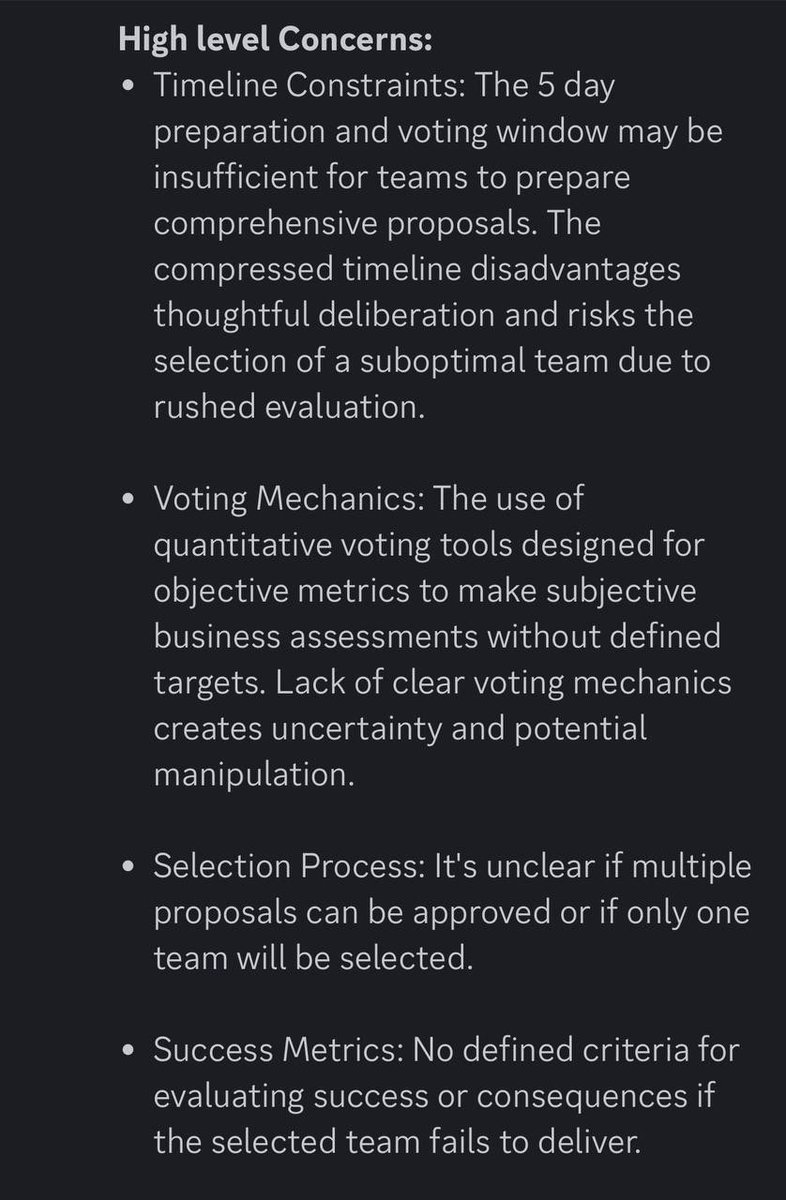

⚔️Hyperliquid ‘ $USDH Wars ⚔️ At D2 we’re traders, not politicians. All we want: clean DeFi legos → to build cool products → to help us keep delivering the top performance in DeFi (3 Sharpe since Dec ‘23, no down epoch for HYPE++). So what do we do with really OUR USERS

