Jslats99-InvestorFinance

@jslats99

$10+ mil net worth. Investor with 6+ $million in stock plus 4+ $million in real estate. Semi-retired Independent global business consultant. Amazing wife & fam!

ID:1028299887400640512

11-08-2018 15:19:32

3,6K Tweets

2,0K Followers

115 Following

I've seen big run-ups over a couple of years, like we've just had, often have a period of big profit taking. Look at the rise in stocks like $META, $CAT, $IBM, $NVDA the last few yrs. Stocks just ran too much fast, IMO.

#DivX #dividends #investing #stocks #passiveincome

Dow and NASDAQ getting crushed and $AVGO killing it! Great to own stocks that grow AND pay a healthy dividend!

#DivX #dividends #stocks #investing #passiveincome

Good morning investors. Just got back from a month-long trip in Europe. While there, the market went up & it went down. But my #dividends kept paying. Today, looks like tech #stocks are crashing & the Dow is following. But dividends keep paying!

#DivX #investing #passiveincome

The stock market might suck. But I'm a dividend investor & those stocks still grow. So, I'm sitting here in Plaza de la Reina in Valencia, Spain on a beautiful day. Dividends doing my work for me and my lovely wife. 😉

#DivX #dividends #stocks #passiveincome #investing

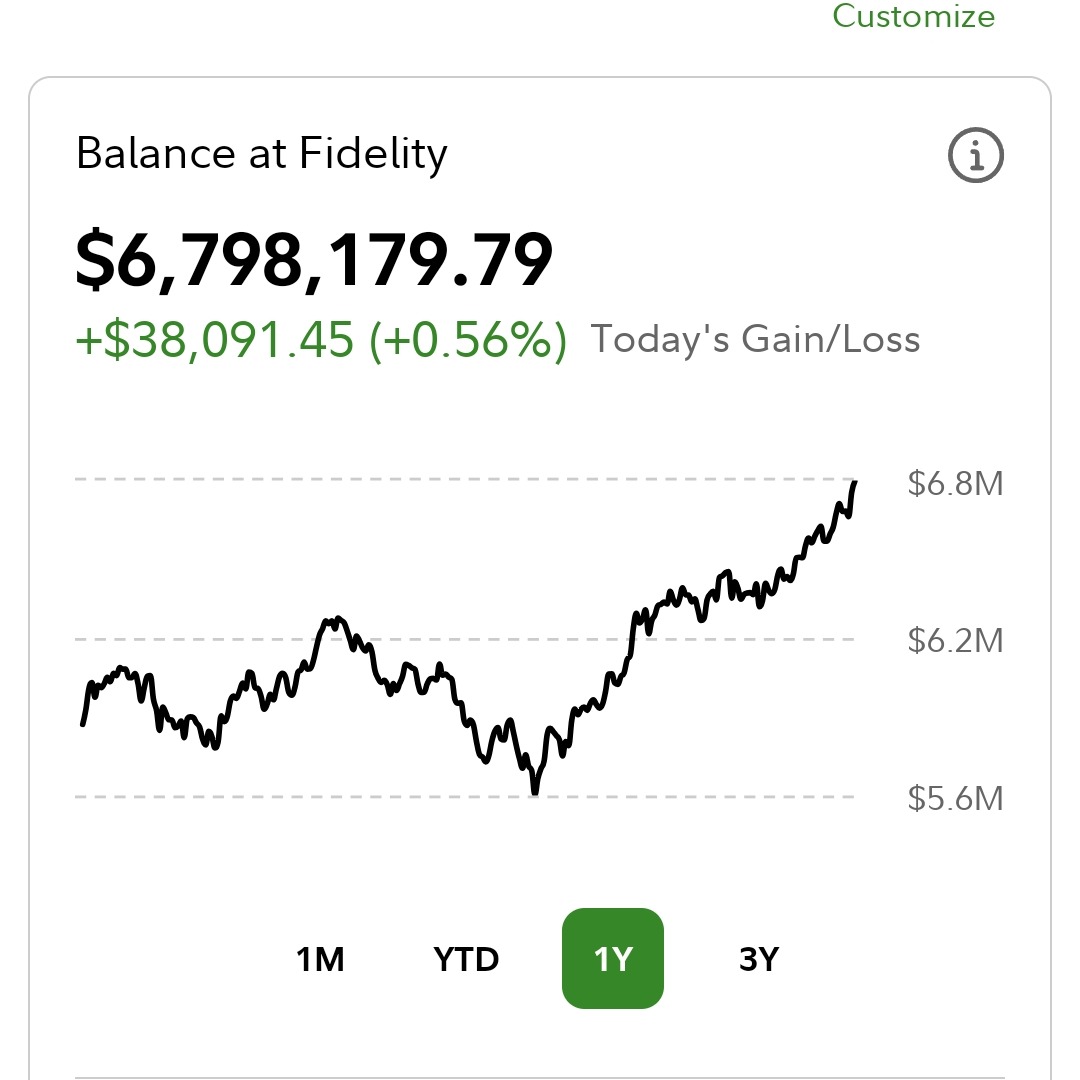

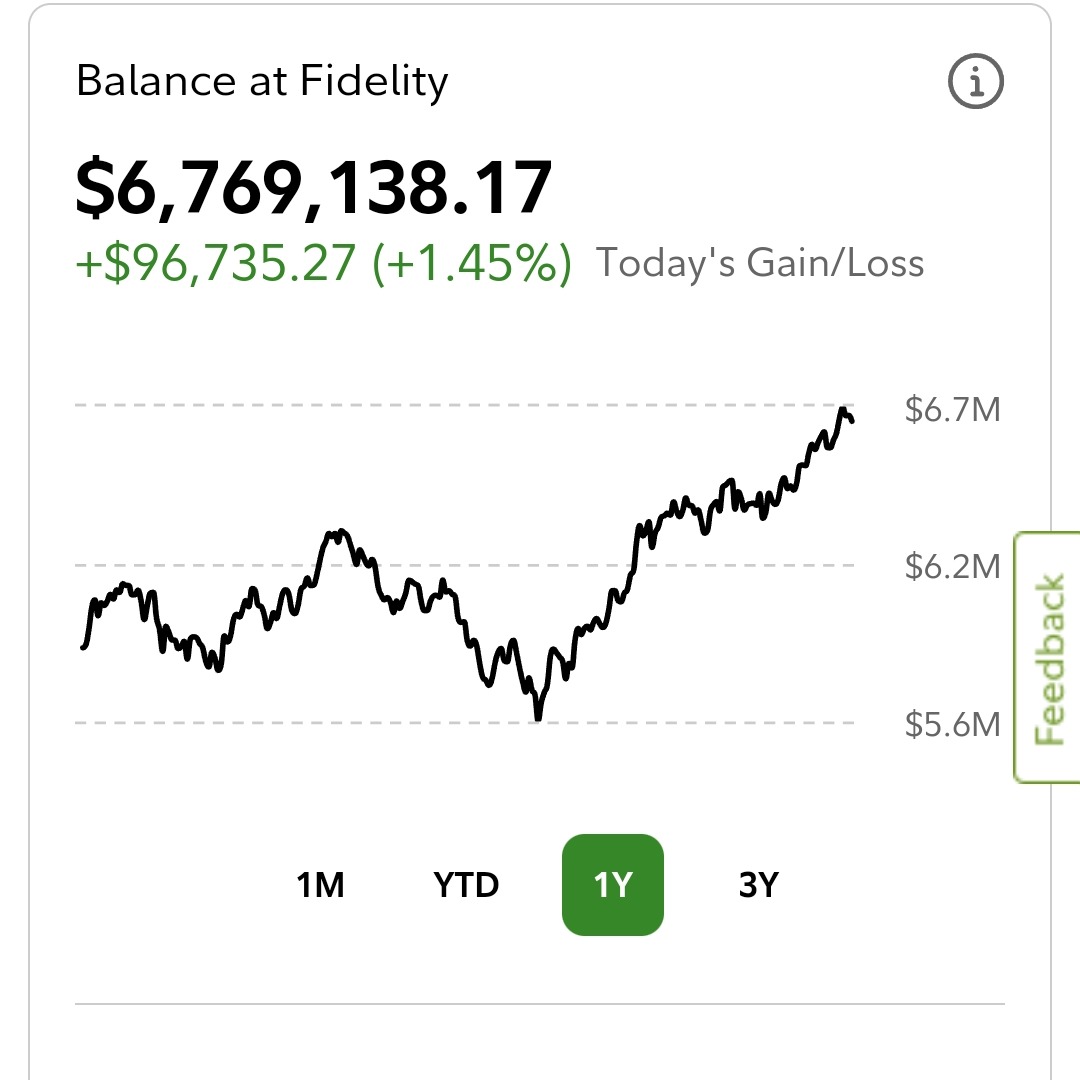

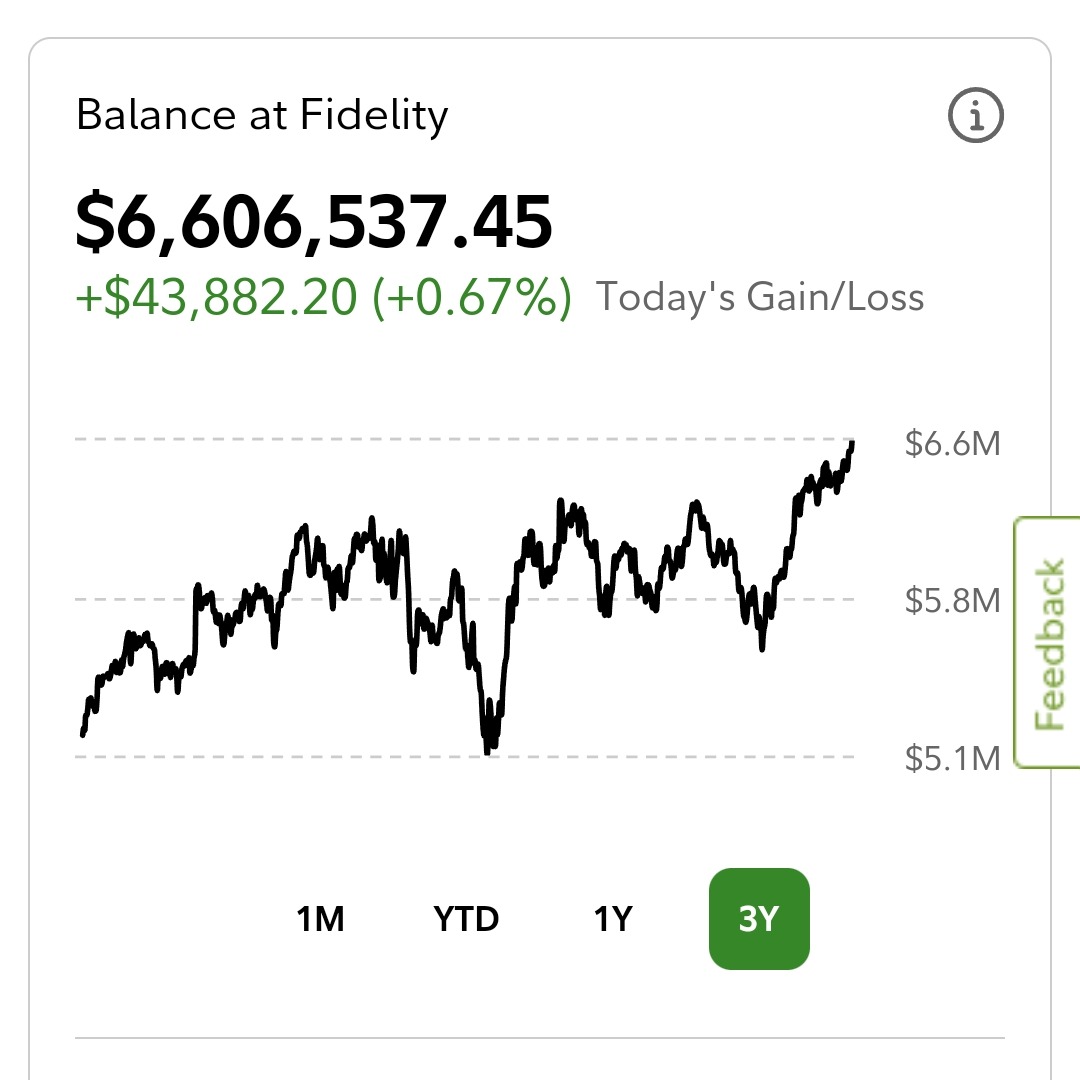

Morning from St Moritz! My post & screenshot from 6 months ago & screenshot yesterday. Who said #dividends #investing has no growth? Up $700,000 in 6 months + $150,000 in dividends I didn't reinvest.

#DivX #stocks #passiveincome

x.com/jslats99/statu…

Good morning investors, from Switzerland! Haven't posted in a while since we're on a month long holiday in Europe. But still monitoring my #stocks & #dividends . Hope u all are enjoying a profitable market. Up nearly $100,000 yesterday! #DivX #investments #passiveincome

I like $PFE but I have a loss that can cover my gains. So I sold 1,700 sh & bought $CAG with the funds (similar #dividends ). Did my research & may swap back after 30 days. Did this before - yes, it's risky & I don't recommend for beginners.

#DivX #stocks #PassiveIncome #fintwit

Unbelievable to read people on X hating on #stocks paying #dividends . My acct is 95% into dividend stocks & has grown from $5.1 mil to $6.6 mil in 3 years. Plus, I don't even reinvest the dividends (~ $290k a yr)! This is organic growth.

#DivX #fintwit #investing

I learned from Dividendology & The Dividend Dream on YouTube that some on X hate on... dividends? What?

I posted that there are plenty of growth #stocks that pay #Dividends . Well, look at $DELL, $NTAP & $AVGO today & the past yr. I own all 3. Huge growth AND dividends.

#DivX #FinX #investing

My ~ $6.5 mil stocks portfolio is only ~ 4% non dividends. ( $GOOG, $CRWD, $CFLT, $PLTR ). IMO, those 4 are among the best in AI, cyber security & cloud integration. But I also own several tech stocks that DO pay solid dividends.

#DivX #Investing #stocks #dividends #fintwit