Julien Brault

@julienbrault

Get the crunchiest fintech news in your inbox every Monday. Sign-up now to my FREE newsletter Global Fintech Insider.

ID: 12141262

https://www.globalfintechinsider.com 12-01-2008 02:43:30

15,15K Tweet

17,17K Takipçi

668 Takip Edilen

Canada's largest digital wealth manager, Wealthsimple, suffered a data breach that exposed sensitive information to a small group of its customers. Data accessed included social insurance numbers, account numbers, dates of birth and government IDs. The incident, detected on

US-based Crypto exchange platform Coinbase 🛡️ is taking on Canada’s big banks with a stablecoin savings account-like product that pays up to 4.5% on USDC balances. “The interest rate for most chequing accounts is 0% in Canada. That makes zero sense,” said Coinbase CEO

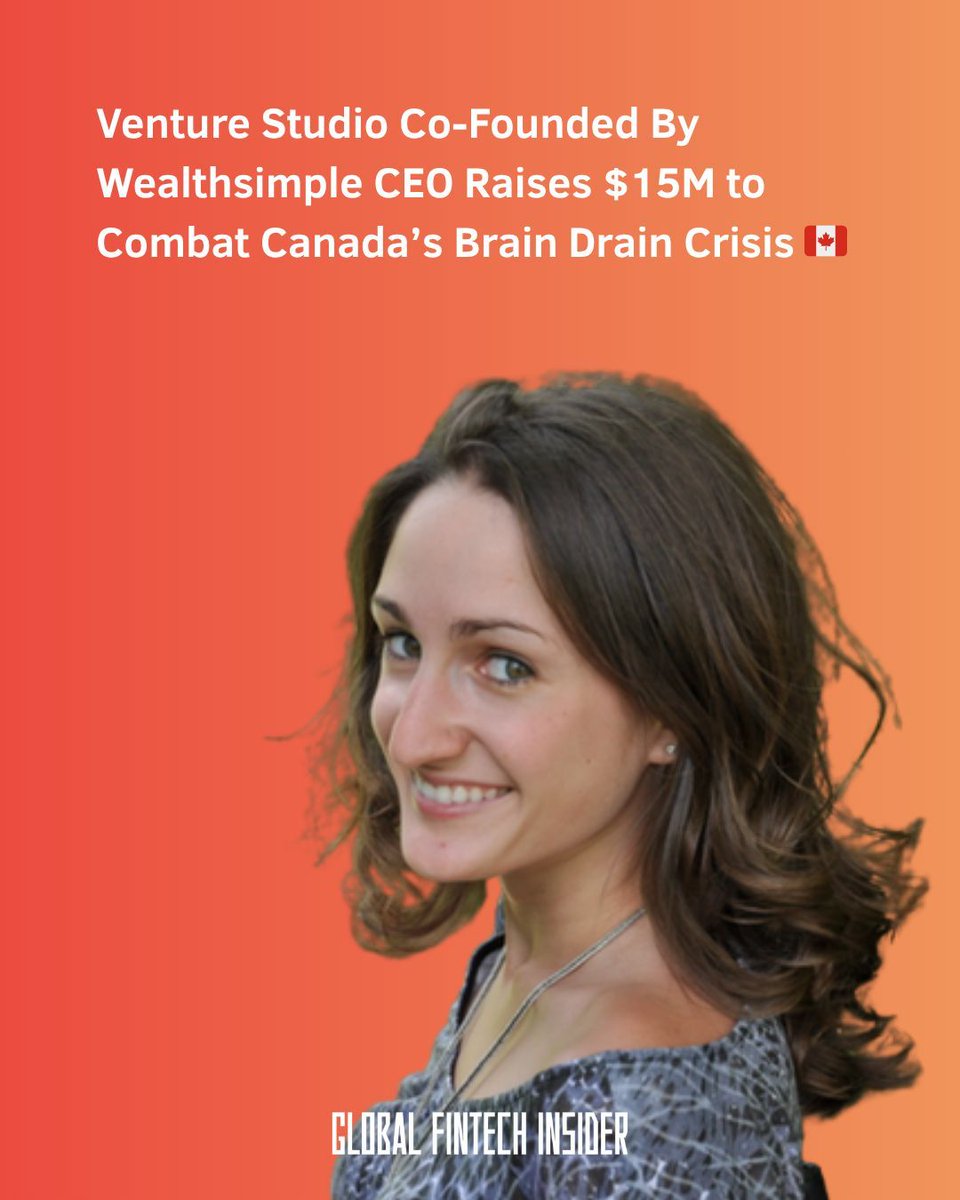

Toronto-based venture studio Simple Ventures has raised $15 million to tackle Canada’s entrepreneurship decline and bring innovation talent back from the US. Co-founded by CEO Rachel Zimmer (pictured below) and chaired by Wealthsimple ’s CEO Michael Katchen, the firm aims to identify

UK-based credit score firm ClearScore eyes London IPO worth up to £2.5 billion ($3.3 billion) within the next couple of years. “To go from a piece of paper, a business plan ten years ago, through to an IPO in London would be a signature achievement of my career,” CEO