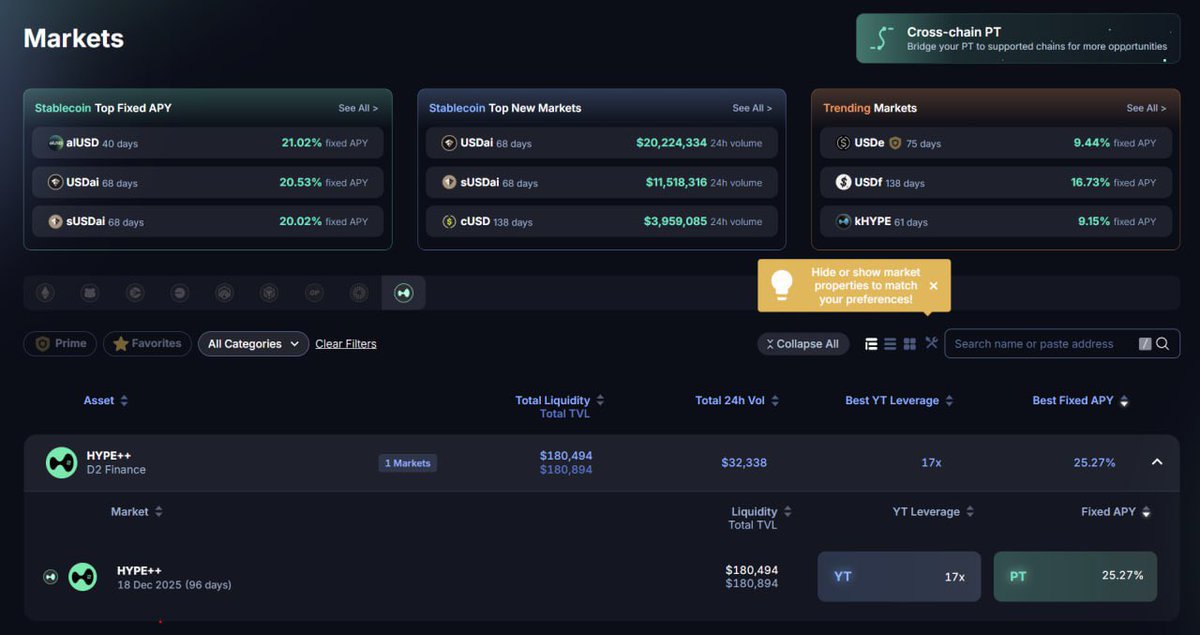

🟢 The D2 $HYPE Assistance Fund 2.0 🟢 Inspired by @hyperunit & Hyperdrive — we TWAP’d $HYPE at 38.140 in early Aug, waited for Pendle deployment (cc RightSide 🉐 Crypto Linn TN | PendleBoros), and now the long-awaited dgnHYPE++ strategy is live: ⚡️ HYPE collateral →

GG to Noel.hl (theo arc) kirbycrypto Velocity.hl for throwing the best TOKEN2049 event, hands down; and finally giving us the first proper meal of the week 💚(back to the gym ASAP 😅) Massive respect for builders who grind and ship no matter what things that’s the Hyperliquid way 💚

