A.P

@limitlesss1

Jesus| 🇬🇭 | 🇺🇸 | Overly Dedicated | $SPY Options Enthusiast| Gamma Guy| Not Financial Advice| Profitable Options Trader| No Paid Services

ID: 70578585

01-09-2009 02:49:36

27,27K Tweet

7,7K Followers

930 Following

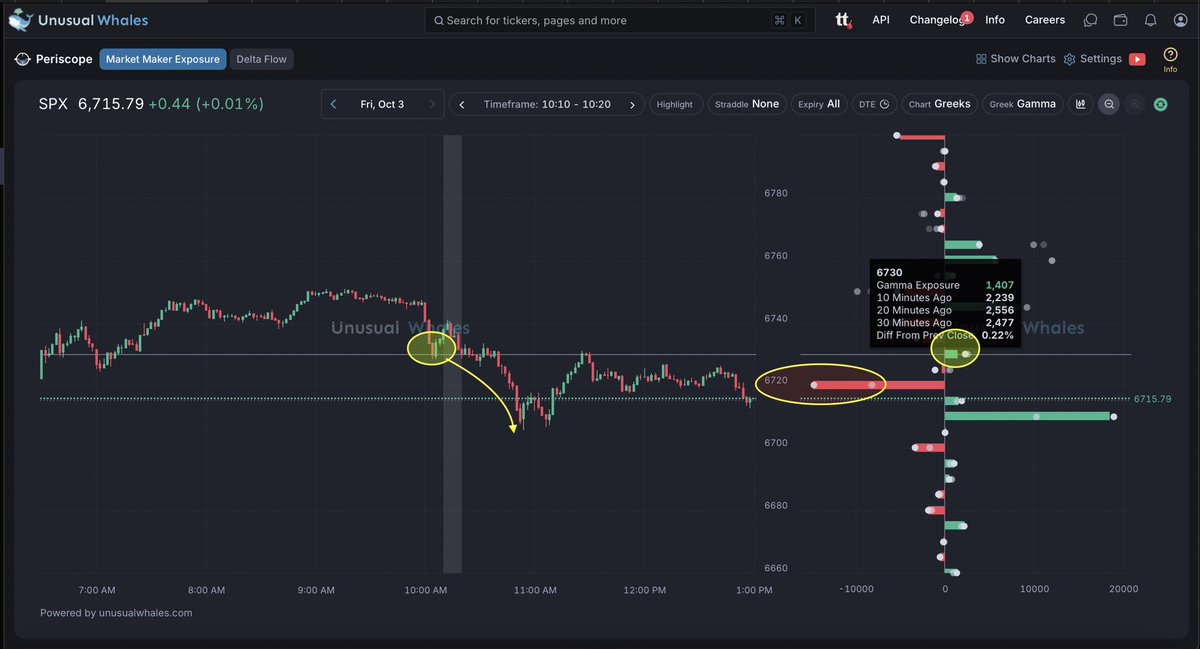

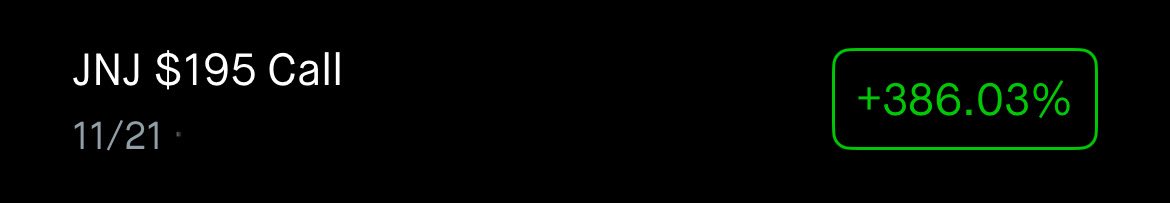

$SPY For those learning IV Rank: We highlighted a $SPY top using the unusual_whales IV Rank data. Since then, SPY is down –4% — we Forecasted the drop using the data below. This is why mastering volatility indicators on the unusual_whales website is essential.

Checkout this quote of tweets teaching Gamma exposure on unusual_whales —we used the data to spot market makers quietly positioning before the $SPY dropped -$100 earlier this year Following this tweet on 3/6, SPY Fell -$80 in March -April