Ken Berg

@kenwberg

ID: 1292166305831780352

08-08-2020 18:30:44

42 Tweet

17 Followers

54 Following

Crude oil versus Gold. Will this trend favoring gold last forever? No. Am I foolish enough to try to pick the bottom in this relationship? Also, no. SentimenTrader

Mortgages will be in the 4s next year. Equities just getting started. Boom not gloom. Doubt at your own peril. Keep watching Thoughtful Money guests with Adam Taggart for horrible advice. He has some insightful guests at times, but at some point there should be accountability. Vast

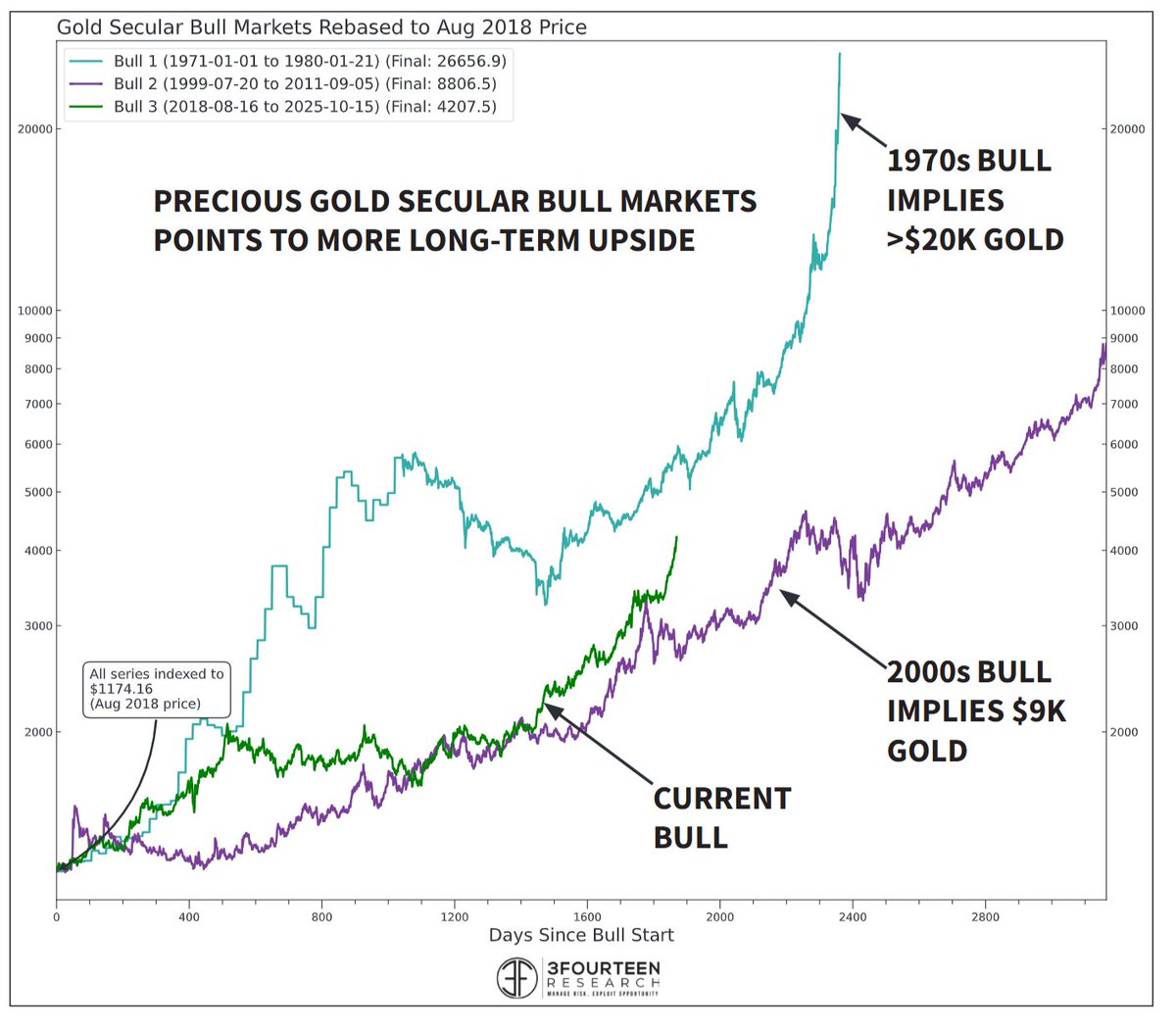

GOLD The current gold secular bull market tracking higher than the early-2000s move and lower than the 1970s bull. As we have said to clients for years, these secular moves go higher, and last longer, than investors expect. 3Fourteen Research

I sat down with Jordi Visser to discuss $TSLA robo-taxis, inflation, interest rates, and the U.S.–China trade dynamic. Jordi also shares how he’s positioning his portfolio, and what Bitcoin, gold, and market psychology reveal about where asset prices are headed next. Enjoy!

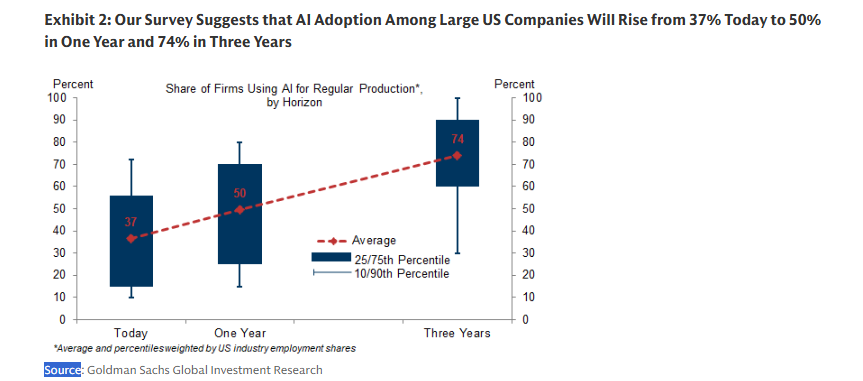

It is not often I read something that blows my mind, but this did. 🤯 I would highly recommend taking the 5 minutes to read it, and then an additional 5 minutes to pause and reflect to consider all the ways our world is about to radically change. h/t Matthew Pines