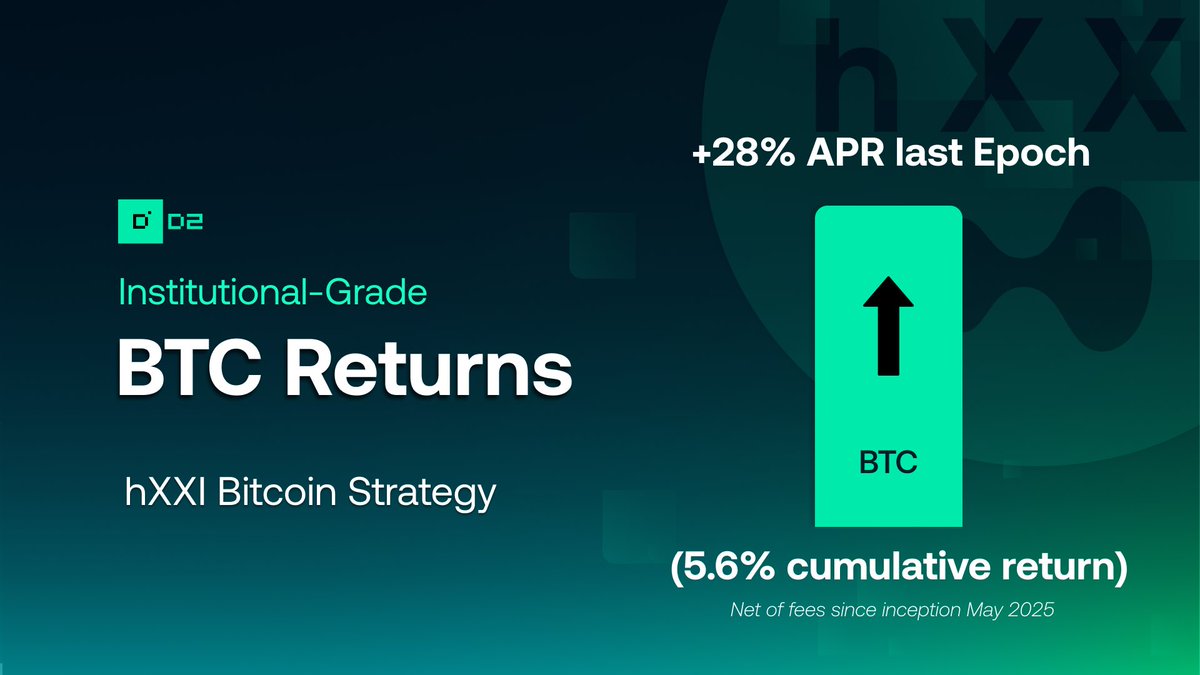

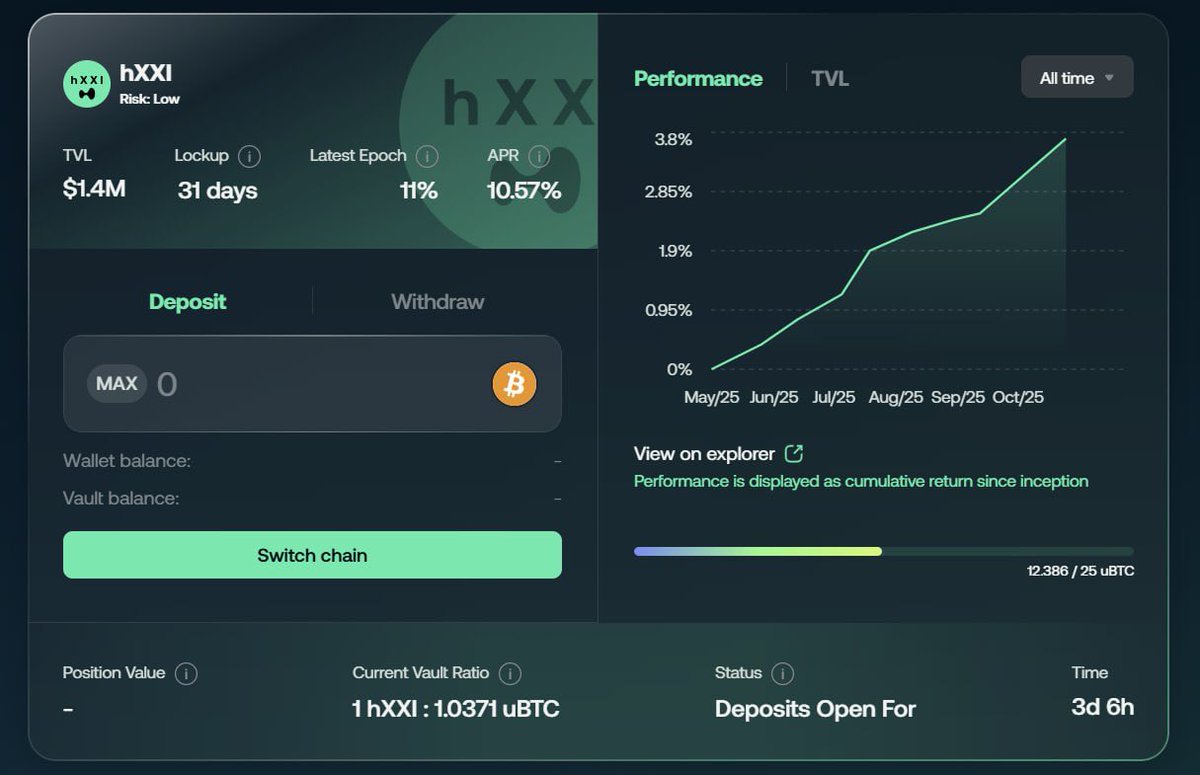

Best $BTC real yield in all of DeFi — and farming Unit and Hyperliquid S3 at the same time? 🤝 Any thoughts, Stephen | DeFi Dojo? 👀 hXXI just wrapped an exceptional epoch: ✅ +11% APR last epoch ✅ 10.6% APR since inception (+3.7% cumulative) ✅ No exposure / risk for most

