Jonathan Harrier, CMT

@jonathanharrier

I post charts, backtests, trade strategies, and journal thoughts on abnormal market events. Nothing is advice, just information.

ID: 316540936

13-06-2011 16:12:49

3,3K Tweet

8,8K Followers

86 Following

$TMDX - shot higher today, post blowout earnings report - now above Brian Shannon, CMT AVWAP from all time high (weekly) - AVWAP curling up here, now turning to support vs. prior resistance

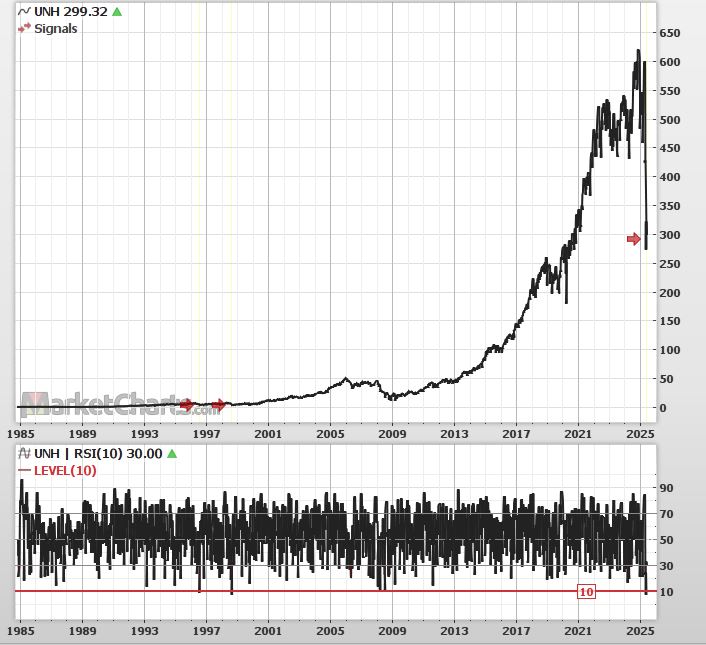

There was only 1 stock in the US (any exchange) that in the past month had: - price > $10 - avg daily volume > 100,000 shares - RSI(10) that crossed above 10 from below $UNH Pretty amazing that a $270B company is the only stock with these criteria. Scan via MarketCharts.com

$LB study/observation looking at Brian Shannon, CMT AVWAP from April low with a logical spot to manage downside risk at lows of this week.