Dervish

@kundunsan

NOSCE TE IPSUM

ID: 262618618

08-03-2011 12:03:10

12,12K Tweet

17,17K Takipçi

1,1K Takip Edilen

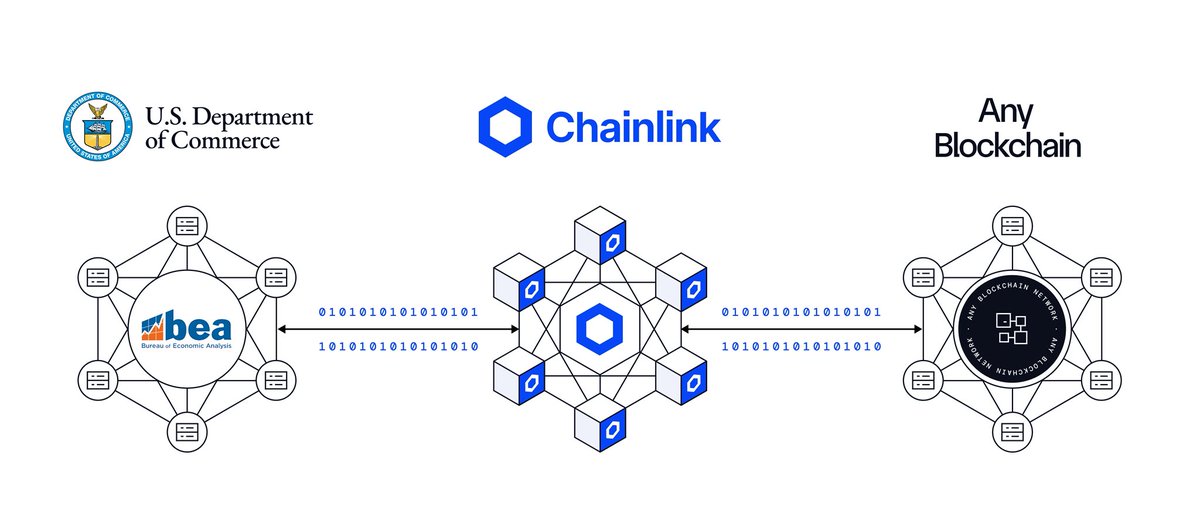

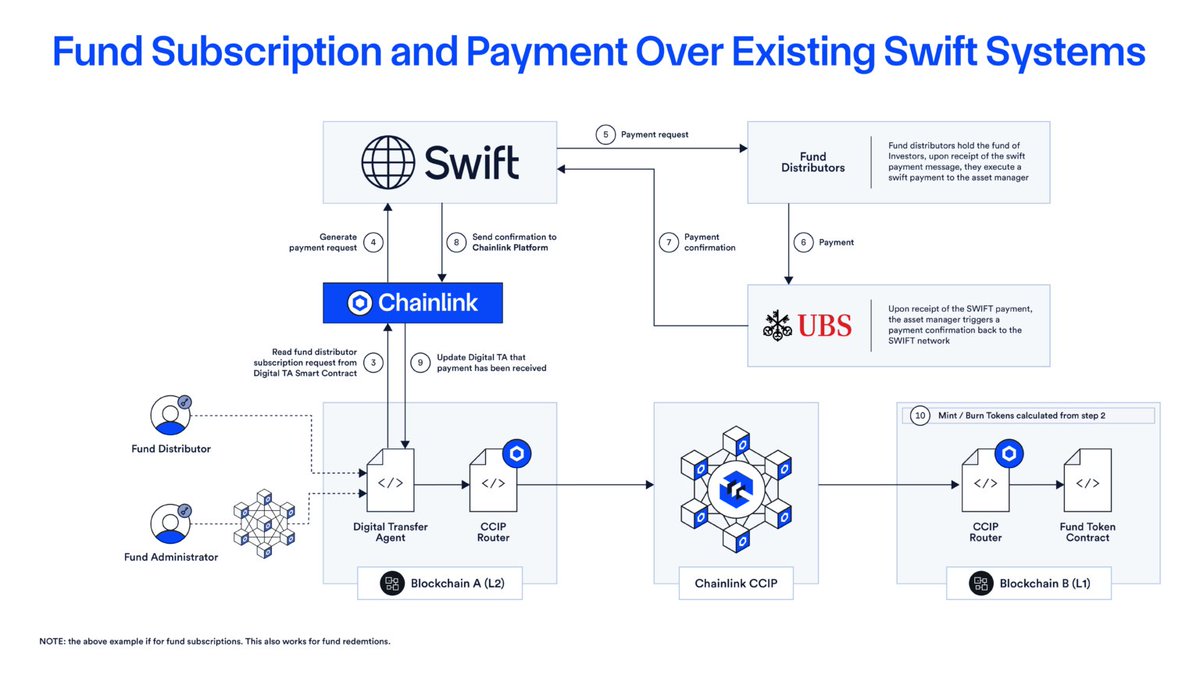

Nasdaq’s recent move to embrace tokenized stocks and exchange-traded products is part of a global transformation to move all the world’s assets onchain, with Chainlink at the center of this generational paradigm shift. Last week, Chainlink Co-Founder Sergey Nazarov met with U.S.

![Arca (@arcamids) on Twitter photo [1]

🚨 Big move:

<a href="/CaliberCo/">Caliber - The Wealth Development Company</a> - $CWD - a $2.9B real estate asset manager, just announced they’re putting $LINK on the balance sheet.

Not just buying tokens.

They’re integrating <a href="/chainlink/">Chainlink</a> into their business.

🧵 👀 [1]

🚨 Big move:

<a href="/CaliberCo/">Caliber - The Wealth Development Company</a> - $CWD - a $2.9B real estate asset manager, just announced they’re putting $LINK on the balance sheet.

Not just buying tokens.

They’re integrating <a href="/chainlink/">Chainlink</a> into their business.

🧵 👀](https://pbs.twimg.com/media/Gzbq78UXQAAtmmh.jpg)