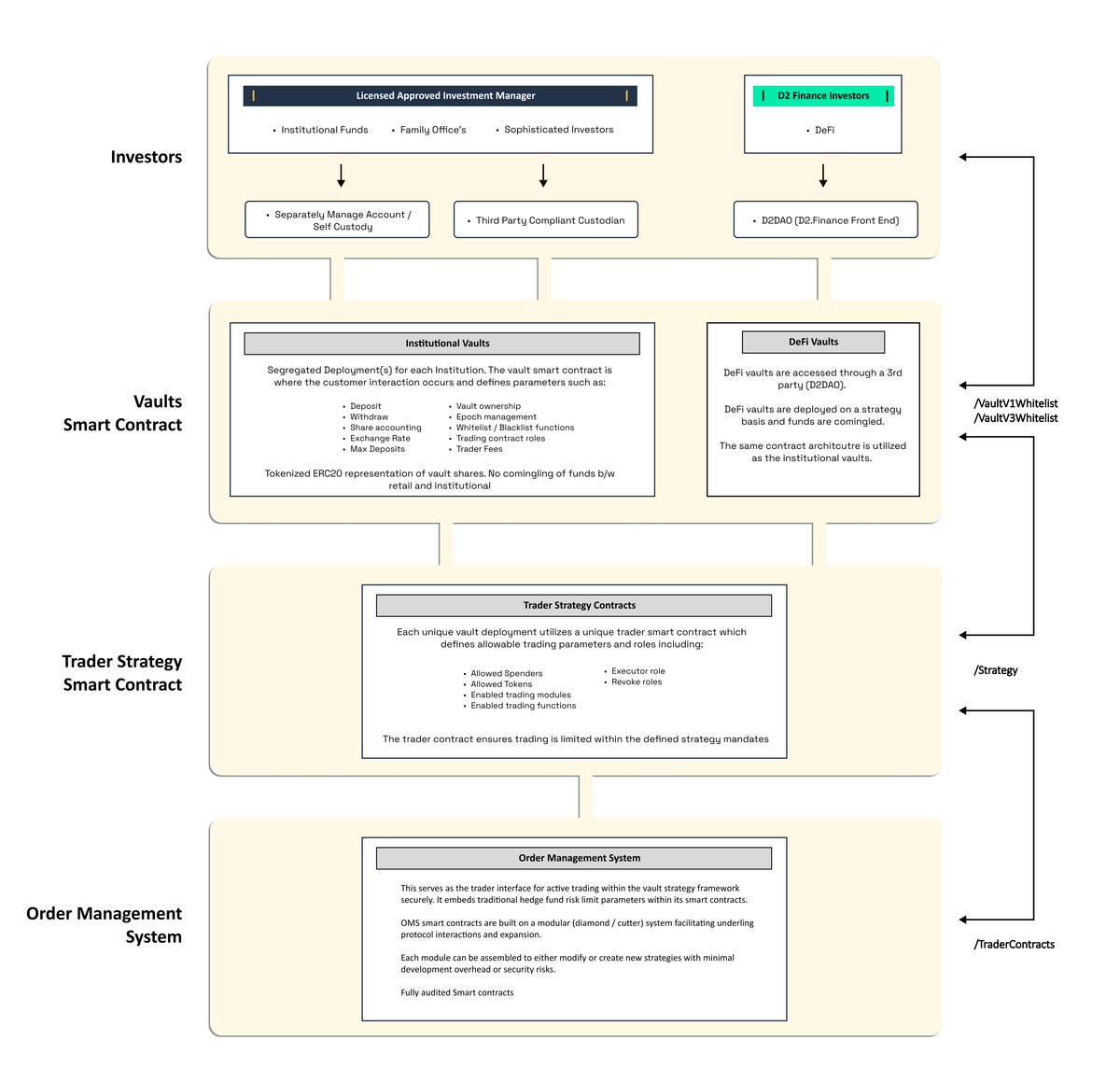

TLDR on the Market Structure Bill: A major win for D2. Great recap by Justin Slaughter As the market digests the 278-page bill, we're already live with the target architecture: • BVI-licensed Asset Manager • Decentralized Front-End Check the 2-Year Report below for the breakdown (only

One structural failure of the Ethereum was tolerance to scammers. vitalik.eth and others allowed extractors to coexist with builders until the signal drowned in noise in name of ‘credible neutrality’. Hyperliquid to be the house of all finance must be different. As

MetFi DAO (we're hiring) Have y’all heard of D2 Finance this protocol is the pinnacle of Low risk #DeFi made for institutional investors, family offices and #DAOs check out their two year report and find out for yourself why this is a must for treasuries using #Web3 x.com/D2_Finance/sta…