Chris Kimble

@kimblecharting

I use the power of the chart pattern to find extremes in price to identify reversal and breakouts kimblechartingsolutions.com

ID: 202915788

http://kimblechartingsolutions.com/blog 15-10-2010 03:02:42

15,15K Tweet

46,46K Followers

1,1K Following

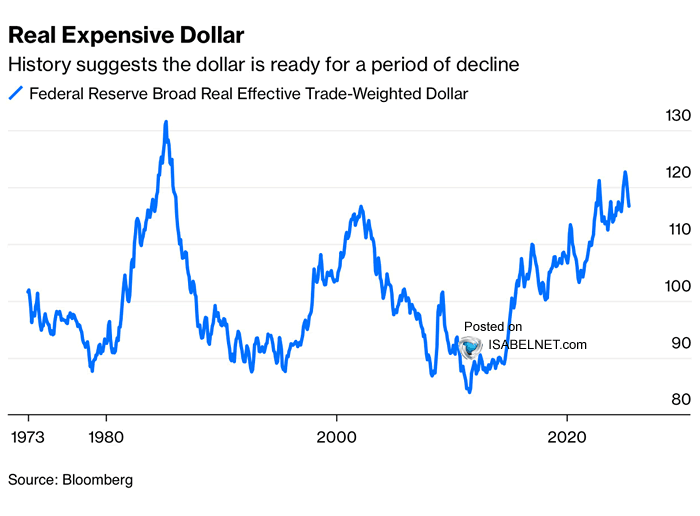

🇺🇸 Dollar Both historical trends and current economic indicators suggest that the US dollar is entering a period of decline. Structural fiscal challenges, policy uncertainty, and cyclical patterns all point to further weakness ahead 👉 isabelnet.com/blog/ Bloomberg Opinion $usd #usd